Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 27 July 2020 00:59 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

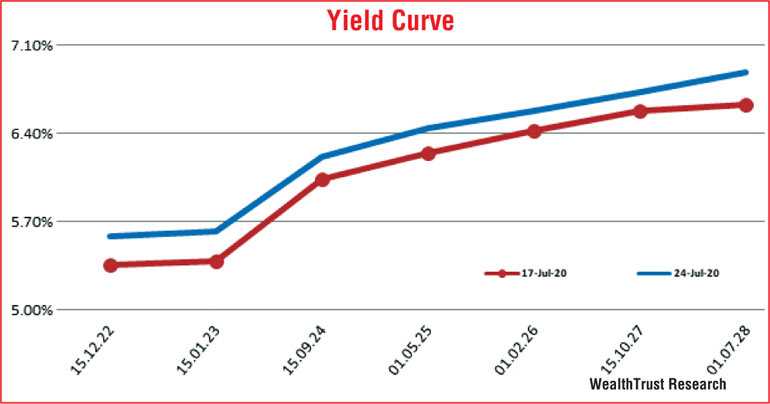

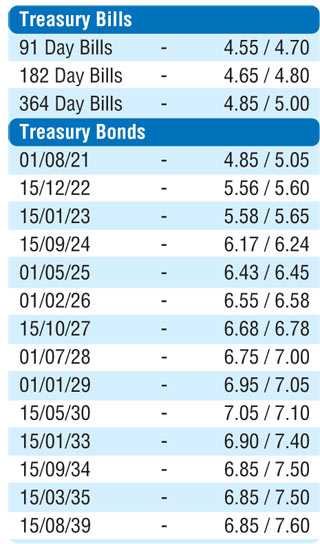

The secondary bond market witnessed renewed selling interest during the week ending 24 July, mainly subsequent to the weekly Treasury bill auction, which led to yields increasing across the yield curve.

Trades were mainly seen on the maturities of 15.12.22, 15.01.23, 15.09.24, 01.05.25, 01.02.26, 15.10.27, and 15.05.30 as its yields were seen hitting weekly highs of 5.60%, 5.62%, 6.25%, 6.45%, 6.59%, 6.72%, and 7.25%, respectively, against its previous weeks closing levels of 5.33/38, 5.35/43, 6.02/05, 6.22/26, 6.40/43, 6.55/60, and 6.50/90, reflecting a parallel shift upwards of the overall yield curve on a week on week basis for the first time in seven weeks. In addition, maturities of 15.12.23 and 01.01.24 hit weekly highs of 5.95% and 6.10%, respectively, as well.

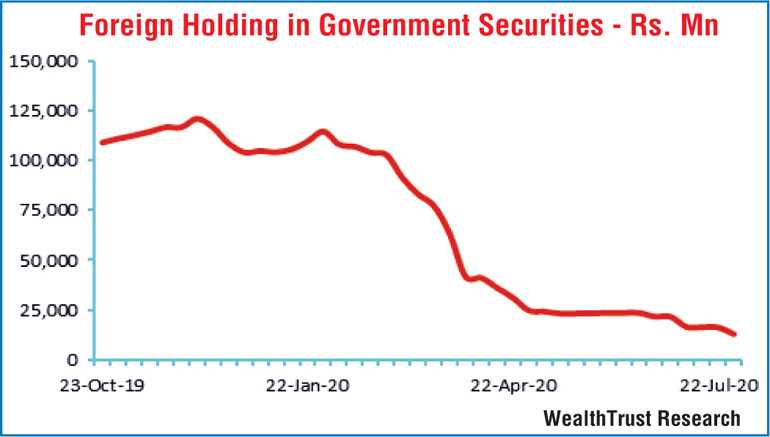

The foreign holding in rupee bonds recorded an outflow of Rs. 3.4 billion for the week ending 22 July.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 11.56 billion.

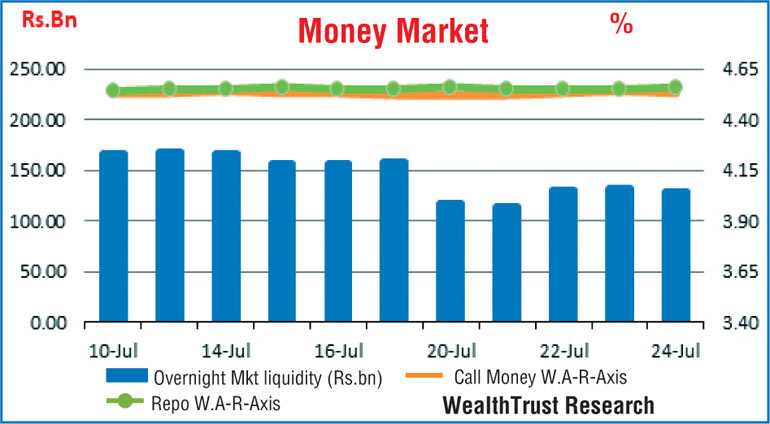

In money markets, despite overnight surplus liquidity decreasing to Rs. 129.56 billion as of Friday against its previous week of Rs. 158.84, the weighted average yields on overnight call money and repos remained unchanged to average at 4.53% and 4.55%, respectively, for the week.

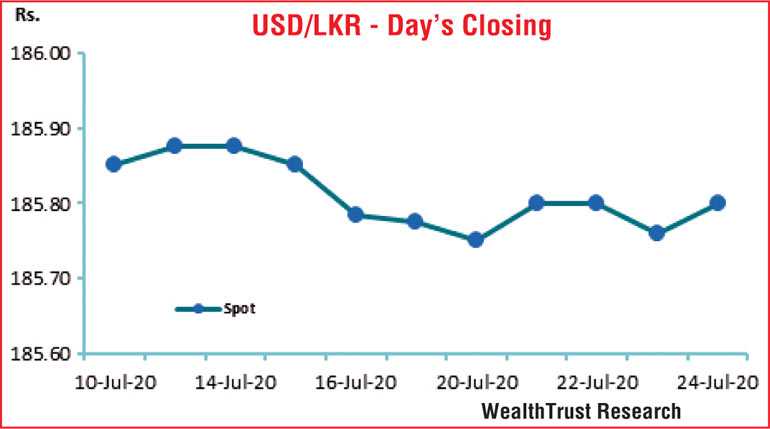

Rupee continues to trade within a steady range

In the forex market, USD/LKR rate on spot contracts were seen trading within a steady range of 185.74 to Rs. 185.82 during the week before closing the week at levels of Rs. 185.75/85 against its previous weeks of Rs. 185.75/80.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 62.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)