Sunday Feb 15, 2026

Sunday Feb 15, 2026

Saturday, 14 February 2026 00:16 - - {{hitsCtrl.values.hits}}

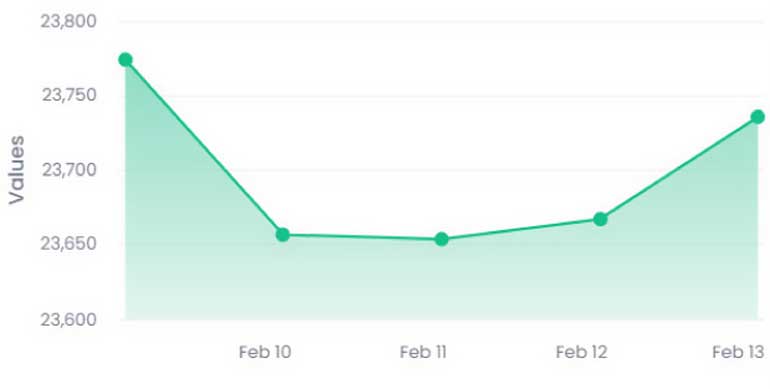

ASPI movement during the week (Source: CSE)

The ASPI ended up 0.24% or 57.33 points at 23,709.84 and the S&P SL20 was up 0.29% or 19.21 points at 6,618.73.

Turnover was over Rs. 8.5 billion on nearly 191.4 million shares traded. Foreign investors were net sellers on a net outflow of Rs. 986.2 million.

During the week, the ASPI fell 92.12 points, or 0.39% while the S&P SL20 gained 4.01 points or 0.06%. The net Foriegn outflow was Rs. 2.9 billion, compared to an outflow of Rs. 5 billion the previous week.

First Capital Research said the bourse posted modest gains over the session, with both major indices climbing steadily after a softer start and accelerating into the afternoon.

Top positive contributors to the ASPI were HNB, RICH, CTEA, COMB and AEL.

Market breadth was evenly split, with 113 stocks declining and 113 advancing, reflecting a balanced session. HNW participation was robust during the session.

Rs. 1.2 billon worth of TKYO shares were traded, representing 14% of total market turnover through crossings. Followed by TJL with Rs. 671 million (7.9%) and SAMP with Rs. 367 million (4.3%).

The materials sector led the daily turnover with a share of 37%, followed by the banking, and capital goods sectors collectively contributing 28%.

Almas Equities Research said that after several dull trading sessions, the market recorded significant gains today, supported by higher turnover and share volumes. An increase in block trades contributed to the stronger turnover, with value investors actively taking positions.

The materials sector led market activity, recording Rs. 3.10 billion in turnover with 36.04 million shares traded. TKYO.N was the top contributor in the sector, generating Rs. 2.05 billion in turnover with 19.80 million shares traded.

Crossings accounted for Rs. 3.14 billion or 36% of total turnover. The largest crossing was in TKYO.N, with Rs. 1.19 billion involving 11.46 million shares traded.

Among notable trades, JINS.N recorded strong activity, posting Rs. 0.22 billion in turnover with 1.51 million shares traded, alongside a price gain of 7.80%.