Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 4 July 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

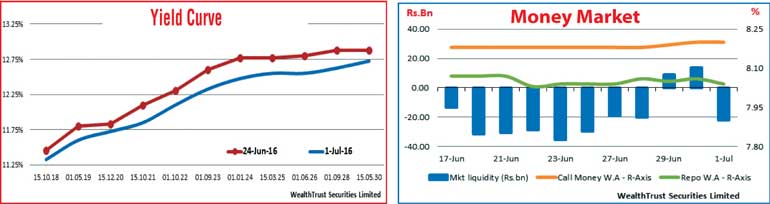

Weighted averages that were well below market expectations, at both the primary Treasury bond auctions, held during the week, resulted in the bond market turning bluish with considerable buying interest, and along with it a parallel downward shift of the overall yield curve, witnessed for the first time in three weeks.

The liquid maturity consisting of 01.01.24 reflected the sharpest decline of 43 basis points to a weekly low of 12.34% followed by the 15.03.25 which declined by 38 basis points to 12.40% and the 01.06.26 by 35 basis points to 12.45%.

Furthermore, the 2018 and 2019 maturities were seen changing hands within a range of 11.15% to 11.40% and 11.60% to 11.90% respectively, against their previous weeks closing levels of 11.40/50 and 11.70/90, while the 15.12.20 maturity was seen trading within a range of 11.74% to of 11.90%.

This bullish trend was further supported by the increase in foreign holdings of rupee bonds, for a fourth consecutive week, recording an inflow of Rs. 1.2 billion during the week ending 29 June 2016.

In the money market, Overnight call money and repo rates remained mostly unchanged to average at 8.19% and 8.05% respectively, with the net liquidity shortfall in the system dropping to Rs. 7.65 billion against its last week level of Rs. 31.01 billion.

Rupee appreciates during the week

The USD/LKR rate on one week forward contracts appreciated during the week to a high of Rs. 145.80 against the previous weeks closing level of Rs. 147.80/90 before losing marginally to close the week at Rs. 146.55/85. The daily USD/LKR average traded volume for the first four days of the week stood at $ 54.79 million.

Some of the forward dollar rates that prevailed in the market were one month – 147.00/20; three months – 148.30/50 and six months – 150.70/90.