Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 8 March 2016 00:35 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

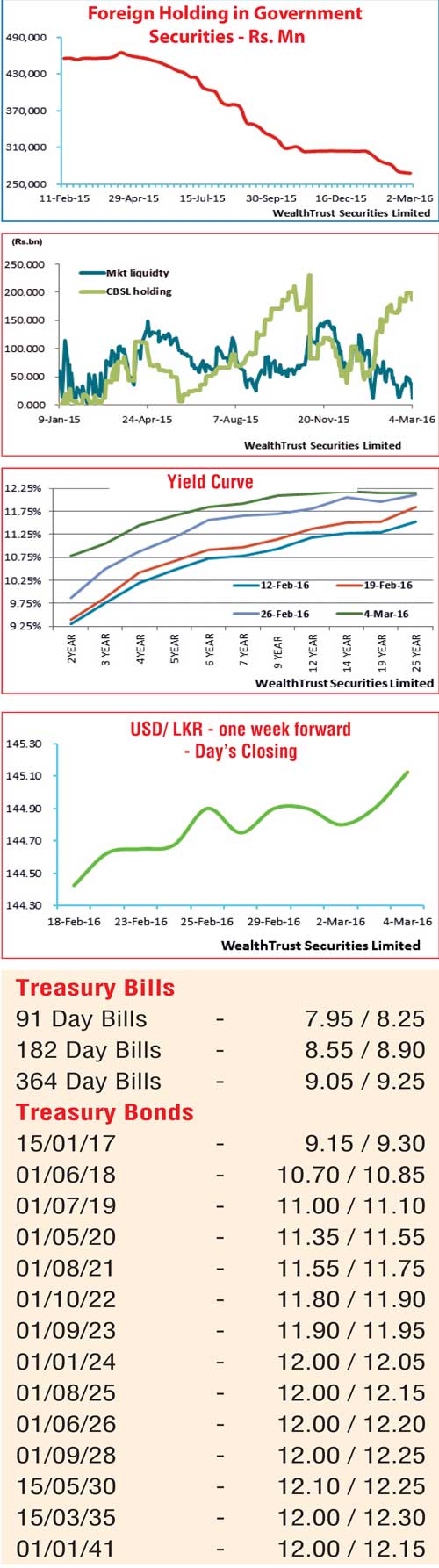

The upward momentum in primary and secondary market Treasury bill and bond yields continued for a seventh consecutive week, reflecting a parallel shift upwards of the yield curve for a fourth consecutive week as well.

The downgrade to Sri Lanka’s country rating and its outlook to negative from stable coupled with the increase in Inflation for the month of February and the uptick in all primary auction weighted averages contributed to this development.

Secondary markets remained active during the week ending 4 March, mainly centering the liquid maturities of 1 August 2021, 1 October 2022 and 1 September 2023 as they were seen hitting weekly highs of 11.55%, 11.85% and 12.01% respectively recording week on week increases of 45 basis points (bp), 30 bp and 28 bp.

In addition on the short end of the yield curve, early 2017 maturities were seen changing hands within the range of 9.00% to 9.30%, 2018’s within 10.32% to 10.75% and 2019’s within 11.00% to 11.10% during the week while on the long end the 15 May 2030 maturity was seen changing hands within the range of 12.15% to 12.25%.

Furthermore, selling interest in secondary market bills continued as well with the 91, 182 and 364 day maturities been offered at levels of 7.95%, 8.50% and 9.05% respectively post its weekly auction.

Meanwhile, foreign selling in rupee bonds was seen slowing down to record its lowest volume of Rs.961 million over the past eight consecutive weeks for the week ending 2 March.

In money markets, the surplus liquidity in the banking system was seen reducing to over a one year low of Rs.10.39 billion on Friday (4 March) against its previous weeks average of Rs. 38.65 billion. However, overnight call money and repo rates remained broadly steady to average 7.52% and 7.02% during the week ending 4 March.

Rupee dips further during the week

The rupee on active one week forward contracts closed the week marginally lower at Rs.145.05/25 against its previous weeks closing of Rs.144.70/80 on the back of seasonal importer demand. The daily USD/LKR average traded volume during the first four days of the week stood at $ 70.61 million.

Some of the forward dollar rates that prevailed in the market were one month – 145.60/00; three months – 146.80/10; and six months – 149.00/30.