Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 29 February 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

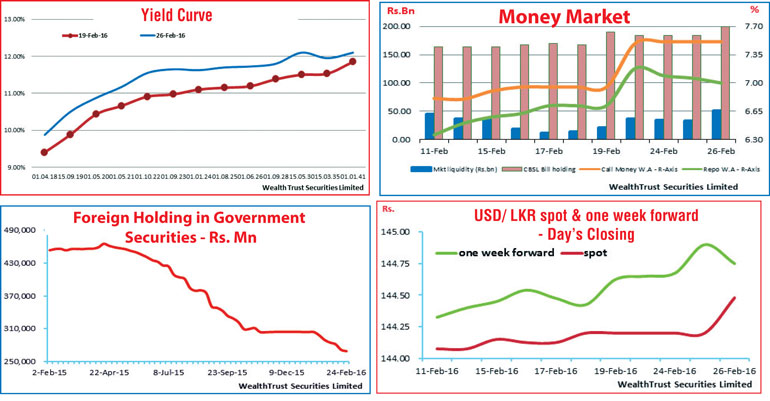

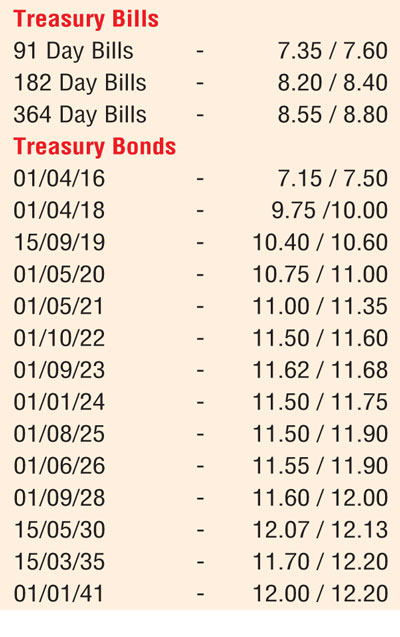

The upward trend in secondary market bond yields continued for a sixth consecutive week for the week ending 26 February, driven by the outcome of the monitory policy announcement this time around. Yields on the 5.04 and 5.07 year maturities of 01.05.2021 and 01.08.2021 were seen increasing week on week by 39 basis points (bp) and 44 bp respectively to over two year highs of 11.05% and 11.10% followed by the 6.08 year and 7.05 year maturities of 01.10.2022 and 01.09.2023 increasing by 69 bp and 73 bp respectively to highs of 11.60% and 11.70%. In addition, yields on the rest of the yield curve moved up as well with 2019 maturities changing hands within the range of 10.45% to 10.55% while on the long end of the curve, the 15.05.2030 and 01.01.2041 maturities were seen changing hands within the range of 11.85% to 12.10% and 12.00% to 12.05% respectively. Furthermore the foreign holding in Rupee bonds dipped for a seventh consecutive week, recording its slowest outflow of Rs.2.49 million over the past six weeks.

This was ahead of today’s Treasury bond auctions, the first following the policy rate hike where an total amount of Rs.9 billion will be on offer consisting of Rs.3 billion each on a 1.11 year maturity of 01.02.2018, a 5.05 year maturity of 01.08.2021 and a 7.06 year maturity of 01.09.2023.

Meanwhile in money markets, the base rate increase saw overnight call money and repo rates increasing during the week to average 7.51% and 7.08% respectively despite average surplus liquidity in the system increasing to Rs.38.65 billion. The Central Bank holding in Treasury bills increased further to close the week at Rs.199.59 billion.

Downward trend in Rupee continue

The rupee on active one week forward contracts were seen dipping to a weekly low of Rs.145.00 against its previous weeks closing levels of Rs.144.60/65 on the back of seasonal imported demand before bouncing back to close the week at Rs.144.70/80. More interestingly spot contacts which were inactive during the first three days of the shortened trading week, was seen hitting low of Rs.144.50 on Friday before closing higher once again at Rs.144.40/55. The daily USD/LKR average traded volume during the first three days of the week stood at US $ 53.65 million.

Some of the forward dollar rates that prevailed in the market are 1 Month - 145.10/50; 3 Months - 146.50/80 and 6 Months - 148.60/00.