Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 1 September 2021 03:56 - - {{hitsCtrl.values.hits}}

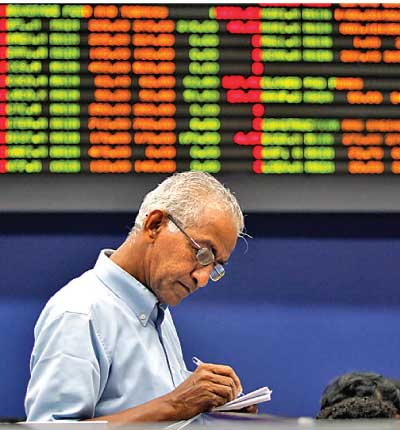

The Colombo stock market yesterday produced a strong recovery with indices up by over 1% and turnover once again topping the Rs. 10 billion mark.

The Colombo stock market yesterday produced a strong recovery with indices up by over 1% and turnover once again topping the Rs. 10 billion mark.

The All Share Price Index (ASPI) gained by 1.16% or 103 points whilst the S&P SL20 shot up by 1.6% or 54 points. Turnover was Rs. 10.8 billion involving 329 million shares.

Asia Securities said the indices returned to positive territory today as investors resumed positioning themselves in momentum-driven stocks. Following yesterday’s decline, caused by a technical glitch in the trading system along with profit-booking at higher levels, the ASPI commenced trading on a positive note with a gap-up of 44 points.

“However, the index witnessed a brief decline and reached an intra-day low of 8,840 (-98 points) before gaining momentum on the back of heavy retail and HNI buying support,” Asia said.

It said activity in EXPO subsequently improved overall market sentiment and drove the indices as the stock continued its rally following yesterday’s decline.

The ASPI touched the 9,000 level in the mid-afternoon session and stabilised in the range of 8,990-9,010 afterwards. EXPO extended a strong 110-point contribution to the index as the stock advanced from Rs. 142.50 to Rs. 169.50 during the session before closing at Rs. 167.75 (+18.0%) and contributed (46.0%) to turnover.

Asia also said foreigners recorded a net inflow of Rs. 3.5 million while their participation remained at 1.2% of turnover. Net foreign buying topped in COMB.N at Rs. 50.9 million and net foreign selling topped in JKH at Rs. 42.6 million.

First Capital said the bourse jumped back to the green zone to scale a new all-time closing high of 8,998, while recording a more than Rs. 10 billion high turnover for the fourth straight session.

“The Index seesawed during the early hours of trading, with a sharp fall at 8,841 but subsequently shook off the early selling pressure by displaying a sharp rally during mid-day. Thereafter, the index moved sideways to finish solidly in the green, gaining 103 points while closing at 8,998,” First Capital added. It said turnover was driven by high retail participation. Transportation sector dominated turnover, followed by Food, Beverage and Tobacco sector accounting for a joint contribution of 63%.

NDB Securities said The ASPI closed in green as a result of price gains in counters such as Expolanka Holdings, Commercial Leasing & Finance and Commercial Bank with the turnover crossing Rs. 10.8 billion. A similar behaviour was witnessed in the S&P SL20. High net worth and institutional investor participation was noted in Ambeon Holdings, John Keells Holdings and Windforce.

Mixed interest was observed in LOLC Holdings, Dipped Products and Hayleys, whilst retail interest was noted in Browns Investments, Expolanka Holdings and SMB Leasing. Foreign participation in the market activity remained at subdued levels with foreigners closing as net buyers.

During the month, the ASPI and the S&P SL20 gained 10.80% and 9.88% respectively, whilst recording an average daily turnover of Rs 6.52 Bn.

Transportation sector was the top contributor to the market turnover (due to Expolanka Holdings), whilst the sector index gained 17.70%. The share price of Expolanka Holdings increased by Rs. 25.25 (17.72%) to close at Rs. 167.75.

Food, Beverage & Tobacco sector was the second highest contributor to the market turnover (due to Browns Investments), whilst the sector index decreased by 0.05%. The share price of Browns Investments gained Rs. 0.10 (0.97%) to close at Rs. 10.40.

LOLC Holdings, Dipped Products and Hayleys were also included amongst the top turnover contributors. The share price of LOLC Holdings moved down by Rs. 9.25 (1.54%) to close at Rs. 591.75. The share price of Dipped Products recorded a loss of Rs. 1.50 (2.24%) to close at Rs. 65.60. The share price of Hayleys appreciated by Rs. 0.75 (0.68%) to close at Rs. 110.25.