Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 29 December 2025 05:53 - - {{hitsCtrl.values.hits}}

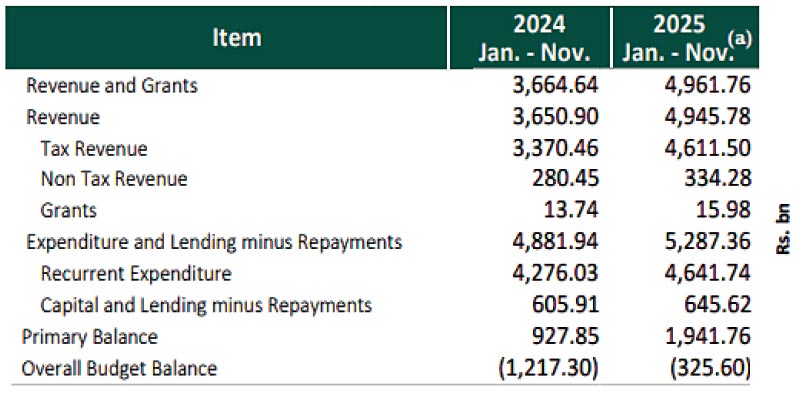

Govt. Fiscal Performance (Source: CBSL)

The Government’s fiscal performance continued to strengthen before the Ditwah crisis, with the Budget deficit in the 11 months to end-November 2025 contracting by over 73% from a year ago and the record primary surplus nearing Rs. 2 trillion.

The Government has earmarked Rs. 700 billion for post-Ditwah relief and recovery measures, comprising Rs. 500 billion via a supplementary estimate for 2026 approved by Parliament on 19 December with an additional Rs. 200 billion to be diverted from the 2026 Budget capital expenditure allocation.

With the International Monetary Fund (IMF) approving the $ 206 million Rapid Financing Instrument (RFI), Sri Lanka has formally assured the IMF that it will preserve fiscal discipline and maintain an open trade and payments regime while responding to the devastation caused by Cyclone Ditwah, as concerns mount over the sustainability of the country’s economic recovery.

The World Bank has estimated initial damage from the disaster at around $ 4.1 billion, while the International Labour Organisation (ILO) has placed the total economic impact at $ 16 billion. The IMF has separately forecast Sri Lanka’s balance of payments (BOP) deficit to widen by about $ 700 million.

According to new Central Bank of Sri Lanka (CBSL) data, the Government’s Budget deficit for the first 11 months of 2025 reached Rs. 325.6 billion, down 73.25% from Rs. 1.22 trillion a year ago, with tax revenue growth outpacing expenditure.

Tax revenue was up 36.82% year-on-year (YoY) to Rs. 4.94 trillion in the first 11 months of 2025, non-tax revenue was up 19.19% YoY to Rs. 334.3 billion, and grants increased by 16.3% YoY to nearly Rs. 16 billion.

Recurrent expenditure was up 8.55% YoY to Rs. 4.64 trillion, while capital and net lending increased 6.55% YoY to Rs. 645.62 billion, while the total allocation for capital expenditure for 2025 was budgeted at Rs. 1.3 trillion.

The Government reported a primary surplus of Rs. 1.94 trillion for the 11-month period, up 109.28% from Rs. 928 billion a year ago.

Earlier this month, in the wake of Cyclone Ditwah, Opposition MP Dr. Harsha de Silva said about Rs. 1 trillion was already available for immediate deployment without new legislation. This was prior to the latest data, which place the primary surplus at nearly Rs. 2 trillion.

Disaster spending would not fall under the 13% of GDP cap on other expenditure, and exemptions under the Central Bank Act allowed monetary support in the event of a natural disaster. Additional allocations would be needed in next year’s Budget as rebuilding advances.

Dr. de Silva said fiscal rules and improved public finance management had strengthened discipline, but warned against using buffers to accumulate surpluses “larger than necessary” at the expense of investment. Sri Lanka, he said, could not rely on incremental inflows. Sustainable growth depended on opening the economy, accelerating reforms, and attracting substantial foreign and domestic private capital.

CBSL Governor Dr. Nandalal Weerasinghe told the Sri Lanka Economic and Investment Summit earlier this month that he was not concerned about the Government’s fiscal performance post-Ditwah, but warned that long-term structural reforms must not be forgotten in order to generate sustainable growth.