Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 10 July 2023 00:26 - - {{hitsCtrl.values.hits}}

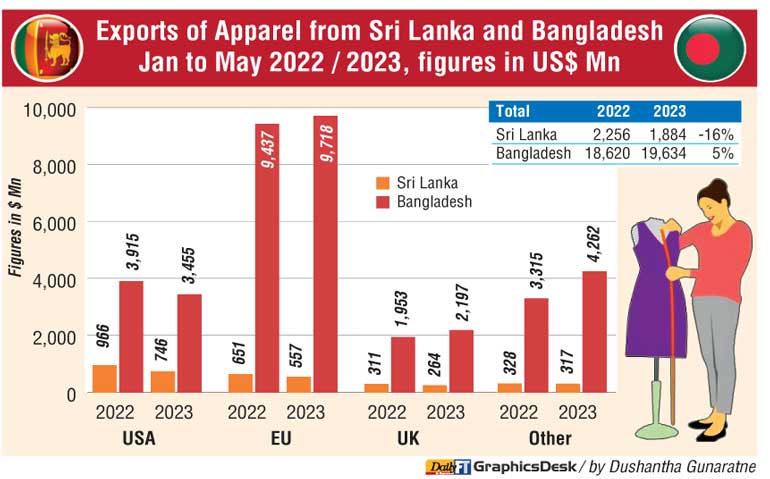

Bangladesh’s apparel industry appears to be navigating the global downturn better than Sri Lanka by achieving an over 5% growth in exports to $ 19.6 billion upto May whilst the latter is languishing with a 16% decline to $ 1.8 billion.

Industry analysts said in the US, where Bangladesh does not have any preferential trade terms, its exports are down by 12% to $ 3.4 billion whereas Sri Lanka’s dip is severe at 25% to $ 746 million. “This would be because of pricing, as Bangladesh has the scale that Sri Lanka doesn’t have,” analysts opined.

In the EU and the UK where Bangladesh has complete duty-free access, the position is quite divergent.

Bangladesh›s exports to the EU were up 3% to $ 9.7 billion whereas Sri Lanka›s exports were down 14% to $ 557 million. Its exports to six countries in EU region, i.e. Germany, Poland, Latvia, Malta, Lithuania, and Slovenia have slowed down; the remaining countries have shown positive growth. Particularly, exports to Germany, the largest export destination for us in the EU, declined by 18.53% to $ 2.58 billion in Jan-May 2023 from $ 3.17 billion in Jan-May 2022. In France and Spain, exports reached $ 1.24 and $ 1.52 billion with 13.99% and 20% growth respectively. At the same time, exports to Italy have also shown promising growth by 30.63% ($ 940.38 million).

Bangladesh’ exports to the UK are up 12% to $ 2.2 billion whereas Sri Lanka’s exports were down by 15% to $ 264 million.

Bangladesh’s latest performance could further benefit on the back of the UK DCTS scheme which is extremely favourable to countries such as Bangladesh whereas Sri Lanka has the same as the EU scheme, which is duty-free on garments made from (EU/UK) or SAARC fabrics only.

More importantly, Bangladesh’s exports to non-traditional markets have increased significantly by 33.34% to reach $ 3.64 billion from $ 2.73 billion in Jan-May 2022. Currently, the share of the non-traditional market to our total apparel export is 18.57%.

Among the major non-traditional markets, Bangladesh’s exports to the top market Japan has shown 49.55% growth while exports in other countries such as Australia, India, China, South Korea , Brazil and Turkey have raised by 55.88%, 41.83%, 39.85%, 22.45%, 92.25% and 33.60% respectively. However, few major markets such as UAE, Russia and Chile have shown 8.67%, 0.69% and 19.91% negative growth respectively.

Sri Lanka›s exports to other markets were down by 3% to $ 317 million upto May 2023.

Analysts said Bangladesh is giving utmost priority on diversifying markets, not only to ensure sustained export growth and reduce overconcentration, but also as a strategy to prepare for the country’s graduation out of the Least Developed Countries (LDCs) on 24 November 2026.

This month (July) a Bangladesh Apparel Summit is being held in Melbourne, Australia considering the importance of the market as well as to open dialogue on post LDC market access issues.

Analysts also said that Bangladesh has also introduced special finance schemes to help the apparel industry.

Its Government has created a BDT 50 billion scheme called “pre-shipment credit refinancing scheme” to support export-oriented companies affected by the COVID-19 pandemic in April 2021. Previously, the interest rate for such loans at the client level was 5%. As per the new circular issued by Bangladesh Bank, the rate has decreased to 3% at the client level. The banks are also able to disburse up to 50% loan for packing credit under this pre-shipment credit refinancing scheme. This will significantly help Bangladesh factories to meet the need for working capital, analysts emphasised.

The Bangladesh Bank has also created another scheme titled “Export Facilitation Fund” of BDT 100 billion to support export-oriented companies to import raw materials. An exporter is allowed to take a loan of a maximum of BDT 2 billion from the fund with only 4% interest rate, which is a pre-finance scheme by nature. This will add further flexibility in securing funds for raw materials sourcing at a lowered cost if we can make use of it.