Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 3 October 2022 03:30 - - {{hitsCtrl.values.hits}}

The Colombo stock market completed its third consecutive month of gain in September helping to erase a fair chunk of the losses suffered in the early part of the year.

The Colombo stock market completed its third consecutive month of gain in September helping to erase a fair chunk of the losses suffered in the early part of the year.

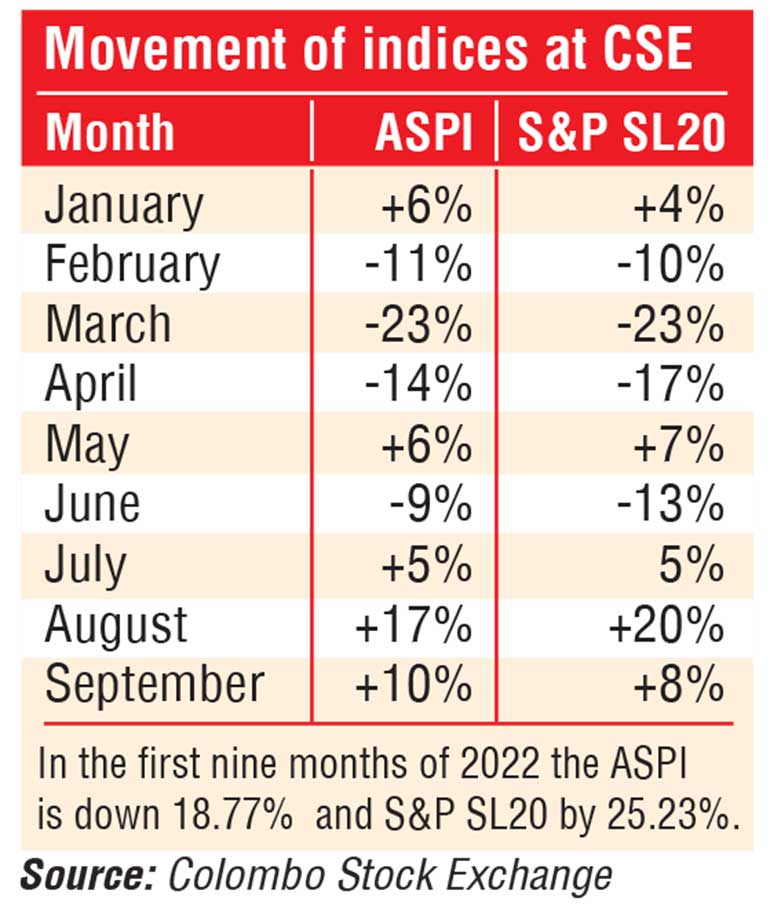

The market saw the benchmark ASPI gain by 10% and the active S&P SL20 by 8%. The gains were less subdued than those enjoyed in August and CSE on a year to date basis remains negative. But marking the third month of upward momentum reflects improved investor confidence according to analysts. More importantly, relatively bullish sentiments have helped to erase much of the losses suffered in the early part of the year.

In the first nine months of 2022 the ASPI is down 18.77% and S&P SL20 by 25.23%. This is far better than how CSE was in end June when ASPI down 40% and S&PSL by 45%.

As at end June market capitalisation was Rs. 3.18 trillion and by end September it was Rs. 4.34 trillion, down 21% year to date.

The ASPI also crossed the psychologically important 10,000 points level last week but bearish investor sentiment saw it closing September at 9,931 points.

What is more redeeming is the fact that CSE is enjoying record net foreign inflow. In September net foreign buying was Rs. 14.7 billion propelling the year to date figure to Rs. 15.2 billion. This is largely on account of parent SG Holdings buying into Sri Lanka’s number one listed entity Expolanka Holdings Plc.

Last year net foreign outflow was Rs. 53 billion and in the preceding three years the outflow was Rs. 51 billion, Rs. 11.7 billion and Rs. 23 billion respectively. The previous net inflow was in 2017 at Rs. 17.6 billion.