Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 1 July 2022 00:23 - - {{hitsCtrl.values.hits}}

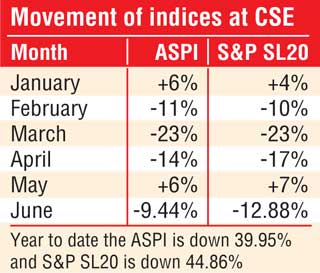

The Colombo stock market reverted to a negative monthly performance in June, signalling that the upturn in May was short-lived.

The Colombo stock market reverted to a negative monthly performance in June, signalling that the upturn in May was short-lived.

June ending yesterday saw the active S&P SL20 plunging by nearly 13% and the benchmark ASPI by nearly 10%. In contrast, May saw a welcome return to positive territory after three months of decline.

By end of the first half, the ASPI was down 40% whilst the S&P SL20 dip was sharper at 35%. Last year CSE was one of the best performing markets in the world with a gain of 80.5%.

Yesterday, the market continued its bearish run amidst lacklustre investor activity given the worsening macro situation.

Asia Securities said the indices ended lower in a range-bound session as retail and HNI investors remained on the side-lines, awaiting directional cues from the ongoing IMF talks.

The ASPI commenced the session with a gap-up of 25 points and touched an intra-day high of 7,391 in the first few minutes of trading. However, the index slipped into negative territory and moved in the range of 7,340-7,370 for the rest of the session.

Front-line stocks EXPO (-1.4%), BIL (-1.3%), LOLC (-1.6%), LOFC (-1.5%), and HAYL (-1.5%) recorded losses during the session while LIOC (+3.7%), SHL (+10.4%), COMB (+0.8%), and HBS (+1.1%) ended higher.

Turnover was supported by EXPO (Rs. 244 million), LIOC (Rs. 182 million), and CSF (Rs. 51 million). The trading volume (number of shares traded) increased from 34.7 million to 115.9 million due to a large crossing recorded in CSF. Overall, 73 stocks ended in green while 87 settled with losses.

Asia also said foreigners recorded a net inflow of Rs. 3.1 million. Net foreign buying topped in RICH at Rs. 5.6 million and selling topped in HAYC at Rs. 3.9 million.

First Capital said the bourse slipped back to the red zone as the market displayed a mixed sentiment with most investors being side-lined awaiting for clarity from SEC, pertaining to extension of credit which ended yesterday.

“In a volatile trading session, the index opened on an upsurge but failed to uphold the momentum as the index plunged shortly thereafter. Subsequently, index see-sawed from green to red before closing for the day at 7,342 losing 24 points,” First Capital said.

Despite the off-board transaction of Nation Lanka totalling to Rs. 51 million, turnover remained poor with the average weekly turnover being recorded at Rs. 950.7 million. The day’s turnover was led by a joint contribution of 54% from the Transportation sector and Energy sector.

NDB Securities said high net worth and institutional investor participation was noted in Nation Lanka Finance and Renuka Holdings. Mixed interest was observed in Expolanka Holdings, Lanka IOC and Teejay Lanka whilst retail interest was noted in Browns Investments, SMB Leasing nonvoting and LOLC Finance.

Transportation sector was the top contributor to the market turnover (due to Expolanka Holdings) whilst the sector index lost 1.42%. The share price of Expolanka Holdings decreased by Rs. 2.50 (1.43%) to close at Rs. 172.75.

Energy sector was the second highest contributor to the market turnover (due to Lanka IOC) whilst the sector index increased by 2.58%. The share price of Lanka IOC gained Rs. 2.60 (3.73%) to close at Rs. 72.30.

Nation Lanka Finance, Browns Investments and Teejay Lanka were also included amongst the top turnover contributors. The share price of Nation Lanka Finance closed flat at 60 cents. The share price of Browns Investments recorded a loss of 10 cents to close at Rs. 7.40. The share price of Teejay Lanka declined by 40 cents to close at Rs. 38.10.