Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 13 December 2021 04:09 - - {{hitsCtrl.values.hits}}

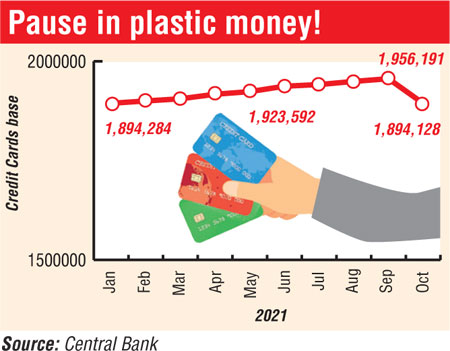

The credit card industry has apparently suffered a rare and sudden cancelation in October, throwing new challenges to a market which is trying to entice more spending.

The credit card industry has apparently suffered a rare and sudden cancelation in October, throwing new challenges to a market which is trying to entice more spending.

The active credit cards base in October declined by over 62,000, which industry analysts described as ‘rare’ but of concern. The cards base amounted to 1,894,128 down from 1,856,191 in September.

The most cancellations (nearly 62,000) have been in globally accepted cards, whilst locally accepted cards cancellations were fewer at 150.

Despite the cancellations, outstanding balance of all cards by end October was Rs. 124.2 billion, up from Rs. 121 billion in September and Rs. 117 billion in end last year. Globally accepted cards outstanding amounted to Rs. 88.3 billion, up from Rs. 86 billion in September and Rs. 84.5 billion end-2020.

Some analysts opined the cancellations to waning wealth of credit card users amidst the pandemic-caused economic crisis and rising default or dues. Others claimed stricter rules and new limitations on what and how much you could spend via cards online or in person were the cause.

Nevertheless, in tandem with seasonal sentiments, all credit cards have stepped up offers to entice domestic spending ranging from holidays, dining and shopping.

Last year, value of credit card transactions amounted to Rs. 222 billion, down from Rs. 277 billion in 2019. Number of transactions declined to 44.7 million from 51 million in 2019. However, credit card use value wise is higher as against debit cards (Rs. 210 billion in 2020), whilst number of transactions debit cards is greater with 75 million transactions.