Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 30 May 2024 00:20 - - {{hitsCtrl.values.hits}}

Bank of Ceylon

Peoples Bank

National Savings Bank

The Finance Ministry has announced the roll out of key reforms in State owned banks.

State owned banks (SOBs) have faced significant stress during the recent economic crisis. Inadequate risk mitigation measures and weaknesses in governance have undermined the quality of lending practices of these entities. The balance sheets of State owned banks had been used to absorb losses of State-Owned Enterprises (SOEs) and help finance large fiscal deficits thereby delaying reforms and accumulating debts, which contributed to the economic crisis.

Direct and indirect exposure to the government and related activities dominated the balance sheets of the SOBs, diminishing their ability to serve their expected purposes such as advancing financial inclusion and addressing market failures in the provision of financial services to the productive sectors of the economy.

In order to prevent a recurrence of such detrimental practices, it is necessary to implement a number of reforms in SOBs relating to governance, risk management, and oversight as outlined in this document. Implementing the proposed reforms for SOBs in Sri Lanka is crucial to enhance efficiency, effectiveness, and financial stability.

These reforms can streamline processes, improve governance, and modernise banking practices, making the respective banks more competitive in the market. Additionally, these reforms can reduce the fiscal burden on the Government, enhance financial inclusion, and improve transparency and accountability.

The aforementioned reforms were approved by the Cabinet of Ministers on 8 April 2024. The principles laid out in this document apply to all State owned banks – including licenced commercial and specialised banks, as well as other new State owned banks that may be established – unless otherwise stated.

1. Business models of Bank of Ceylon and People’s Bank

This section will specifically apply to People’s Bank and the Bank of Ceylon. These State-owned commercial banks had originally been established to enhance financial inclusion and address market failures in the financial services sector. As Bank of Ceylon and People’s Bank need to gradually rebalance their portfolios towards these primary objectives, it is necessary to articulate the Government’s policy on the business models of both banks.

1.1 In addition to providing financial services to established markets, the banks’ business models should focus on providing the following financial services within the framework of the Banking Act:

(a) To under-served areas and groups

(b) To support the development of cash-flow based lending that reduces excessive reliance on collateral which disadvantaged groups are poorly positioned to provide

(c) To provide targeted financing, technical support, and know-how for micro and small businesses, co-operatives, and disadvantaged groups such as women; and,

(d) Administration of State-sponsored development finance programs.

1.2 The banks would compete on a level playing field in full compliance with all Central Bank of Sri Lanka regulations, and without being excessively advantaged over private commercial banks in access to Government and SOE business. The Government commits to cease using Bank of Ceylon and People’s Bank as quasi-fiscal institutions:

i) In order to increase the supply of finance for productive investment, Bank of Ceylon and People’s Sank shall gradually, over time, reduce the share of public sector exposure in total assets, including holdings of debt instruments issued by the Government of Sri Lanka, in line with commercial judgement, prudent policies and regulatory requirements for liquidity and currency risk management, and growth of the banks’ private sector lending portfolio.

ii) Bank of Ceylon and People’s Bank shall only extend credit (in any form) to loss-making SOEs when: (a) credit is provided on commercial market terms reflecting the risk profile of the SOE borrower;

(b) the independent risk management function of the banks has given a positive opinion on granting such credit based on the standard credit assessment criteria of the bank and in compliance with regulatory ceilings for the bank’s open foreign currency position and single borrower exposure;

(c) for any credit to a loss making SOE in excess of 5% of equity capital the consent of the bank’s board of directors has been given; and (d) any State guarantee offered as collateral is authorised within the limits specified in the (forthcoming) Public Finance Management Act. These credits shall be provided on commercial terms (including price, maturities, credit limits, among other considerations) reflecting the risk profile of such borrowers. This provision does not prevent the banks or the Central Bank of Sri Lanka from applying stricter standards, which should prevail.

Under the circumstances above, comfort letters and similar instruments, when used, must have been recorded as liabilities of the Government and may only be used as secondary collateral.

Under the circumstances above, comfort letters and similar instruments, when used, must have been recorded as liabilities of the Government and may only be used as secondary collateral.

iii) Bank of Ceylon and People’s Bank may continue to do business with, and extend credit to, profitable SOEs with positive cash flow on commercial terms and with the same credit quality and other risk management requirements as applied to comparable private sector borrowers.

2) Capital adequacy of Bank of Ceylon and People’s Bank

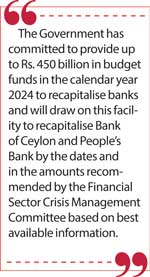

The Government has committed to provide up to Rs. 450 billion in budget funds in the calendar year 2024 to recapitalise banks and will draw on this facility to recapitalise Bank of Ceylon and People’s Bank by the dates and in the amounts recommended by the Financial Sector Crisis Management Committee based on best available information.

The Government further commits itself to maintain regulatory capital compliance of Bank of Ceylon and People’s Bank by either: (a) providing further budget funds as and when required; or (b) selling new shares to institutional investor(s) (e.g. a development finance institution)2; or (c) a combination of (a) and (b).

In order to protect retail investors from potential losses, the Government will not seek to sell shares to retail investors in either of the banks (Bank of Ceylon/People’s Bank) until the bank has been profitable and in full compliance with all CBSL prudential ratios for not less than two consecutive calendar years following the date of this Cabinet Decision. In any event, the Government would only consider selling a minority stake in selected state banks, whilst the Government retains the majority share ownership, as articulated in the 2024 budget speech (paragraph 70).

3) Strengthening governance of all SOBs

3.1 In order to improve oversight of all SOBs, the Ministry of Finance shall by 30 June 2024 initiate the process for establishing a specialised unit under the Public Enterprises Department charged with responsibility for managing the state’s shareholdings in SOBs and to monitor and report on their performance.

3.2 The Ministry of Finance will request the Auditor General to appoint qualified external auditors for all SOBs, and will enter into a Memorandum of Understanding with the Auditor General to establish this as standard practice going forward. With the consent of the Auditor General, all SOBs shall select new external auditors for the year beginning 1 January 2025 from amongst the auditing firms with substantial international footprint, named in the list of qualified auditors issued by the CBSL, as well as in line with the requirements for qualified auditors under the Constitution.

3.3 All SOBs shall ensure (a) full implementation of all governance regulations and guidelines as revised by the forthcoming amendments to the Banking Act; and (b) all recommendations and requirements given in the forthcoming CBSL’s Guidelines for Governance of SOBs.

3.4 By 30 November 2024, the Government will: (a) ensure that the SOB boards of directors have not less than nine and not more than 13 members; and (b) appoint a number of independent directors such that independent directors comprise the majority of the total number of directors of each SOB board, one of whom shall be Chair of the Board of each of the banks.

3.5 A director is considered independent if he or she meets the following requirements: (a) all of the criteria for independence set down in the CBSL Banking Act Direction No. 11 of 2007 “Corporate Governance for Licenced Commercial Banks in Sri Lanka”, Section 3(2)(iv), as subsequently amended or superseded, and in addition requirements given in CBSL’s forthcoming Guidelines for Governance of SOBs; (b) is not a Politically Exposed Person (PEP) as defined in the CBSL Financial Intelligence Unit Guidelines on Identification of Politically Exposed Persons, No. 03 of 2019; (c) is a “fit and proper” person to be appointed as an independent director as determined by CBSL; (d) is not an employee or consultant of the bank and has no personal financial interest in or material business relationship with the bank3; and (e) is not a public servant or Government contractor.

3.5 A director is considered independent if he or she meets the following requirements: (a) all of the criteria for independence set down in the CBSL Banking Act Direction No. 11 of 2007 “Corporate Governance for Licenced Commercial Banks in Sri Lanka”, Section 3(2)(iv), as subsequently amended or superseded, and in addition requirements given in CBSL’s forthcoming Guidelines for Governance of SOBs; (b) is not a Politically Exposed Person (PEP) as defined in the CBSL Financial Intelligence Unit Guidelines on Identification of Politically Exposed Persons, No. 03 of 2019; (c) is a “fit and proper” person to be appointed as an independent director as determined by CBSL; (d) is not an employee or consultant of the bank and has no personal financial interest in or material business relationship with the bank3; and (e) is not a public servant or Government contractor.

3.6 The Government will implement in the calendar year 2024 an extraordinary procedure for the selection of independent directors of Bank of Ceylon, National Savings Bank, and People’s Bank (as described below) in order to immediately strengthen the capacities of these SOB boards of directors and expand the number of independent directors. Subsequent to completion of this special procedure, independent directors will continue to be recruited and nominated by the Nominations Committee of the board of directors of each bank acting in compliance with the Banking Act and its Directions. The extraordinary process shall not apply to the nomination of ex-officio non-independent directors, whilst they must still comply with CBSL criteria as per directions under the Banking Act.

3.7 The same extraordinary procedure will be implemented for the remaining specialised SOBs in 2025.

3.8 The extraordinary procedure for selection of independent directors of Bank of Ceylon, National Savings Bank and People’s Bank shall be as follows:

3.8.1 By 31 May 2024, the Government will launch a process for the recruitment of independent members of the banks’ boards of directors. The process will have four stages:

3.8.2 In the first stage, a reputable recruitment firm will be hired jointly by the three banks. The costs of the recruitment firm will be shared equally between the banks. The recruitment firm will be supervised by, and report to, a special selection committee described below.

3.8.3 In the second stage, a request for expressions of interest (EOls) will be published and EOIs received will be screened by the recruitment firm. The recruitment firm will prepare a short list of candidates for each bank. Current independent members of the boards of directors of the SOBs shall be eligible to apply for re-election.

3.8.4 A five-member special selection committee will be established by order of the Ministry of Finance to recommend nominees for the independent directors of each of the three banks. The committee will report to the Secretary to the Treasury and will be composed of two representatives of the Ministry of Finance, one of whom who would be the Director General Public Enterprises Department, and three other independent members, nominated by the Institute of Chartered Accountants of Sri Lanka, the Sri Lanka Institute of Directors, and the Ceylon Chamber of Commerce (each nominating one member of the Committee). An independent member shall serve as Chair and members of the committee shall not be employees of the banking sector or in other ways conflicted.

3.8.5 Within 30 days of receipt of the recommendations of the selection committee, the names of the nominees and other data as required shall be submitted by the Ministry of Finance to the CBSL for approval in compliance with the directions issued under the Banking Act. Once CBSL approval is received, the Ministry of Finance will call an extraordinary shareholders’ meeting for each of the banks to dismiss the current independent members of each bank’s board of directors and elect the independent members nominated by the special selection committee.

3.9 By 30 June 2024, the Government will remove any restrictions on the compensation paid to independent members of all SOB boards of directors.

3.9.1 For Bank of Ceylon, National Savings Bank and People’s Bank, compensation of independent members will be at market-competitive levels comparable to other (privately owned) domestic systemically important banks in Sri Lanka, subject to no objection from the Secretary to the Treasury within 30 days of submission of the specific proposal to the Ministry of Finance.

3.9.2 For all other SOBs, compensation of independent members will be comparable to their peer private sector commercial banks.

3.10 By 31 December 2024, the independent members of each SOB board of directors shall form a subcommittee to review the performance of the SOB’s senior management team (the Chief Executive Officer/General Manager; Deputy Chief Executive Officer/Chief Operating Officer; Head of Finance/Deputy General Manager for Finance; Senior Most Credit Officer/Deputy General Manager for Credit; and other bank officers as determined by the board of directors during the calendar year of 2024 and prepare, by 31 March 2025, a recommendation to the full board of directors as to whether the services of members of the senior management team should be retained or replaced. Any new members of senior management will be selected by the banks’ nomination committees and must have required qualifications, and demonstrate robust professional skills and experience.

Failure to source personnel with required qualifications and professional experience internally shall result in an open search procedure to fill such positions.

3.11 In the case of a new Chief Executive Officer (or equivalent) or Chief Risk Officer (or equivalent), the positions shall be selected by the Nominations Committee following an open search procedure in the first instance with clear requirements for robust professional skills, experience, and qualifications. Existing bank staff may apply for such positions through this open search procedure.

4 Strengthening the risk management architecture of State owned banks

4.1 By 30 June 2024, boards of directors of all SOBs shall set the compensation of risk management employees at market-competitive levels to enable the recruitment and retention of professionally qualified risk managers.

4.2 The SOB board of directors shall ensure that: (a) the risk management functions of the bank are fully staffed with professional employees who possess the requisite experience and qualifications, including market and product knowledge as well as command of risk disciplines; and; (b) the financial and other resources allocated to risk management functions in the bank’s budget are sufficient to allow the effective functioning of risk management units.

4.3 In order to ensure the independence of the banks’ integrated risk management functions, the Government will require Bank of Ceylon and People’s Bank to adopt stricter governance requirements than CBSL Guidelines.

For both banks:

4.3.1 The Integrated Risk Management Committee (IRMC) of the board of directors will be composed of five voting members, of whom three or more members (including the IRMC Chair) will be independent directors, of whom at least one shall have a professional background in risk management. Executive directors and other employees of the bank invited by the IRMC may attend IRMC meetings in the capacity of observers.

4.3.2 Each bank will appoint a Chief Risk Officer (CRO). The CRO will be recruited and appointed by the board of directors Nomination Committee as set out in 3.11, on the recommendation of the IRMC, subject to the Assessment of Fitness and Propriety by the CBSL. On the recommendation of the IRMC, the board of directors will also determine the remuneration of the CRO. The CRO:

4.3.3 Appointment or dismissal of risk managers for the bank’s risk management unit shall not take place without the approval of the CRO. Risk management units will be independent of bank management and report to the CRO.

4.3.4 All SOBs shall in any case fully comply with relevant Banking Act provisions and relevant Directions including Pillar II requirements set by the Central Bank of Sri Lanka.

Footnotes

1 If necessary, the Government will amend the Ordinance of any SOB for which institutional investment is sought to allow such investment.

2 lf selected as an independent director, all business transactions with the bank shall be disclosed and subject to CBSL Related Party regulations.

3 l lf selected as an independent director, all business transactions with the bank shall be disclosed and subject to CBSL Related Party regulations.