Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 23 October 2025 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

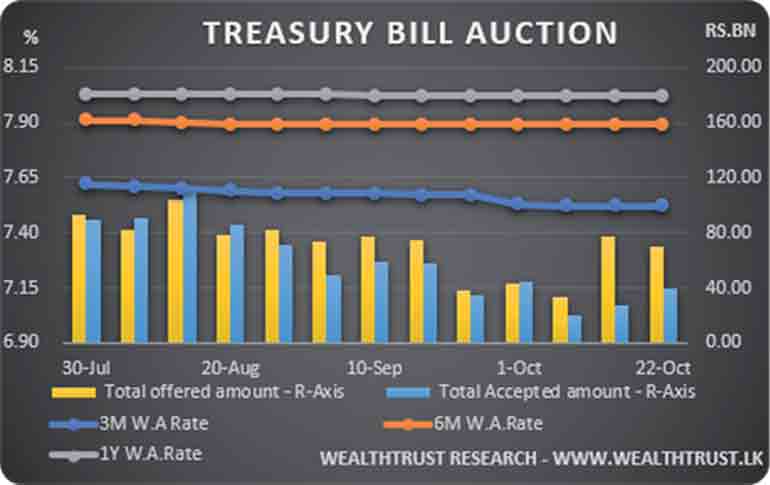

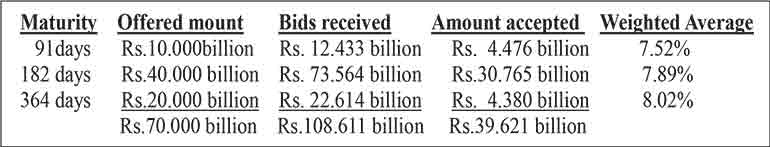

The weighted average rates at the weekly Treasury bills primary auction conducted yesterday remained steady with a total amount of Rs.39.62 billion being accepted against its offered amount of Rs.70.00 billion. This resulted in a shortfall of Rs.30.38 billion while the 182-day bill represented 77.65% of the total accepted amount. The weighted average rates of the 91-day, 182- day and 364-maturities stood at 7.52%, 7.89% and 8.02% respectively while the bids to offer ratio registered at 1.55:1

The phase 2 of the auction will be opened for all 3 maturities at their weighted average rates until close of business of the day prior to settlement (i.e., 3.00 pm on 23.10.2025).

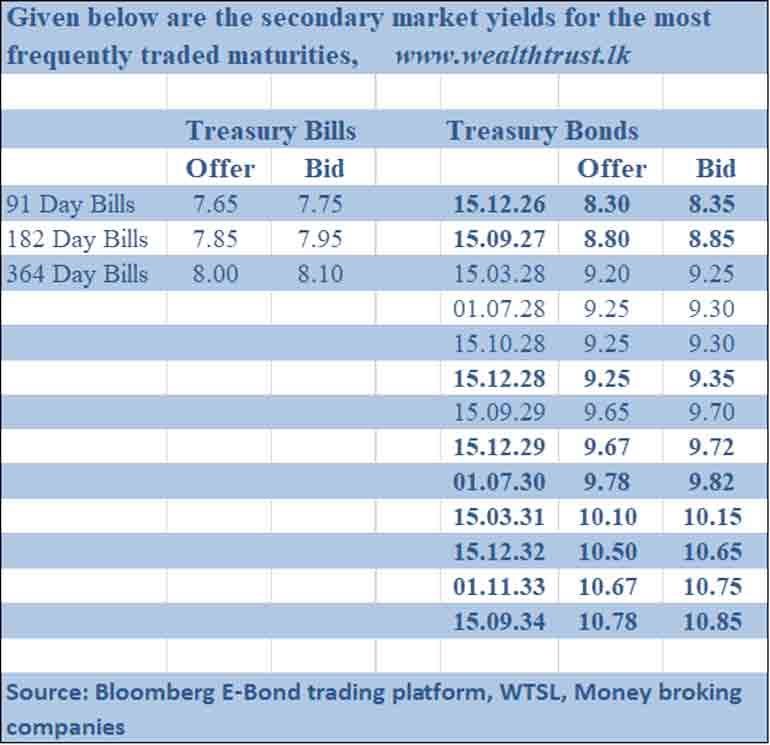

In the secondary bond market, activity remained moderated yesterday with most market participants continuing to be on the sidelines. Limited trades were seen on the maturities of 01.06.26, 15.12.26, 15.01.27, 01.05.27, 15.02.28, 15.03.28 and 15.12.28 at levels of 8.25%, 8.35%, 8.37%, 8.77%, 9.20%, 9.23% to 9.25%, and 9.33% respectively.

In secondary bills, January, March, June, July and August 2026 maturities traded at levels of 7.65% to 7.83%, 7.90% to 7.92%, 8.05% to 8.06%, 8.05% and 8.06% to 8.07% respectively.

The total secondary market Treasury bond/bill transacted volume for 21 October of 2025 was Rs.3.24 billion.

In money markets, the net liquidity surplus stood at Rs.119.08 billion yesterday as an amount of Rs.135.47 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25% against an amount of Rs.16.39 billion being withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 8.25%. The weighted average rates on overnight call money and REPO stood at 7.89% and 7.92% respectively.

USD/LKR

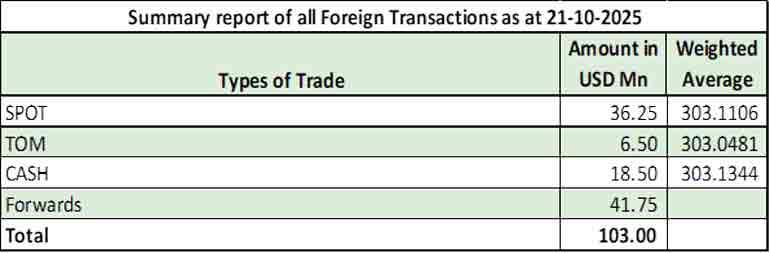

In the Forex market, the USD/LKR rate on spot contracts depreciated further to close trading yesterday at Rs.303.40/303.50 against its previous day’s closing level of Rs.303.15/303.25.

The total USD/LKR traded volume for 21 October 2025 was $ 103.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)