Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 13 January 2026 02:12 - - {{hitsCtrl.values.hits}}

Softlogic Stockbrokers believes the Colombo stock market remains a lucrative investment avenue in 2026, supported by Sri Lanka’s low interest rate environment, improving corporate earnings, and anticipated renewed foreign inflow.

It also said fiscal stability and rising consumer demand may create conditions for valuations to expand, positioning fundamentally strong listed companies for sustained performance in the coming years.

This optimism is contained in Softlogic Stockbrokers’ review of 2025, which it said was a year of robust gains and strong fundamentals.

The review stated that the Colombo Stock Exchange (CSE) concluded 2025 on a strong note, with the All Share Price Index (ASPI) gaining 41% year-on-year (YoY) compared with a 49.7% gain in 2024. The S&P SL20 index also recorded a notable increase of 26.6% in 2025 following a 58.5% gain in 2024.

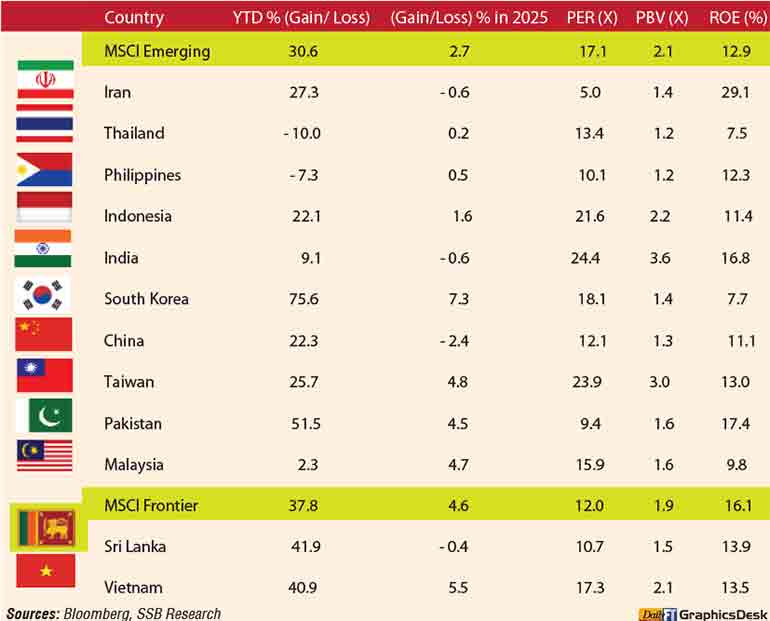

“Market valuations at the end of 2025 reflected a PER of 10.73x, PBV of 1.45x, and dividend yield of 2.62%, indicating that the CSE remains an attractive investment relative to selected regional peers,” Softlogic Stockbrokers said.

Market capitalisation crossed the Rs. 8 trillion mark, representing a 41.67% gain, while total market turnover surged 129% to Rs. 1.23 trillion.

Despite strong market activity, foreign investors were net sellers with net outflows of Rs. 38.6 billion. Corporate earnings for the first nine months of 2025 grew by 16% to Rs. 512 billion, with the Banking sector remaining the largest contributor, accounting for 38% of total. “Overall, the strong price performance across the majority of listed counters underpinned by robust corporate fundamentals and reinforced market momentum highlighted the CSE’s continued attractiveness for investors,” emphasised Softlogic Stockbrokers.

Its review also said the following.

In the wake of significant economic challenges earlier in the decade, Sri Lanka embarked on a path of fiscal discipline and structural reform that began to bear visible results through 2025. After years of tight financial conditions, Government coffers saw a meaningful uptick in revenue through determined policy measures to strengthen tax collection and broaden the revenue base.

By late 2025, total tax revenue had risen by 37% YoY, enabling the Government to significantly contract its budget deficit by more than 73% relative to the previous year. The growing fiscal space provided the necessary breathing room that had long been elusive.

Meanwhile, inflation remained subdued, cushioning households from sudden price shocks. The Colombo Consumer Price Index (CCPI) stood at 2.1% YoY in 2025, rooted in balanced monetary policy and improved supply conditions. This moderation in inflation fostered a sense of stability among businesses and consumers alike, reducing uncertainties that often slow down economic activity.

As Sri Lanka’s economy found firmer footing, GDP expanded steadily. Although the nation had a long journey to reach pre-crisis output levels, growth in the first nine months of 2025 confirmed the early promise of recovery. With support from multilateral partners, projections from global institutions like the World Bank and International Monetary Fund (IMF) pointed towards continued expansion into 2026 whilst the country’s monetary conditions also reflected this stabilisation.

The Central Bank of Sri Lanka (CBSL) maintained an accommodative Overnight Policy Rate (OPR) of 7.75%, providing confidence to borrowers and businesses.

Supported by this environment, credit to the private sector grew notably in 2025, energising spending and investment across sectors from small enterprises to larger infrastructure firms.

Purchasing Managers’ Index (PMI) surveys told their own story of broadening activity, whilst the manufacturing and services sectors posted readings above expansion thresholds, and construction, a key growth driver across the country, showed robust momentum, indicating renewed confidence in future prospects.

Yet, just as recovery was gathering strength, nature delivered a harsh test. On 28 November 2025, Cyclone Ditwah struck Sri Lanka, inflicting widespread damage. Early estimates from the World Bank placed the economic loss at nearly $ 4.1 billion, a staggering blow to a nation still shaking off years of financial strain.

Rather than crumble, Sri Lanka’s response was swift and multifaceted. The international community stepped forward with tangible support—from India’s combined concessional lines and grants of around $ 450 million to emergency funding from the Asian Development Bank (ADB) and World Bank and other humanitarian aid flows from partners like the US, Australia, the United Arab Emirates (UAE), and Japan.

The IMF also signalled readiness to assist with additional financing to support rehabilitation and resilience building.

These combined efforts helped contain the immediate impact and paved the way for structured recovery efforts. Even as reconstruction began, Sri Lanka’s broader reform journey remained on track, backed by continued technical support from global institutions.

Looking ahead, Sri Lanka’s story is one of resilience and cautious optimism. While challenges remain, including ensuring inclusive growth and maintaining fiscal discipline, most global agencies forecast continued recovery. Growth rates in the mid-single digits were expected if reconstruction efforts proceeded and reforms remained steadfast.

Thus, from the early stirrings of fiscal reform to the resilience shown in the face of a powerful natural disaster, Sri Lanka’s economy in 2025 illustrated a nation finding its feet again, stabilising prices, broadening credit, expanding output, and earning renewed confidence on the global stage.