Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 15 December 2025 00:00 - - {{hitsCtrl.values.hits}}

Senior Prof. Hareendra Dissabandara

An interview with

Securities and Exchange Commission of Sri Lanka Chairman Senior

Prof. Hareendra Dissabandara.

Q: Many people are still not familiar with the term ‘Unit Trust’. Could you start by explaining what a Unit Trust is in simple terms?

Q: Many people are still not familiar with the term ‘Unit Trust’. Could you start by explaining what a Unit Trust is in simple terms?

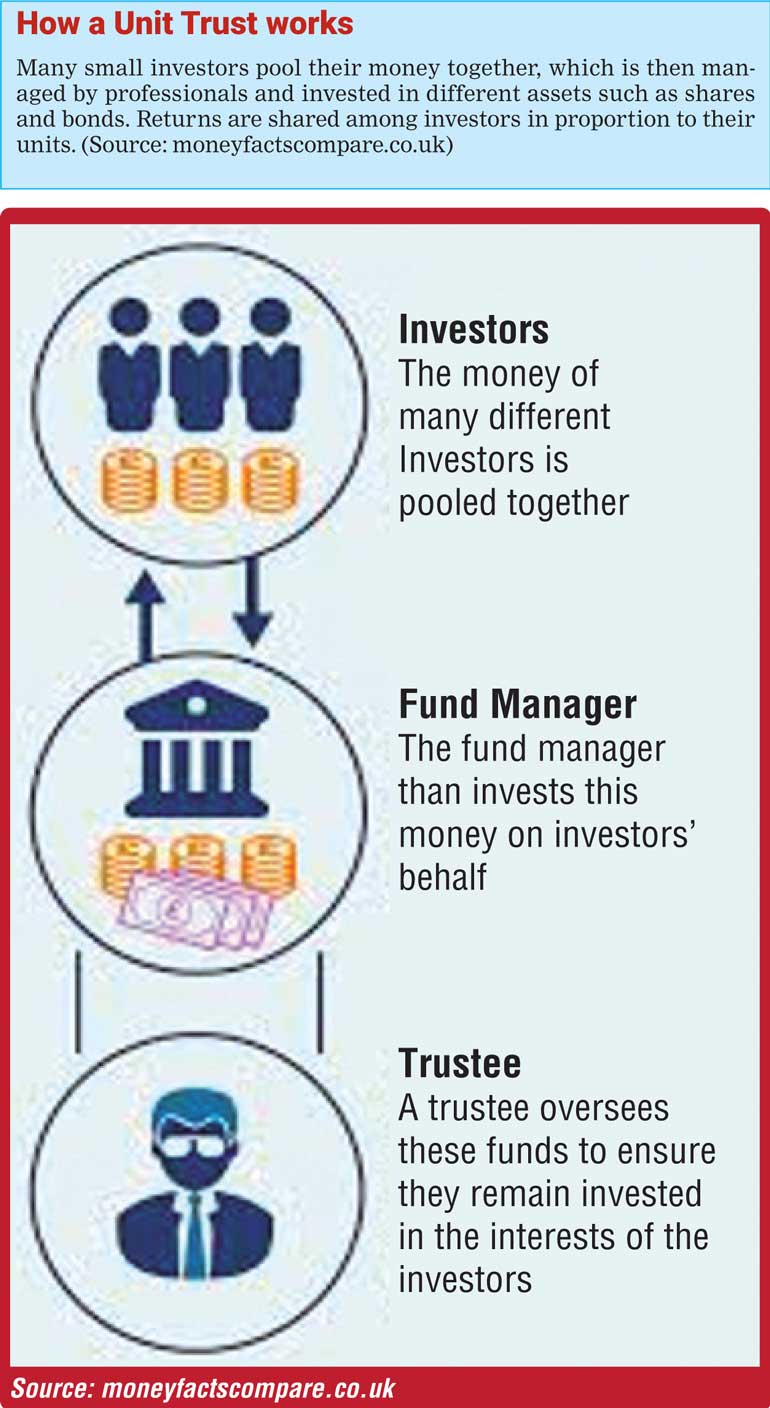

A: A Unit Trust is a simple way for people to invest their money collectively. Instead of trying to buy shares or bonds on your own, you join together with thousands of other small investors. Your money is pooled and managed by professional fund managers who invest it in different assets such as company shares, government securities, and other financial instruments.

Each investor owns “units” in this fund — just like owning a small portion of a large paddy field. When the field produces a harvest, everyone gets a share according to the size of their portion. That’s the basic idea of a Unit Trust.

Q: Why do you think Unit Trusts are important for a country like Sri Lanka, especially for rural and low-income communities?

A: Unit Trusts open the door for ordinary citizens — even those with small savings — to become investors. In Sri Lanka, many people keep money idle in banks or informal schemes that don’t give real returns.

Through Unit Trusts, a farmer, teacher, or small business owner can invest even a few thousand rupees and enjoy the same benefits as a large investor. This builds financial inclusion, encourages savings to flow into productive investments, and ultimately strengthens our capital market and national economy.

Q: Some call this initiative a ‘national program to make the poor rich’. Do you see it that way?

A: I would say it’s not just about making the poor rich — it’s about giving everyone a fair chance to grow. It’s a national empowerment program designed to make every Sri Lankan a participant in the country’s economic journey.

This connects directly with our new initiative, “සැමට fකdටසක් – සැමට ඒකකයක්්”, or in English, “A Share for Each – A Unit for Everyone.” It’s a national initiative we proposed to the Government through the recent budget process. The idea is simple but powerful: every Sri Lankan household should own at least one unit in the capital market — either directly through shares or indirectly through Unit Trusts.

Under this programme, we have proposed that the Government allocates Rs. 1 billion, with additional contributions from the SEC, CSE, stockbrokers, and listed companies, to open the door for around 263,000 families across the island. Each selected household will receive a small investment credit — around Rs. 3,000 - 5,000 — into a Central Depository System (CDS) account. This will be their first real step into the capital market.

Low-income and rural families will be guided toward Unit Trusts, which are safer, professionally managed, and easier to understand.

This will be the first time in Sri Lanka’s history that ordinary families — from farmers to teachers, from rural workers to small business owners — will be given a real opportunity to become shareholders in the nation’s economy.

It empowers individuals and families in three ways:

For instance, if a family invests Rs. 3,000 per month in a balanced Unit Trust, they could accumulate over Rs. 1 million in about 15 years, depending on market performance. That’s life-changing — it could fund a child’s education, housing, or retirement.

For instance, if a family invests Rs. 3,000 per month in a balanced Unit Trust, they could accumulate over Rs. 1 million in about 15 years, depending on market performance. That’s life-changing — it could fund a child’s education, housing, or retirement.

And this is not just about individual prosperity — it’s about nation building. When families invest, their money flows to Sri Lankan companies and government projects. These companies expand, create jobs, and produce more goods and services. So each small investment contributes to citizen-powered economic growth.

When citizens invest, the whole country rises with them.

Q: How exactly does a Unit Trust work? Is it like keeping money in a bank deposit, buying shares, or investing in treasury Bills?

A: A Unit Trust is a mix of all these in a balanced way — but it’s not a deposit. When you put money in a bank, you lend it to the bank and get a fixed interest. In a Unit Trust, your money is invested in assets such as shares and Government securities, and your return depends on how well those investments perform. Unlike buying a single share or bond yourself, Unit Trusts spread your money across many investments. This diversification reduces risk and gives you a more stable return over time.

Q: Who manages these Unit Trusts? Can ordinary people trust these fund managers with their savings?

A: All Unit Trusts are managed by Licenced fund management companies that are approved and supervised by the Securities and Exchange Commission (SEC) of Sri Lanka. These managers are professionals who make investment decisions on behalf of investors. They are required by law to follow strict rules, maintain transparency, and are regularly monitored by the SEC to ensure investor protection. So yes — people can trust the system. It’s regulated, transparent, and designed to protect their interests.

Q: What kind of returns or benefits can an investor expect from Unit Trusts? How are these benefits distributed?

Q: What kind of returns or benefits can an investor expect from Unit Trusts? How are these benefits distributed?

A: Unit Trusts generate two main types of benefits — dividends and capital growth.

Dividends come from the income earned on the investments, while capital growth happens when the value of the investments increases over time. These returns are distributed to investors in proportion to the number of units they hold. The investor also has the option to reinvest these returns to accumulate wealth faster.

Q: You mentioned that Unit Trusts are a form of investment, not just saving. Could you explain why investing is more powerful than saving for personal development?

A: Saving helps you protect your money. Investing helps you grow your money.

If you keep all your money in a savings account, inflation slowly reduces its real value. But by investing, you allow your money to earn a return that can outpace inflation and generate long-term wealth. For families who dream of better education for their children, buying land, or starting a small business — investing is the key to achieving those goals.

Q: Are Unit Trust investments safe? What protections are in place for small investors?

A: Every investment carries some risk, but Unit Trusts are one of the safest ways to invest in the market. They are regulated by the SEC and held under the custody of independent trustees — often banks — who ensure your money is not misused. The funds are required to disclose their performance regularly, so investors can see how their money is growing. Transparency and accountability are built into the system.

Q: How can someone practically start investing in a Unit Trust? Is it complicated or can even a villager with a small income start?

A: It’s very simple. Anyone can visit a Licenced Unit Trust management company or their agents, fill out a short form, and start with a small amount — even as little as Rs. 1,000 or Rs. 5,000. There’s no need for technical knowledge or stock market experience. Once you invest, professional fund managers handle everything on your behalf.

Q: What is the minimum amount required to start, and how can someone continue to invest gradually?

A: You can start small and keep adding regularly. The key is consistency. For example, setting aside a small sum each month — just like you pay a utility bill — can grow into a significant fund over time. This disciplined investing habit helps families plan for future needs without feeling burdened. For more details: https://www.utasl.lk/members/ and contact Unit Trust Association: https://www.utasl.lk/contact/

A: You can start small and keep adding regularly. The key is consistency. For example, setting aside a small sum each month — just like you pay a utility bill — can grow into a significant fund over time. This disciplined investing habit helps families plan for future needs without feeling burdened. For more details: https://www.utasl.lk/members/ and contact Unit Trust Association: https://www.utasl.lk/contact/

Q: You mentioned “rolling over” earlier — could you explain what that means in the context of Unit Trusts?

A: “Rolling over” simply means reinvesting your earnings instead of withdrawing them. When the fund pays you a dividend, you can choose to reinvest that amount and buy more units. Over time, this allows your investment to grow faster — it’s the power of compounding.

Q: How is investing in a Unit Trust different from buying shares directly from the stock market?

A: When you buy shares directly, you take on the full risk of that one company. If it performs badly, your return falls.

But in a Unit Trust, your money is spread across many shares, government securities, and other instruments. This diversification reduces risk, and professional fund managers monitor and adjust the portfolio regularly to maximise returns.

Q: Are there different types of Unit Trusts? How can an investor choose what suits them best?

A: Yes, there are several types — equity funds, income funds, balanced funds, and money market funds.

If someone wants steady income, an income or money market fund may be ideal. If they seek long-term growth, equity or balanced funds are better.

Licenced fund managers guide investors based on their financial goals and risk tolerance.

Q; Some people say, “Don’t put innocent people’s money at risk. Let real investors do the gambling in the stock market without turning it into a micro-credit story.” What do you think, and how would you explain this to the average person?

A: That’s a fair concern — and it’s based on a misunderstanding we must patiently correct.

First, the stock market is not gambling. Gambling is when you bet on luck — without understanding or value creation. The capital market, on the other hand, is about investing in businesses that produce goods, services, and jobs for our country. When you invest, you’re becoming a partner in that real economic activity.

Second, what we are promoting is not micro-credit — it’s micro-investing. Micro-credit gives loans that people must repay, often with high interest. But in micro-investing, people own a share of productive assets — their money works for them instead of the other way around.

When you put Rs. 5,000 or Rs. 10,000 into a Unit Trust, you are not giving it to another person to spend. You are pooling it with others, under professional management, to buy small parts of big businesses and government projects. Those businesses then earn profits — and a part of that profit comes back to you as an investor.

This is a disciplined, transparent, and regulated system — not a gamble. The Securities and Exchange Commission (SEC) oversees every fund manager, trustee, and product to make sure investors’ money is handled responsibly.

The goal is not to make people take risks they don’t understand. It’s to help them build wealth safely, gradually, and intelligently.

In fact, one of the main reasons we launched the “සැමට fකdටසක් – සැමට ඒකකයක් (A Share for Each – A Unit for Everyone)” initiative is to ensure that small investors participate in the market in a guided and protected manner.

When we educate and include our people in the financial system, they stop being victims of informal, unregulated schemes and become empowered, informed investors. That’s how we create true financial inclusion — not through credit or charity, but through ownership and participation.

Q: How does this program fit into the broader goals of national financial inclusion and capital market development?

A: Unit Trusts bridge the gap between the small saver and the national economy. When people from villages and towns invest, their money flows into companies that create jobs, pay taxes, and expand the economy. So, every small investor becomes a partner in national development. This is exactly the kind of inclusive financial system Sri Lanka needs.

Q: Finally, what is your message to people who still think the stock market or investment products are “only for the rich”?

A: That’s a myth we must break. The truth is you don’t need to be rich to invest — you become rich by investing. With as little as a few thousand rupees, anyone can start. What matters is not how much you have today, but whether you take the first step. Investing through Unit Trusts is a safe, simple, and smart way to secure your family’s future and help build our nation’s financial strength.