Thursday Feb 12, 2026

Thursday Feb 12, 2026

Wednesday, 21 October 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Central Bank of Sri Lanka was seen holding its policy rates steady at 6.00% and 7.50% for a sixth consecutive month at its monthly monetary policy announcement yesterday for the month of October.

Following the announcement, buying interest returned back to markets to reverse an upward trend witnessed in yields over the previous two trading days.

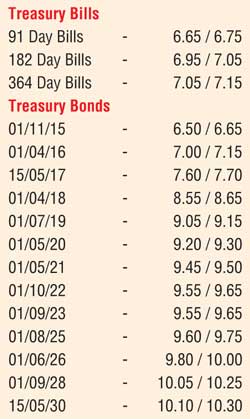

This intern saw yields decrease with the liquid maturities of the two 2018s (i.e. 1 April 2018 and 15 November 2018), the two 2019s (i.e. 1 July 2019 and 15 September 2019), the 1 May 2020, the two 2021s (i.e. 1 May 2021 and 1 August 2021) and the 1 September 2023 hitting intraday lows of 8.65%, 8.75%, 9.10%, 9.11%, 9.25%, 9.49% each and 9.60% respectively against its previous day’s closing levels of 8.75/85, 8.90/10, 9.20/30, 9.20/35, 9.20/45, 9.70/80, 9.65/80 and 9.70/80.

In addition the shorter maturity of 15 May 2017 was seen changing hands within the range of 7.65% to 7.70% while on the long end the 1 September 2028 and 15 May 2030 was seen changing hands within the range of 10.10% to 10.15% and 10.20% to 10.25% respectively as well.

This was ahead of today’s weekly Treasury bill auction, at where a total amount of Rs.25 billion will be on offer consisting of Rs. 5.0 billion, Rs. 9.0 b and Rs. 11 b on the 91 day, 182 day and the 364 day maturities respectively. At last week’s auction, the weighted averages decreased across the board to 6.73%, 7.04% and 7.10% respectively.

Meanwhile in money markets, overnight call money and repo rates remained broadly unchanged to average 6.36% and 6.29% respectively as surplus liquidity increased to Rs.69.72 b yesterday.

Rupee gains marginally in thin trade

In Forex markets, the USD/LKR rate on spot contracts were seen gaining marginally to close the day at Rs 141.00/10 in thin trade against its previous day’s closing levels of Rs.141.05/15. The total USD/LKR traded volume for 19 October was $ 74.78 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 141.60/70; three months – 142.70/90 and six months – 144.30/40.