Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 3 October 2025 01:49 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The upward momentum in secondary Bond markets continued yesterday with rates rising for a third straight session. Activity and transaction volumes were seen at healthy levels during the earlier trading hours but fizzled out to a virtual standstill during the later trading hours.

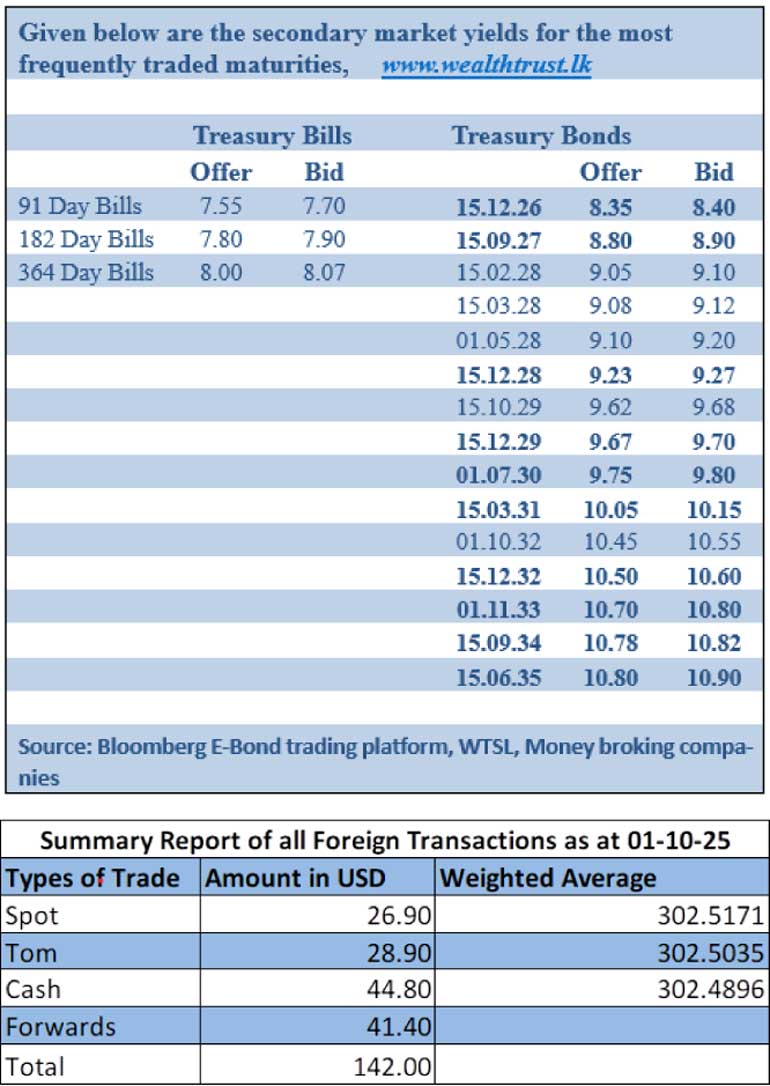

The 15.09.27 maturity was seen trading at the rate of 8.85%. The 15.10.28 and 15.12.28 maturities were seen changing hands at levels of 9.23%-9.25%. The 15.06.29, 15.09.29 and 15.12.29 maturities were seen trading at highs of 9.60%, 9.65% and 9.68% respectively. The 15.05.30 and 01.07.30 maturities were seen changing hands at the rates of 9.75% and 9.76% respectively while the 15.12.32 maturity at the rate of 10.55%. The 01.11.33 maturity traded within the range of 10.75%-10.74%. The 15.09.34 maturity traded down the range of 10.82%-10.80%.

The total secondary market Treasury Bond/Bill transacted volume for 1 October was Rs. 23.17 billion.

In money market, the weighted average rates on overnight call money and Repo stood at 7.87% and 7.88% respectively.

The net liquidity surplus was recorded at Rs. 172.16 billion yesterday. An amount of Rs. 21.00 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 193.16 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day steady at Rs. 302.46/302.52 as against Rs. 302.47/302.53 the previous day.

The total USD/LKR traded volume for 1 October was $ 142.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)