Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 26 June 2023 01:08 - - {{hitsCtrl.values.hits}}

Electricity tariff revisions proposed by the Ceylon Electricity Board (CEB) for the period from July to December indicate there is room for a reduction in the tariff and that these reductions would be for “entities of economically important businesses”. However, to the dismay of the Joint Apparel Association Forum (JAAF), CEB has failed to extend these industrial tariff reductions to the apparel industry – the country’s largest foreign exchange earner and a significant contributor to Sri Lanka’s debt-ridden economy.

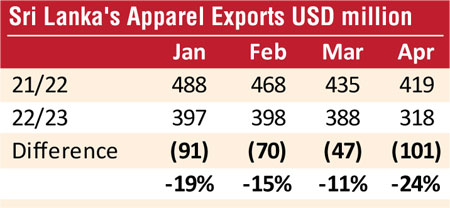

The electricity tariff hikes that came into effect at end 2022 and the beginning of this year have completely disregarded the integral role played in the country’s economy by the apparel industry. Despite continuous warnings and cautions from JAAF, the Public Utilities Commission (PUCSL) granted approval to a 66% electricity tariff hike earlier this year based on an overestimation of electricity demand. This was done having well realised that the industry was faced with a15-20% drop in orders which signalled a reduction in demand due to the ongoing global recession. The result is an exponential increase in costs to business operations, threatening the sustenance and operation of a $ 5 billion industry that braces the country’s economy. As a result, due to this reduction in exports, the sector has become less competitive. Charted below is the fall in apparel exports in the first four months of 2023, highlighting a 17% decrease over the quarter.

It is vital that Sri Lanka apparel maintains its competitiveness in the global manufacturing sector. Earlier this year, amidst the 66% electricity tariff hike, JAAF highlighted that in terms of electricity rates, Sri Lanka’s electricity tariff in US dollars stood at the top end of the scale when compared to regional giants like India, Bangladesh, Vietnam, Indonesia, and Thailand which offered $ 9-10 cents per kWh. It is important to note that with the strengthening of the Sri Lankan Rupee, Sri Lanka’s energy costs in US Dollars are now significantly higher than our competitors. When fixed and maximum demand charges are included, Sri Lanka’s energy costs are notched at over $ 16 cents per kWh, while our biggest competitor Bangladesh is under $ 10 cents. Vietnam and Indonesia offer rates under $ 8 cents. It is also alarming to note that the government hopes to export surplus power to India in this context, as our industrial electricity tariff rates are now 21% higher than that of India.

It is vital that Sri Lanka apparel maintains its competitiveness in the global manufacturing sector. Earlier this year, amidst the 66% electricity tariff hike, JAAF highlighted that in terms of electricity rates, Sri Lanka’s electricity tariff in US dollars stood at the top end of the scale when compared to regional giants like India, Bangladesh, Vietnam, Indonesia, and Thailand which offered $ 9-10 cents per kWh. It is important to note that with the strengthening of the Sri Lankan Rupee, Sri Lanka’s energy costs in US Dollars are now significantly higher than our competitors. When fixed and maximum demand charges are included, Sri Lanka’s energy costs are notched at over $ 16 cents per kWh, while our biggest competitor Bangladesh is under $ 10 cents. Vietnam and Indonesia offer rates under $ 8 cents. It is also alarming to note that the government hopes to export surplus power to India in this context, as our industrial electricity tariff rates are now 21% higher than that of India.

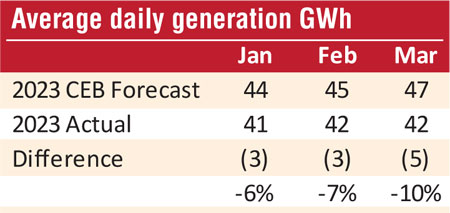

Earlier this year, JAAF highlighted that the proposed electricity tariff hikes were based on increased electricity demand, pointing to a clear overestimation of electricity demand by the CEB. JAAF’s statement is now confirmed as accurate by CEB’s own documentation with the actual consumption being recorded as 10% less than what was actually forecasted by the CEB early this year.

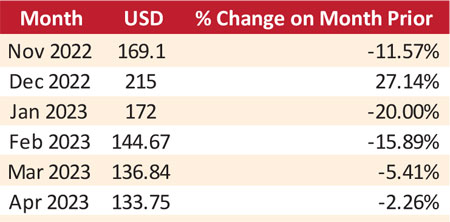

As the Sri Lankan economy continues to contract, it is logical that demand will continue to fall. This in turn reduces the reliance on more costly fuel sources driving overall costs higher. It is also worth noting that coal prices have also reduced leading to a reduction in the price of energy to the industrial sector. Coal prices are expected to remain at approximately $ 104 per MT this year.

As the Sri Lankan economy continues to contract, it is logical that demand will continue to fall. This in turn reduces the reliance on more costly fuel sources driving overall costs higher. It is also worth noting that coal prices have also reduced leading to a reduction in the price of energy to the industrial sector. Coal prices are expected to remain at approximately $ 104 per MT this year.

The depreciation of the US Dollar has also resulted in a reduction of import costs to the CEB. Therefore the electricity distributor can no longer pass on the costs of the rupee depreciation to the apparel industry via exponential industry electricity tariff rates.

The depreciation of the US Dollar has also resulted in a reduction of import costs to the CEB. Therefore the electricity distributor can no longer pass on the costs of the rupee depreciation to the apparel industry via exponential industry electricity tariff rates.

In light of this, JAAF urges the PUCSL to recognise the sizable contribution the apparel industry makes to the Sri Lankan economy and extend industrial tariff reductions to the industry, allowing the industry to compete on a level playing field in an intensely competitive global market.