Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 2 November 2015 00:00 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The successful launch and attractive pricing of Sri Lanka’s ninth sovereign dollar bond issue during the early part of the week ending 30 October saw activity in secondary bond markets increase as market sentiment turned bullish.

This was further supported by the impressive outcome of both primary auctions for bills and bonds where the weighted averages dipped across all three bill maturities for a third consecutive week. The same result was witnessed at the Treasury bond auction as well where the weighted averages of all four auctioned maturities dipped when compared with the previously recorded weighted averages.

Secondary market bond yields too declined considerably with the two liquid 2019 maturities (i.e. 01.07.19 and 15.09.19) hitting two month lows of 8.67% and 8.70% respectively. The 01.05.20 and the two 2021’s (i.e. 01.05.21 and 01.08.21) also dropped to 8.85% and 9.00% each respectively, while the 01.10.22 and 01.09.23 both declined to 9.15%. This was in comparison to the previous weeks closing levels of 9.12/18 each, 9.25/30, 9.44/48 each, 9.55/65 and 9.65/90 respectively.

Furthermore, on the long end of the yield curve, the 01.08.2025, 01.09.2028 and the 15.03.2035 was seen changing hands within the range of 9.40% to 9.45%, 10.05% to 10.15% and 10.75% to 10.85%. The secondary bill market too witnessed considerable buying interest, with the 91day bill changing hands within the range of 6.50% to 6.55%, the 182 day bill within the range of 6.85% to 6.90% and August 2016 bills within the range of 6.90% to 6.92%.

The overall bullish momentum was even reflected in the results of the second Treasury bond auction for the week, which was held on Friday, where the 01.05.20 and 15.05.30 dipped by 59 and 63 basis points respectively to register weighted averages of 8.99% and 10.33%. However all bids received for the 01.01.24 maturity were rejected. A total amount of Rs.10.3 billion was accepted of the two maturities against its initial total offered amount of Rs.9 billion.

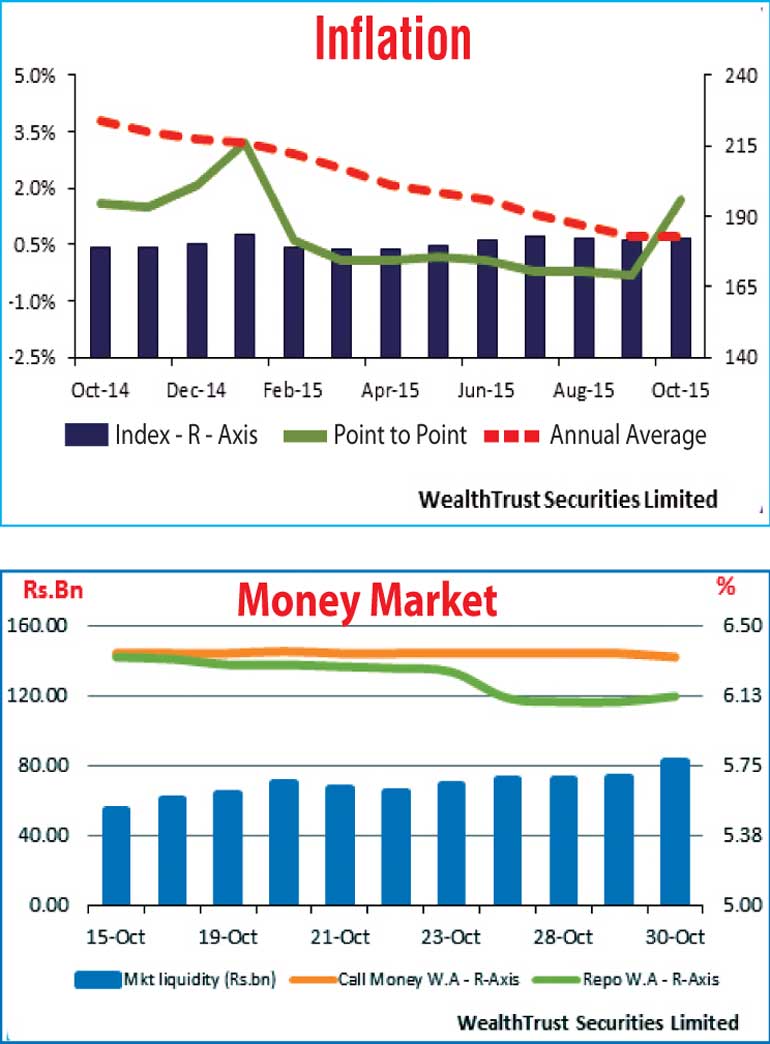

However, the inflation figure for the month of October increased to 1.7% on a point to point basis as against a negative figure of 0.3% recorded in September with the annualised average figure remaining steady at 0.7%.

Meanwhile in money markets, the overnight repo rate decreased further to average 6.10% as surplus liquidity increased to an average of Rs. 74.58 billion. The Overnight call money rate remained steady to average 6.35%.

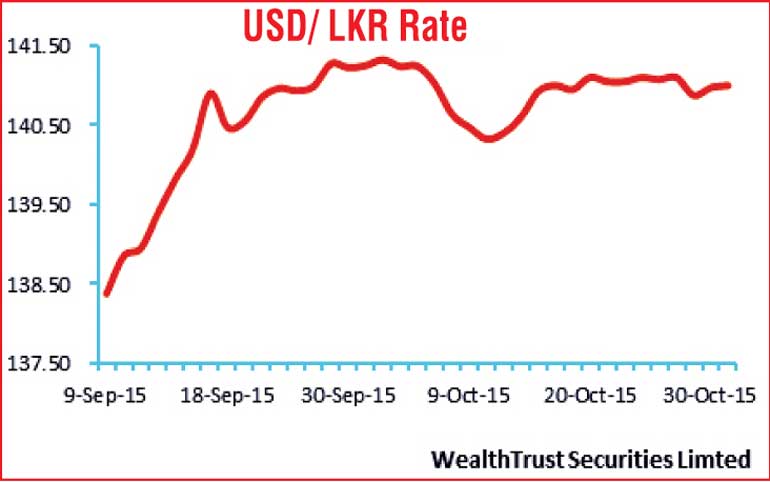

Rupee appreciates during the week

The news of the sovereign dollar bond issue saw the rupee on spot contracts appreciating during the week to close at Rs. 140.95/05 against its previous weeks closing of Rs. 141.10/20, subsequent to appreciating to an intra-week high of Rs. 140.85.

The daily average USD/LKR traded volumes for the first three days of the week stood at $ 72.23 million. Given are some forward dollar rates that prevailed in the market: one month – 141.50/60; three months – 142.40/55; six months – 144.00/10.