Saturday Feb 07, 2026

Saturday Feb 07, 2026

Saturday, 7 February 2026 02:03 - - {{hitsCtrl.values.hits}}

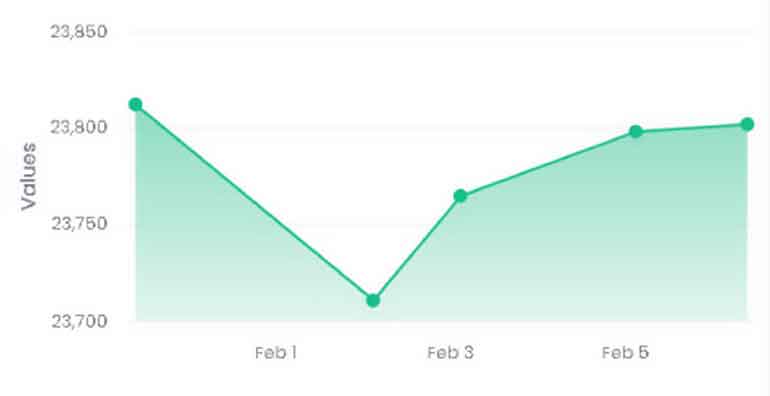

ASPI movement during the week (source: CSE)

The Colombo stock market ended the week on the up on strong high net worth participation while foreign investors continued to be net sellers with YTD outflows totalling nearly Rs. 12 billion.

The APSI ended up 0.14% or 32.97 points to 23,801.96 and the S&P SL20 was up 0.36% or 23.57 points at 6,626.38. Turnover was nearly Rs. 9.1 billion on over 311 million shares traded. During the week, the ASPI fell 0.04% and the S&P SL20 was down 0.40%.

First Capital Research said foreign investors remained net sellers for the second consecutive week, recording a net outflow of Rs. 2.3 billion during the session The YTD total foreign outflow stood at Rs. 11.8 billion, with net foreign selling at Rs. 23.1Bn and net foreign buying at Rs. 11.3 billion.

The bourse indices showed a modest positive session marked by early volatility and a steadier recovery.

Top positive contributors to the ASPI were ACME, JKH, SAMP, HNB, and KZOO. HNW participation remained strong, with over 41% of the day’s total turnover generated through crossings amounting to Rs. 3.8 billion. Major transactions through crossings were recorded in COMB, amounting to Rs. 2.2 billion, contributing 23.9% of the total turnover.

Retail investors were also actively engaged in trading during the session.

The banking sector led the daily turnover with a share of 33%, followed by the capital goods, and consumer durables and apparel sectors collectively contributing 31%.

NDB Securities said the ASPI closed in green, driven by price gains in counters such as ACME Printing and Packaging, John Keells Holdings and Sampath Bank and crossings were recorded in Commercial Bank, Teejay Lanka and Richard Pieris and Company, accounting for 41.9% of turnover.

Mixed interest was seen in Colombo Dockyard, Ceylon Land and Equity and Sierra Cables, while retail interest was noted in Luminex, Renuka Agri Foods and Asia Siyaka Commodities.

The banking sector was the top contributor to market turnover, driven by Commercial Bank, while the sector index gained 0.47%. The share price of Commercial Bank increased by 50 cents to close at Rs. 225.

The capital goods sector was the second-highest contributor to market turnover, led by Colombo Dockyard and Sierra Cables, while the sector index edged down 0.01%. The share price of Colombo Dockyard rose by Rs. 2.50 to Rs. 154.75, while Sierra Cables gained Rs. 1.60 to close at Rs. 38.10.

Teejay Lanka and Ceylon Land and Equity were also among the top turnover contributors. The share price of Teejay Lanka gained Rs. 1.10 to Rs. 38.40 and Ceylon Land and Equity appreciated by Rs. 1.90 to Rs. 22.50.