Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Saturday, 6 December 2025 02:04 - - {{hitsCtrl.values.hits}}

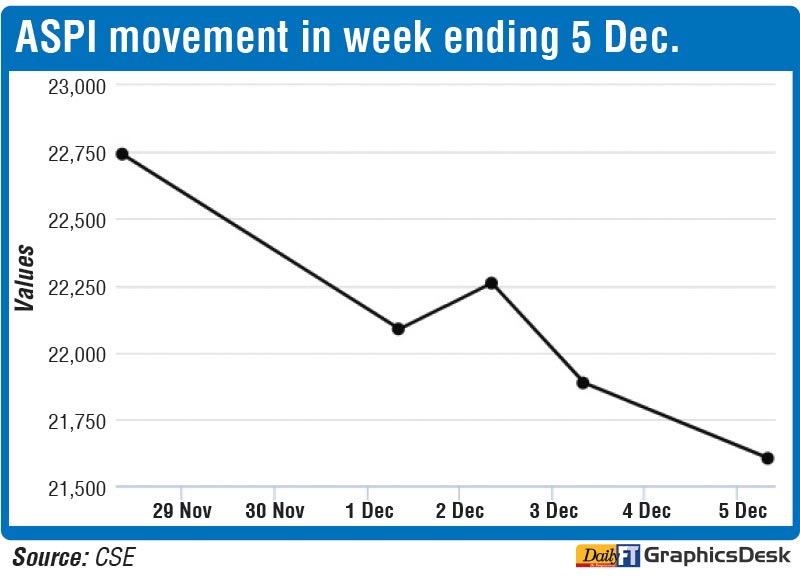

The Colombo stock market closed the week in red yesterday with the benchmark index hitting a two-and-half-month low with Rs. 112.3 billion in value wiped out, taking the total loss during the week to nearly Rs. 424 billion.

Week on week, the ASPI was down 5.35% or 1,215.74 points and the active S&P SL20 was down 5.45% or 341.4 points.

Yesterday, the ASPI closed down 1.51% or 329.51 points to 21,497.08 and the S&P SL20 fell 1.45% or 87.69 points to 5,942.97 with market turnover nearing Rs. 3.97 billion on over 132 million shares traded.

Foreign investors were net buyers with a net inflow of nearly Rs. 72 million.

NDB Securities said the indices closed in red as a result of price losses in counters such as Sampath Bank, John Keells Holdings and Commercial Bank.

High net worth and institutional investor participation was noted in Hatton National Bank, Hemas Holdings and John Keells Holdings. Mixed interest was observed in Commercial Bank, Sampath Bank and Colombo Dockyard while retail interest was noted in SMB Leasing, SMB Leasing nonvoting and Waskaduwa Beach Resort.

The Capital Goods sector was the top contributor to the market turnover due to John Keells Holdings and Hemas Holdings while the sector index lost 1.30%.

The share price of John Keells Holdings lost 50 cents to close at Rs. 21 and Hemas Holdings recorded a loss of 70 cents to close at Rs. 34.20.

The Banking sector was the second highest contributor to the market turnover due to Hatton National Bank, Commercial Bank and Sampath Bank while the sector index decreased by 1.88%.

Hatton National Bank decreased by Rs. 3.25 to close at Rs. 386.75 while Commercial Bank moved down by Rs. 4 to Rs. 194 and Sampath Bank declined by Rs. 3.75 to close at Rs. 137.25.

First Capital Research said the Bourse briefly attempted a rebound in early trading, but sentiment weakened later in the session, driving the index further into negative territory.

Market sentiment was broadly weak, with 202 counters closing lower, while SAMP, JKH, COMB, DFCC and NDB emerged as the top negative contributors.

The Capital Goods sector generated 27.4% of the day’s turnover, while the Banking and Diversified Financials sectors together accounted for 36.7%.