Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 16 September 2025 04:44 - - {{hitsCtrl.values.hits}}

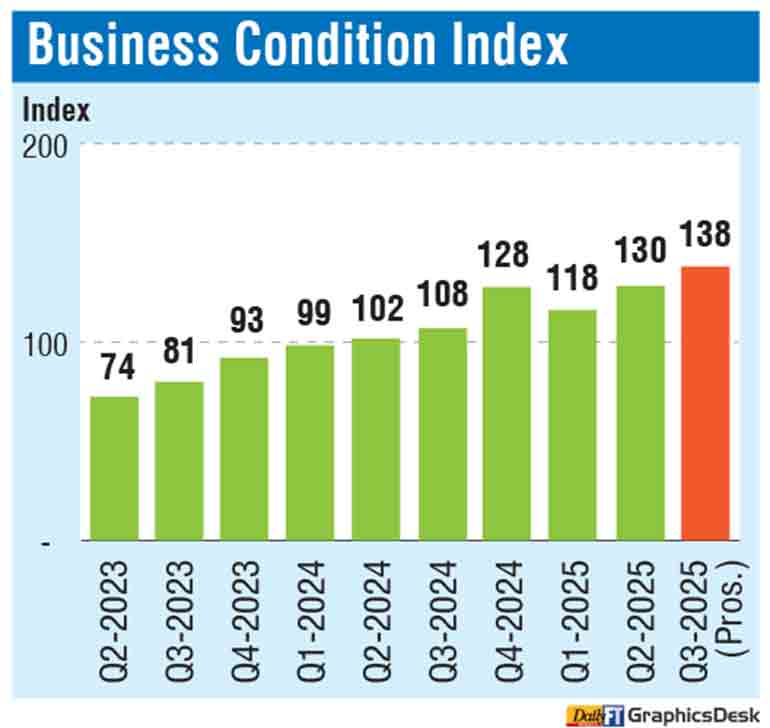

The Central Bank of Sri Lanka (CBSL) recently said its Business Outlook Survey (BOS) Business Condition Index rose to 130 in 2Q 2025, the highest since falling to a low 28 in the 2Q 2022, which would extend further to 138 in 3Q 2025.

CBSL on Friday (12) said the Business Condition Index indicates a notable improvement in business confidence in Q3 2025, extending the upward momentum observed in Q2 2025. This suggests a continuation of positive momentum in the overall business climate.

It said that firms highlighted lower interest rates and a stable exchange rate as the main reasons for this improvement.

A sectoral breakdown further reveals that the positive momentum is broad-based, with all three major sectors, agriculture, industry and services, contributing to the overall improvement in business sentiment.

The CBSL in its outlook for Q3 2025 said businesses expected demand and sales volumes to increase on a year-on-year basis in Q3 2025, supported by contribution from all three major economic sectors.

“The agriculture sector, which has underperformed for a considerable period, is projected to rebound strongly during the quarter. As a result, capacity utilisation is likely to improve during the quarter,” the CBSL said.

The investment outlook for Q3 2025 is also positive, with all three major sectors contributing to the improvement. Firms are expected to direct most of these investments toward expansion or repair/replace existing facilities. Skilled labour availability is expected to remain below the neutral threshold in Q3 2025, particularly in the agriculture and industry sectors.

Meanwhile, the demand for bank credit is projected to grow across all sectors, mainly for their operational requirements, the CBSL said. Noting the development in 2Q 2025, the CBSL said that the balance of opinion on demand and sales improved in volume terms, supported by all three major sectors.

Capacity utilisation also increased on a year-on-year basis, in line with higher demand and sales. At the same time, the investment reported an improvement.

Skilled and Unskilled labour availability declined in all three sectors compared to Q2 2024.

The balance of opinion on demand for bank credit had increased from a year earlier, with firms mainly borrowing for operational purposes. Moreover, the firms rated that the access to credit improved in the quarter, the CBSL said.

The Statistics Department of the Central Bank of Sri Lanka initiated the quarterly Business Outlook Survey (BOS) in 2014 to assess current and future business conditions. BOS summarises opinions expressed by the respondents of around 100 firms selected in accordance with the composition of Sri Lanka’s Gross Domestic Product based on a structured questionnaire.