Sunday Mar 08, 2026

Sunday Mar 08, 2026

Tuesday, 20 October 2015 00:07 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

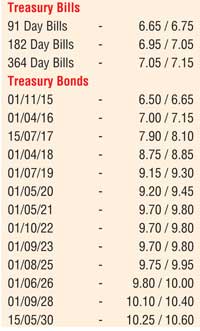

Moderate activity was witnessed in the secondary bond market with yields across all maturities increasing for the first time in nine days ahead of the monitory policy announcement for October, which is due today.

Policy rates currently stand at 6.00% and 7.50% and have remained unchanged over the past five months.

The liquid maturities of 01.05.21 and 01.10.22 hit intraday highs of 9.80% against their previous day’s closing levels of 9.40/50 and 9.50/65 respectively. Furthermore, maturities consisting of 15.11.18, 15.09.19, 01.05.20, 01.09.23 and 01.08.25 were quoted at levels of 8.80/20, 9.15/35, 9.20/45, 9.70/80 and 9.75/95, resulting in two-way quotes widening and increasing along the yield curve.

In money markets, overnight call money and repo rates averaged 6.35% and 6.29% respectively with surplus liquidity standing at Rs. 63.37 billion.

Rupee depreciates marginally

The rupee on spot contracts traded at Rs. 141.00 and went on to close the day at Rs. 140.05/15 against its previous day’s closing levels of Rs. 140.90/00. The total USD/LKR traded volume for 16 October was $ 34.35 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 141.63/70; three months - 142.70/80 and six months - 144.35/50.