Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 28 November 2025 05:35 - - {{hitsCtrl.values.hits}}

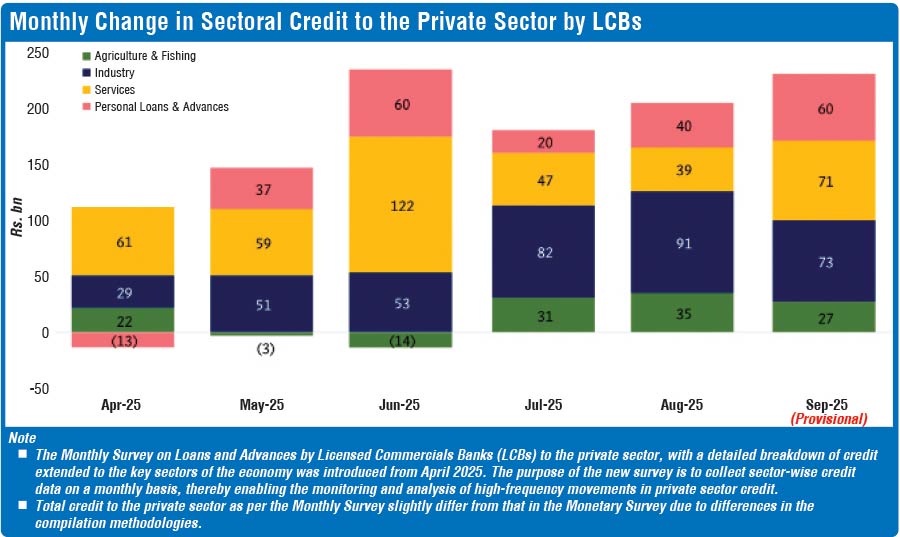

Sectoral credit data from April to September 2025 has shown that the strongest month-to-month turnaround in private sector lending comes from agriculture and personal loans. Both segments recorded negative or weak flows in May and June, but shifted into firm double digit shares of monthly credit by the third quarter.

While industry and services continue to absorb the largest lending volumes, the data indicates that the broadening of credit flows is being led by the sectors that were contracting earlier in the year.

The sectoral figures come from the Central Bank of Sri Lanka’s (CBSL) Monthly Survey on Loans and Advances by Licenced Commercial Banks to the private sector. Introduced from April 2025, the survey tracks the monthly change in outstanding credit to four categories: agriculture and fishing, industry, services, and personal loans and advances.

Because the data captures net changes in credit rather than the total loan book, negative values represent months when repayments exceeded new borrowing, which can result in negative sector shares in the monthly totals.

Agriculture and fisheries posted the sharpest reversal. The sector recorded net repayments of Rs. 3 billion in May and Rs. 14 billion in June, equivalent to shares of –2.1% and –6.3% of total monthly credit.

From July onwards, lending turned positive, with Rs. 31 billion in July and Rs. 35 billion in August, representing 17.2% and 17.1% of total credit.

In September, agriculture contributed Rs. 27 billion or 11.7%. This pattern reflects a shift from two months of net repayments to sustained positive flows in the third quarter.

Personal loans also showed a clear recovery. Net repayments of Rs. 13 billion in April amounted to –13.1% of that month’s total credit. From May onwards, the flows were positive, with Rs. 37 billion and Rs. 60 billion in May and June, corresponding to 25.7% and 27.1% of total credit.

After easing to 11.1% in July, personal lending increased to 19.5% in August and 26.0% in September. The data points to improving household liquidity and small business borrowing after mid-year.

Industry remained the largest recipient of new credit across most months. The sector accounted for 29.3% of total credit in April, 35.4% in May and 24.0% in June. Its share rose to 45.6% in July and 44.4% in August before moderating to 31.6% in September.

These flows reflect steady demand from production-linked sectors despite the shifts occurring elsewhere.

Services lending remained volatile. The sector accounted for 61.6% of total credit in April, declined to 41.0% in May and rose to 55.2% in June.

It fell to 26.1% in July and 19.0% in August before recovering to 30.7% in September. June was the strongest month for services, supported by a temporary surge in trade and transport-related borrowing.

Total private sector credit flows increased from about Rs. 99 billion in April to Rs. 144 billion in May and Rs. 221 billion in June. Lending eased to about Rs. 180 billion in July and Rs. 205 billion in August before rising to about Rs. 231 billion in September.

The data from the new survey highlights not only the rise in total credit but also changes in its distribution, with agriculture and households returning to positive borrowing alongside continued strong flows to industry and services.

According to the CBSL’s regular credit report, based on a separate survey, total private sector borrowings in September spiked to a record Rs. 236.3 billion, resulting in the total outstanding amount reaching Rs. 9.52 trillion, up 22.1% from a year ago.

This is the highest monthly private sector borrowing after Rs. 227 billion in August, followed by Rs. 221 billion in June.

The CBSL noted the data varied between the two surveys due to methodology differences.

CBSL Governor Dr. Nandalal Weerasinghe earlier this week said the recent credit growth did not amount to overheating.