Monday Feb 23, 2026

Monday Feb 23, 2026

Saturday, 27 May 2023 01:52 - - {{hitsCtrl.values.hits}}

Leading blue chip John Keells Holdings (JKH) has expressed optimism on Sri Lanka’s recovery if the country successfully pursues its first ever fundamental framework of economic policies.

Leading blue chip John Keells Holdings (JKH) has expressed optimism on Sri Lanka’s recovery if the country successfully pursues its first ever fundamental framework of economic policies.

JKH Chairperson Krishan Balendra in his review in the company’s FY23 Annual Report commended the efforts of the Government and policy-makers for successfully navigating the economic stabilisation measures over the last few quarters and in reaching some key milestones including securing the EFF with the IMF, together with the implementation of difficult policy actions.

“While many challenges remain, the country has, possibly for the first time ever, put in place the fundamental framework of economic policies that will enable us to emerge from this crisis stronger,” Balendra said adding, “We are optimistic that Sri Lanka is on a path to recovery, particularly, if these measures continue to be in place and sustained over a period of time.”

It was emphasised that whilst these measures, as expected, would curtail consumer spend and activity in the short to medium-term, the stability and confidence in achieving fiscal consolidation will lead to a more sustained recovery.

Balendra said the new legislative enactments regarding fiscal responsibility are much needed to ensure policy consistency and macroeconomic stability as it provides the required checks and balances.

Balendra said the new legislative enactments regarding fiscal responsibility are much needed to ensure policy consistency and macroeconomic stability as it provides the required checks and balances.

“We urge the authorities to expedite the implementation of much needed public sector reforms, including privatisation, as done by countries when faced with similar challenges in the past, to restore and sustain fiscal discipline. These reforms will also aid the Government in raising revenue through investment while ensuring better collaboration, technology and knowledge transfer in key industries,” JKH Chief said.

He said that through the volatility and uncertainty of the previous years, JKH maintained its belief that challenges can also be catalysts for positive transformation.

“Together with our partners, we launched the biggest port investment in the country, while the steady progress of work on ‘Cinnamon Life Integrated Resort’ – notwithstanding the obstacles of last year – has moved the Group closer towards completion of this transformational investment,” Balendra said.

He expressed confidence that these investments come to fruition, and JKH Group will see a “significant upward ‘re-rating’ of its performance from the already strong platform we have built over the years.”

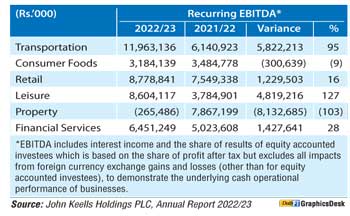

For the financial year 2022/23, JKH Group revenue (excluding equity accounted investees) increased by 27% to Rs. 276.64 billion while recurring Group EBITDA increased by 17% to Rs. 45.74 billion. This growth is despite the significant EBITDA contribution of Rs. 6.30 billion from the Group’s Property business, which included the revenue and profit recognition from the handover of the residential apartments and commercial office floors at ‘Cinnamon Life Integrated Resort’, compared with the absence of any corresponding revenue recognition in the current year.

The recurring Group profit before tax (PBT) decreased by 30% to Rs. 17.14 billion while the recurring profit attributable to equity holders of the parent decreased by 35% to Rs. 13.33 billion for the financial year ended 31 March 2023.

JKH Chief also reiterated the need for tourism authorities to expedite the launch of Sri Lanka’s much awaited global marketing campaign, especially in key source markets, particularly to address the lack of awareness and negative perception regarding the ground situation in the country.

He noted that Sri Lanka recorded over 770,000 tourist arrivals for 2022/23, with March 2023 recording the highest number of arrivals since the peak of the economic crisis. “Although arrivals are still significantly below pre-pandemic levels, it is encouraging to witness the month-on-month pick-up in inquiries and forward bookings. The Group is confident that the current recovery trend in arrivals will continue, particularly given the opening of the Chinese borders for international travel after a period of three years and the increase in frequencies of flights by a few major airlines,” Balendra said.

“Tourism will be a key catalyst to drive the recovery of the economy, particularly in the context of the positive impact it will have on foreign exchange earnings,” JKH Chief added.

Its leisure industry group recorded a strong performance driven by the Maldivian Resorts and the recovery momentum in the Colombo Hotels and Sri Lankan Resort’s segments, supported by a return to normalcy on the back of continued political and social stability during the second half of the financial year.

The Leisure industry group recurring EBITDA grew by 27% to Rs. 8.60 billion in FY23.Balendra said Colombo Hotels recorded a strong performance in its restaurant and banqueting operations. Occupancies of the Colombo Hotels improved on the back of a gradual recovery in business travel. Whilst the first half of the year was subdued due to the fuel restrictions and social instability witnessed in the country, the Sri Lankan resorts segment witnessed a rebound in occupancies during the second half of the year driven by domestic travel and improved tourist arrivals. Margins in the Sri Lankan leisure businesses were under pressure given the rising input and utility costs as yields did not pick up commensurately since the benefit of foreign currency revenue was limited due to the gradual recovery of tourism, he added.

Balendra also said although inflation decelerated, the elevated levels of inflation prevalent since the beginning of 2022/23 compared to the past, and the impact of higher direct and indirect taxes, dampened consumer discretionary spending. JKH’s consumer foods and supermarket businesses were impacted by this.

JKH’s consumer foods industry group recurring EBITDA declined by 9% to Rs. 3.18 billion in FY23. The supermarket business recurring EBITDA grew by 44% to Rs. 7.50 billion.