Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 1 January 2026 00:10 - - {{hitsCtrl.values.hits}}

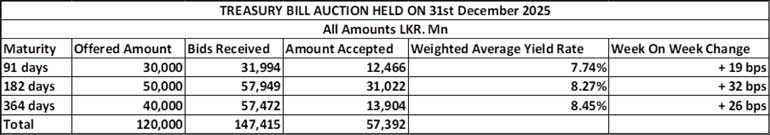

At the weekly Treasury Bill auction held yesterday, weighted average yields recorded an upwards movement across the board for a second consecutive week. Accordingly, the weighted average yield on the 91-day Bill rose by 19 basis points to 7.74%, the 182-day by 32 basis points to 8.27%, and the 364-day by 26 basis points to 8.45% respectively. A total of Rs. 57.39 billion was raised, out of a total offered amount of Rs. 120 billion, translating to a 47.83% subscription ratio. Total bids received amounted to 1.23 times the offered volume.

The Phase II of subscription is now open across all three maturities until 3.00 pm of business day prior to settlement date (i.e., 01.01.2026) at the WAYRs determined for the said ISINs at the auction. Given in the table are the details of the auction (Phase 1).

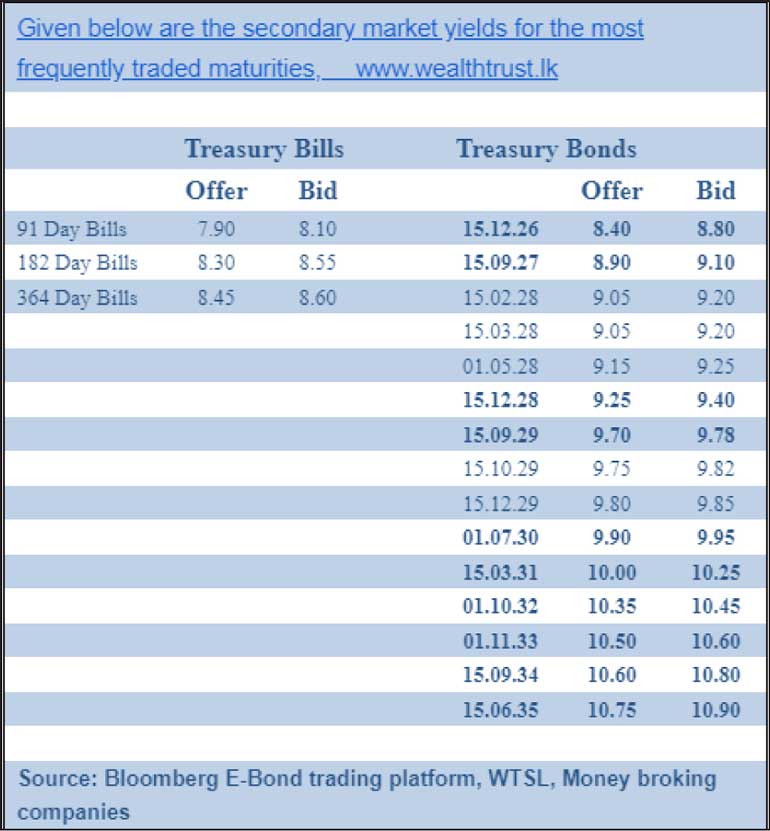

The secondary Bond market yesterday remained largely subdued as market participants maintained a wait-and-see stance. Two-way quotes were seen increasing marginally following the auction outcome.

In terms of the Secondary Bond market trade summary, the 15.09.29 and 15.12.29 maturities were seen trading at the rates of 9.79%-9.80% and 9.75%-9.87%. The 01.07.30 maturity was seen trading at the rate of 9.91%. The 01.10.32 maturity was seen trading within the range of 10.33%-10.37%.

The total secondary market Treasury Bond/Bill transacted volume for 30 December was Rs. 4.10 billion.

In money markets, the net liquidity surplus increased further to Rs. 175.18 billion yesterday as an amount of Rs. 176.29 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%. An amount of Rs. 1.11 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 8.25%.

The weighted average rates on overnight call money and Repo stood at 8.04% and 8.06% respectively.

Forex Market

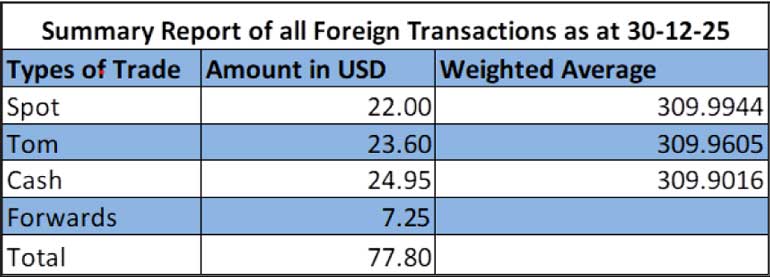

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating marginally to 309.50/309.80 as against its previous day’s closing level of Rs. 310.00/310.20.

The total USD/LKR traded volume for 30 December 2025 was

$ 77.80 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking

companies)