Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 1 October 2024 01:54 - - {{hitsCtrl.values.hits}}

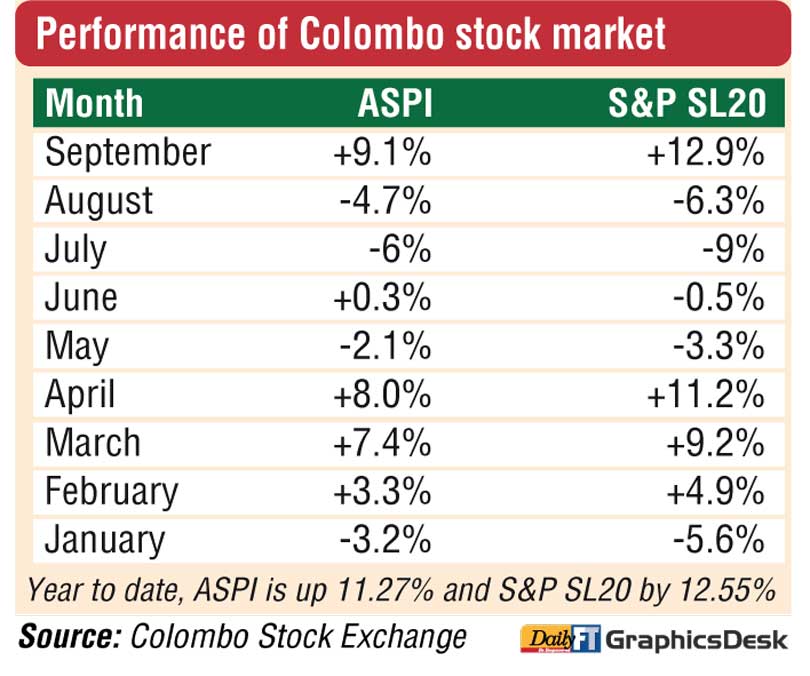

The victory of Anura Kumara Dissanayake (AKD) at the 21 September Presidential election has given the turbo boost for the Colombo bourse to end the month with the highest ever gain so far this year.

The victory of Anura Kumara Dissanayake (AKD) at the 21 September Presidential election has given the turbo boost for the Colombo bourse to end the month with the highest ever gain so far this year.

The record performance was despite CSE slumping to negative Year to Date return prior to the poll. ASPI was up 0.27 and S&P SL20 was negative 3%.

The near 10% gain of the benchmark ASPI and 13% jump by the active S&P SL20 since the victory of AKD boosted the YTD return of both indices to double digit back again after many months.

Owing to the continued momentum, yesterday closed in green for the 10th consecutive day.

First Capital said the Broad Market wrapped the day in green for the 10th consecutive day as investors opted to maintain the positive sentiment of the previous week. The market started the day on a bullish note, with the index soaring to an intraday high of 11,914. As selling pressure emerged, the market experienced a pullback and experienced sideways movement. However, the ASPI recovered gradually and closed the day at 11,885, gaining 81 points.

Significantly, a major stake was traded in UML in the main board, making UML the second highest contributor to the overall turnover. The majority of the hotel sector counters witnessed selling pressure during the day, particularly with notable declines in MARA and BERU.

JKH, COMB, NDB, CFIN and SAMP emerged as the top positive contributors to the index. Turnover yesterday was Rs. 2.6 billion marking an 80.3% increase from the monthly average standing at Rs. 1.4 billion. The Banking sector solely contributed 26% to the overall turnover whilst the Capital Goods and Retailing sectors jointly contributed 28% to the total turnover.

NDB Securities said high net worth and institutional investor participation was noted in United Motors Lanka, Hatton National Bank, Tokyo Cement Company. Mixed interest was observed in John Keells Holdings, Hayleys Fabric and Dipped Products whilst retail interest was noted in SMB Leasing, Industrial Asphalts and Cable Solutions.

Foreign participation in the market activity remained at subdued levels with foreigners closing as net sellers.

The Banking sector was the top contributor to the market turnover (due to Hatton National Bank) whilst the sector index gained 1.06%. The share price of Hatton National Bank increased by one Rupee to Rs. 204.75.

The Capital Goods sector was the second highest contributor to the market turnover (due to John Keells Holdings) whilst the sector index increased by 2.27%. The share price of John Keells Holdings moved up by Rs. 6.50 to Rs. 179.25.

United Motors Lanka, Hayleys Fabric and Dipped Products were also included amongst the top turnover contributors. The share price of United Motors Lanka lost Rs. 13.20 to Rs. 52.40. The share price of Hayleys Fabric recorded a gain of Rs. 1.50 to Rs. 52.50. The share price of Dipped Products appreciated by 20 cents to Rs. 37.80.