Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 4 November 2022 00:25 - - {{hitsCtrl.values.hits}}

The Central Bank of Sri Lanka (CBSL) observed an anonymous short article titled ‘New CBSL regime prints more money than the former’ that appeared on the front page of the Daily FT newspaper on 31 October.

The Central Bank of Sri Lanka (CBSL) observed an anonymous short article titled ‘New CBSL regime prints more money than the former’ that appeared on the front page of the Daily FT newspaper on 31 October.

While the said article presented some data with respect to so-called money printing by the CBSL under different regimes of Governors, this brief article aims to provide context and facts on the same with the intent of providing verity and clarity to the general public.

The CBSL statement is as follows.

On regimes, as many of you would recall, the CBSL has seen changes in its leadership from time to time. Some good, some neutral and some bad. While regime changes have been one aspect that the CBSL has had to deal with, unprecedented macroeconomic developments have been another key challenge encountered by the CBSL in the recent past.

The Easter Sunday Attacks and the COVID-19 pandemic ran initial cracks through the economy. These unfortunate events along with limited foreign exchange inflows, widening twin deficits, rising debt levels, lack of access to global financial markets and rating downgrades made matters worse unearthing long-standing structural issues, leading to the crippling of the economy.

It is, without doubt, true that CBSL's intervention when the pandemic unfolded was necessary to prevent the economy from falling into a crisis. However, the monetary stimulus that was unleashed on the economy was not unwound on time as the pandemic-related concerns eased.

Rather, the ‘former CBSL regime’ grossly overused money printing without paying heed to the need for improving the underlying macroeconomic fundamentals. This led to the rapid expansion of money and credit in 2021. In short, the macroeconomic policy mix was flawed.

By late 2021, it was apparent that the economy was becoming increasingly vulnerable with no immediate options available to prevent the economy from falling off the cliff. Some wishful thinking by the then-CBSL Governor only made matters worse, where non-priorities were prioritised, comprehensive reforms were side-lined and the inevitable was disregarded. This was the era of “denial” and “false hopes”, where basic economic relationships and fundamentals were misinterpreted.

The relationship between money and inflation, and the cons of continued money printing were openly refuted; a gradual adjustment in the exchange rate was unallowed; aggravating underlying issues in the country, obvious even to the international community, were downright downplayed and denied; bailing out holders of sovereign bonds; repayment of debt over procuring of essentials was prioritised; preoccupied with contesting rating downgrades over corrective actions; and the exchange rate was let loose without adequate safeguards and prior actions after allowing the foreign reserves of the country to dip to its lowest of lows.

As the citizens of the country faced in numerous challenges as a result, the urgent implementation of ‘politically unpopular’ reforms had to be pursued. This was when the CBSL (under the new regime) embarked on an economic stabilisation program pursuing the previously side-lined and therefore unexplored options of “engaging with the IMF”, “debt restructuring”, “SOBE reforms including cost-reflective pricing” along with the significant tightening of monetary policy was pursued carefully.

Unlike in the previous regime, the current leadership has been transparent and truthful about the way forward, including the extent of financing Government’s budget deficit through purchase of Treasury bills by the CBSL, but continued to highlight the need for the same at the current juncture to prevent Government shutdown and hardships on the public.

Compared to the current regime, the previous regime bought Treasury bill to provide rupees to the Treasury in order to bail out external creditors using the CBSL foreign reserves. However, the current regime, despite providing funds to the Government to meet essential requirements, has taken prudent policy measures to contain the expansionary impact of money printing – by significantly tightening monetary policy.

The misconceptions of the theory behind money printing need clarification as it seems that some, including the former Governor, have gotten it wrong. Quantification of money printing based on the change in the CBSL’s holdings of Government securities is incorrect, as it reflects only one aspect of money printing. Rather, professional economists would know that the complete picture of money printing is reflected by changes in reserve money.

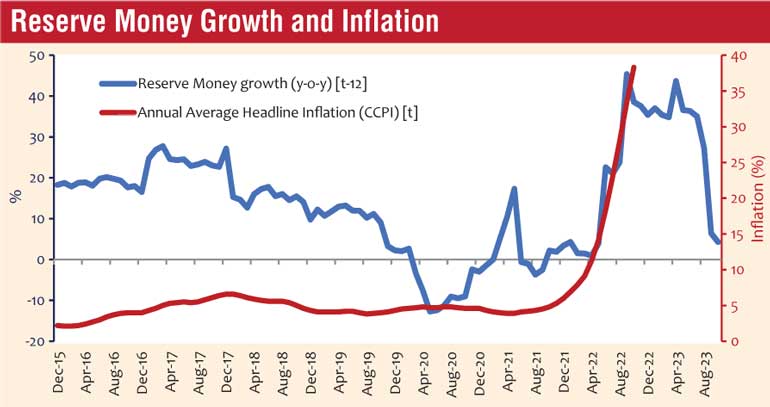

Accordingly, it is worthwhile to assess the movements of reserve money or the monetary base of the country in the period from January 2020 to September 2022. During the year 2020, the expansion in reserve money was recorded at Rs. 32 billion, while from January to August 2021, reserve money expanded by Rs. 125 billion.

Meanwhile, reserve money grew significantly by Rs. 297 billion during the period from September 2021 to March 2022 including the impact of statutory reserve ratio (SRR) adjustment in September 2021, that has contributed to increase reserve money only by about Rs. 170 billion. Nevertheless, under the current leadership, reserve money has, in fact, contracted by Rs. 8 billion during April to September 2022 despite the increase in holdings of Government securities by the CBSL.

With a bit more effort, one would have observed the contraction in reserve money under the current regime in response to the tight monetary policy measures adopted. Another fundamental error is comparing daily averages of money printing indicators. Macroeconomists should adopt a holistic view to assess the implications of policy across economic cycles – as this is not another accounting exercise.

But today, as a result of those carefully-executed and timely corrective policy measures, the CBSL has been able to contain the unwarranted expansion of money and credit, and inflation has commenced moderating as envisaged.

Economic conditions have gradually improved compared to six months ago – fuel queues have normalised, shortages have come down, stability has set in, and slow but gradual progress is observed.

However, it’s a shame that the self-centered, narrow-minded and short-sighted plain vanilla views of those that do not understand the basics of money printing, let alone macroeconomics, are making headlines to dent and undermine the real progress the country has made.