Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 24 October 2025 00:32 - - {{hitsCtrl.values.hits}}

Sri Lanka could raise about $ 450 million annually by imposing a 1.7 to 3.5% wealth tax on the richest 0.5% of its population, according to a new analysis cited by Human Rights Watch (HRW) in its latest report ‘Tax Giveaways, Struggling Schools.’

The rights group said the proposed tax, modelled on Spain’s “solidarity charge,” would generate nearly half the funding allocated to education in 2022.

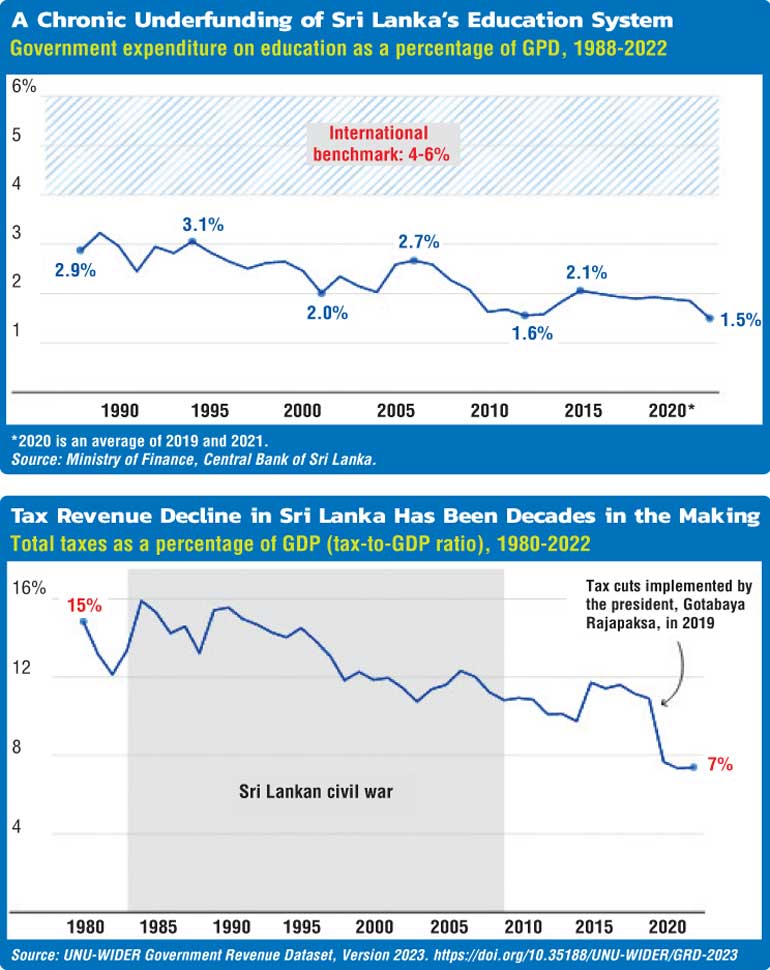

It argued that decades of “tax giveaways” and widespread exemptions for corporations have drained Government revenues and deepened inequality, leaving critical sectors like education underfunded.

HRW said successive policy choices have left Sri Lanka’s tax system “regressive and inadequate,” undermining the State’s ability to meet its human rights obligations.

The report found that widespread corporate tax exemptions, weak taxation of personal income and wealth, and corruption in revenue agencies have led to chronic shortfalls in Government revenue.

According to the report, corporate tax incentives granted through the Board of Investment and under the Strategic Development Projects Act cost the Treasury Rs. 978 billion, or 56% of total tax revenue, in 2022.

“These tax giveaways have drained resources from education and public welfare while benefitting corporations and high-income earners,” the report stated.

HRW also highlighted Sri Lanka’s growing reliance on indirect taxes such as VAT, noting that “direct taxes accounted for 33% of tax revenues in 1977, but averaged just 19% between 1980 and 2018.” That share rose to 30% prior to the crisis, but is projected to fall back to around one-quarter of total revenues under fiscal reforms.

Meanwhile, the share of VAT in total revenues, which stood at 25% between 2010 and 2023, is expected to rise to more than one-third between 2024 and 2027.

A 2024 World Bank review described Sri Lanka’s VAT reforms as “particularly regressive,” saying they had contributed to a 3.9 percentage point increase in poverty.

The report also cited an International Monetary Fund (IMF) governance review that found “virtually no culture of integrity observed [in revenue agencies], with corruption allegedly found at every level – including top management.”

HRW urged the Government to adopt progressive tax measures, improve transparency in granting corporate exemptions, and strengthen the enforcement capacity of revenue agencies.

It also called on global policymakers to finalise a UN tax cooperation treaty to curb tax competition and illicit financial flows that continue to erode the fiscal base of developing economies.