Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 23 January 2026 00:24 - - {{hitsCtrl.values.hits}}

The Board of Investment of Sri Lanka (BOI) yesterday claimed a significant milestone in 2025 by surpassing the $ 1 billion Foreign Direct Investment (FDI) target, saying it marked a decisive turning point in Sri Lanka’s investment recovery and the BOI’s institutional transformation.

“FDI inflows for the year reached $ 1,057 million, representing a 72% increase compared to 2024. This strong performance reflects renewed global investor confidence in Sri Lanka, supported by improving macroeconomic stability, clearer policy direction, and an enhanced investment facilitation framework,” the BOI said in a statement.

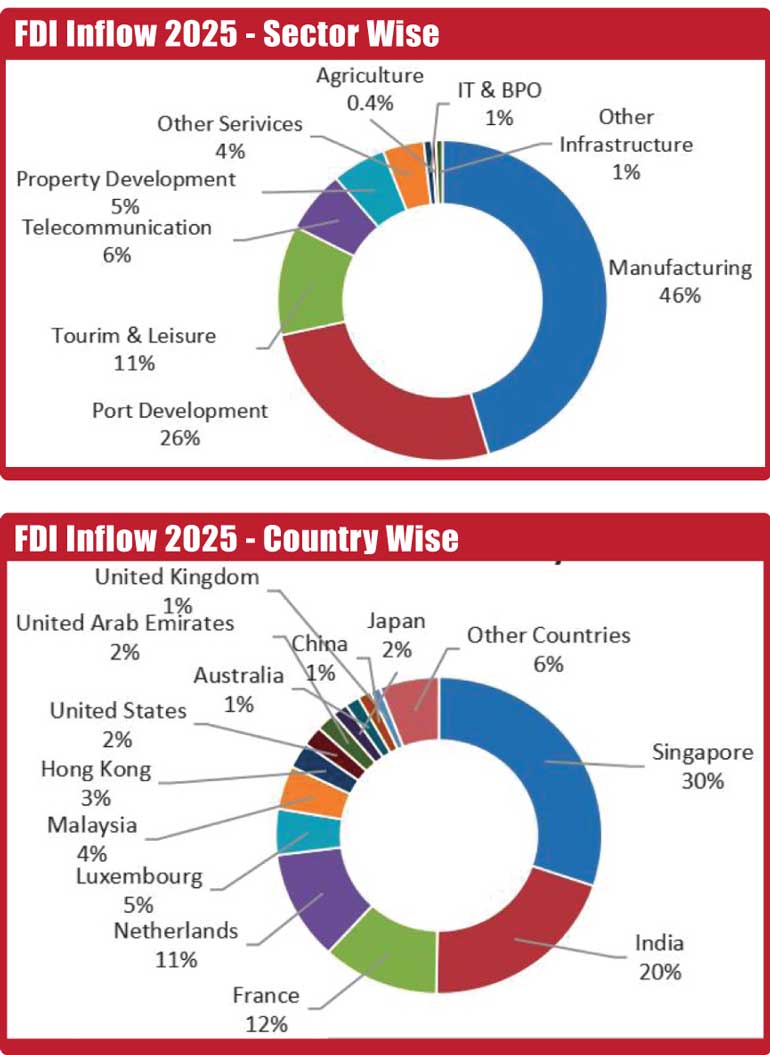

The manufacturing sector attracted 46% of FDI, followed by port development (26%), tourism and leisure (11%), telecommunication (6%), and property development (5%). Singapore was the biggest FDI source at 30%, followed by India 20%, France 12%, Netherlands 11%, and Luxembourg 5%.

In total, 189 companies infused FDI during 2025, of which 26 were new investment projects that signed agreements with the BOI during the year. These new projects contributed $ 134 million, accounting for 13% of total FDI inflows for the year, which is an increase from the norm of 2%-10% of FDI coming from projects within the year, while the remaining $ 923 million originated from continuations and expansions of projects of existing investors.

Attracting new investments is a critical indicator of investor confidence, as greenfield and first-time investments typically involve higher risk perceptions and longer-term commitments. The successful entry of new investors in 2025 demonstrates Sri Lanka’s regained credibility as an investment destination.

At the same time, continuation and expansion projects through fresh injection of funds and re-investments by existing investors reflect a positive and expected trend in a growing investment environment, indicating sustained confidence among existing investors.

According to updated and scrutinised data gathered from BOI-approved companies, the $ 1,057 million FDI inflow comprised $ 167 million in equity capital, $ 213 million in re-investments, $ 567 million in intra-company borrowings, and $ 110 million in foreign commercial borrowings.

In addition, during 2025, the BOI approved 146 investment projects with a total investment value of $ 1,906 million. This includes 70 new projects and 76 expansion projects. Of the total approved investments, $ 896 million is expected to flow in as foreign capital, providing strong momentum towards achieving the FDI target of $ 1.5 billion set for the year 2026, the BOI said.

The BOI attributes this success to the strong institutional foundation established over the past year, including continuous monitoring of project progress, streamlined approval processes, and close coordination with line Ministries and regulatory agencies. These measures have strengthened investor confidence not only within the BOI framework but across the broader investment ecosystem.

Building on the momentum of 2025, the BOI has embarked on a focused path of institutional transformation. A key initiative in this journey is the launch of the BOI Accelerator Program, which sets out a clear strategy and roadmap supported by a two-year action plan aimed at strengthening institutional capacity, enhancing investor facilitation services, and positioning the BOI as a globally competitive and investor-friendly agency.

Several complementary initiatives have also been undertaken to enhance the BOI’s facilitation role. In collaboration with the Asian Development Bank (ADB), the BOI developed comprehensive policy and strategy frameworks for Investment Promotion, Investment Project Evaluation, and a Policy on Land Allotment.

Recognising the importance of human capital development within the organisation, the BOI recruited Management Trainees with diversified skill sets in 2025 and secured approvals to fill 88 critical vacant cadre positions whilst continuing with sustained training and development together with empowerment of the management. In addition, a performance-based bonus scheme was approved by the BOI Board and is scheduled for implementation from 2026 onwards, subject to Cabinet approval.

Laying an emphasis on structured and high-impact investments, the BOI also launched a new initiative to identify, develop, and promote “Structured Investment Opportunities.” Under this initiative, 20 structured projects will be announced in the first phase, supported by a targeted and vigorous promotion campaign to attract sustainable and high-quality investors.

Looking ahead to 2026, several significant investment projects are in the pipeline, including the Sinopec Oil Refinery, while sector-specific investments are progressing in areas such as cannabis or Thriloka Vijaya Pathra-based manufacturing, spices and areca nut processing, data centres, virtual Special Economic Zones (SEZs), and capital mobility initiatives for startups and other emerging sectors. The BOI expects to finalise agreements on these during the coming months.

With the institutional transformation underway and the ongoing review of the Economic Transformation Act to further strengthen the BOI’s mandate, Sri Lanka is well-positioned to achieve its $ 1.5 billion FDI target in 2026, the investment promotion agency said.