Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 28 April 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

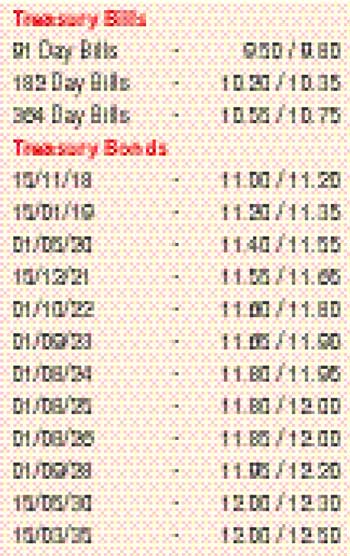

The weighted averages at yesterday’s Treasury bond auctions were seen plunging in comparison to its previously recorded averages and below its secondary market yields as well.

The 1.08 year maturity of 15.01.2019 recorded a decrease of 109 basis points to 11.21% closely followed by the 4.07 year maturity of 15.12.2021 by 105 basis points to 11.55% while the 8.03 year maturity of 01.08.2025 recorded an average of 11.87%.

The total accepted volume was seen matching the total offered volume of Rs. 23 billion to the dot.

Activity in the secondary bond market continued to remain high as yields were seen see-sawing during the day. During opening trades yields on the two 2024 maturities (i.e. 01.01.24 and 01.08.24) and the 01.08.26 maturity were seen changing hands at lows of 11.80%, 11.85% and 11.95% respectively and increasing subsequently to daily highs of 12.00%, 12.05% and 12.10% respectively on profit-taking. However, leading to the outcome of the bond auctions and following it, yields were seen declining once again to lows of 11.69%, 11.79% and 11.78%.

Furthermore, the 15.12.21 maturity was seen opening the day at a high of 11.75% and dipping to a low of 11.50% during the day while the 01.03.21, 01.05.21 and 01.08.21 maturities were seen changing hands within the range of 11.50%-11.75% as well. Profit-taking once again at these levels led to yields picking up towards the end of the day.

The total secondary market Treasury bond transacted volume for 26 April 2017 was at Rs. 7.50 billion.

In money markets, liquidity was seen increasing to Rs. 33.98 billion yesterday as overnight call money and repo rates remained steady to average 8.71% and 8.53% respectively. The Central Bank was seen draining out a volume of Rs. 36 billion yesterday through its Open Market Operations (OMO) at a weighted average of 7.29%.

The USD/LKR rate on the active two week forward contracts was seen closing the day down at Rs. 153.25/35 against its previous day’s closing of Rs. 153.10/20 on the back of importer demand outweighing dollar inflows.

The total USD/LKR traded volume for 26 April 2017 was $ 139 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 153.85/95; 3 Months - 156.05/15 and 6 Months - 159.05/25.