Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 30 July 2020 00:15 - - {{hitsCtrl.values.hits}}

COVID-19 has caused an unprecedented Rs. 2.4 billion 1Q pre-tax loss at premier blue chip John Keells Holdings (JKH) which however pointed to signs of a faster than anticipated recovery strong

|

| JKH Chairman Krishan Balendra |

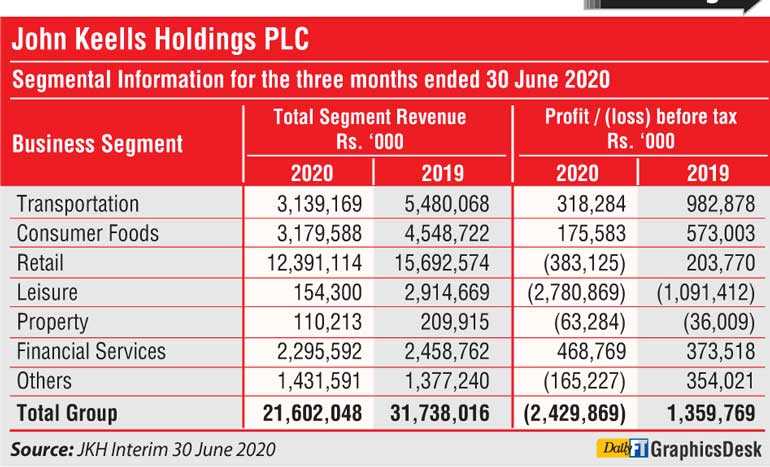

enough to declare an early interim dividend. For the quarter ended 30 June, JKH Group revenue was Rs. 21.60 billion down by 32% from a year earlier.

JKH ended the 1Q with a pre-tax loss of Rs. 2.43 billion as against a profit of Rs. 1.36 billion a year earlier.

The profit attributable to equity holders was a negative Rs. 1.66 billion compared to the Rs. 994 million in 1Q of FY20.

“As expected, the performance in the quarter under review was significantly impacted and extremely challenging on account of the stringent lockdown measures prevailing for the first one-and-a-half months of the quarter,” JKH Chairman Krishan Balendra told shareholders in a note accompanying interim results.

However he said post easing of the strict lockdown measures from mid-May, the underlying month-on-month performance of the Transportation, Consumer Foods, Retail and Financial Services businesses displayed a faster than anticipated recovery momentum reaching almost pre-COVID-19 levels.

The proactive cost containment and productivity improvement measures undertaken to strengthen the Group’s financial and cash position from the beginning of the quarter, combined with the recovery momentum in business activity, enabled the Group to record cash profits despite the extremely challenging operating conditions.

The Group earnings before interest, tax, depreciation and amortisation (EBITDA) was Rs. 802 million but lower by 78% from a year earlier. EBITDA excluded the impact of exchange losses and gains on its foreign currency denominated debt and cash to demonstrate the underlying cash operational performance of the businesses.

Balendra said given the faster than anticipated recovery momentum in business activity and the generation of cash profits by the Group, a first interim dividend of Rs. 0.50 per share, amounting to a pay-out of approximately Rs. 659 million, was declared to be paid on or before 28 August.

“This reflects the positive outlook the Group has in the current circumstances for its portfolio of businesses and the generation of cash profits in the Group, despite the impacts on the Leisure business on the overall performance of the Group,” Balendra said.

He added that the Group will follow its dividend policy which corresponds with growth in profits, whilst ensuring that the company maintains adequate funds to ensure business continuity given the prevailing unprecedented circumstances.

Given the challenging FY20, JKH didn’t declare a final dividend except a Rs. 1 per share first interim dividend and a Rs. 1.50 per share second interim dividend.

In FY20 Group revenue rose only by 3% to Rs. 140.04 billion while recurring Group EBITDA was down by 14% to Rs. 22.06 billion. The recurring Group profit before tax (PBT) was down 28% to Rs. 12.28 billion and recurring profit attributable to equity holders of the parent dipped by 26% to Rs. 9.33 billion.

Balendra said the Group’s Leisure business was significantly impacted during the quarter given the suspension of operations of our hotels in April and May on account of the closure of the airports in Sri Lanka and the Maldives and the lockdown measures in Sri Lanka.

“The Maldivian airport was opened for arrivals in mid-July. While bookings for the next few weeks are low, we are encouraged by strong forward bookings for the peak season of January to April 2021, exceeding the bookings we had for the same time last year. Whilst Sri Lanka is yet to re-open its airport, our hotels in Sri Lanka have now commenced operations where the recovery of domestic tourism has been encouraging,” Balendra said.

He said JKH’s Consumer Foods businesses displayed a faster than expected recovery in volumes post the easing of the lockdown in May. In June, the Frozen Confectionery and Convenience Foods recorded positive volume growth whilst the Beverage business recorded a low single digit decline.

“The week-on-week momentum of same store sales of the Supermarket business displayed signs of recovery,” Balendra added.

The Group’s Bunkering business, Lanka Marine Services, recorded an increase in profitability driven by improved margins despite a reduction in the overall market volumes due to lower throughput in the Port of Colombo.

Construction resumed at ‘Cinnamon Life’ in mid-May after a two-month closure and it is encouraging to note that the momentum is gradually reaching pre-COVID-19 levels. Balendra said the Group is working closely with the contractor to ascertain the impact of the COVID-19 disruptions on the overall timelines of the project. The finishing work of the apartment and office towers are being re-sequenced to be completed within the financial year to enable handover.

The profitability of Nations Trust Bank recorded an increase despite pressure on margins, due to the positive impact on account of the removal of the Debt Repayment Levy from January onwards.

Due to the deployment of cash equity to fund the ‘Cinnamon Life’ project, Group profitability for the quarter was impacted by a year-on-year decrease in finance income, as expected, Balendra added.