Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 10 April 2024 02:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

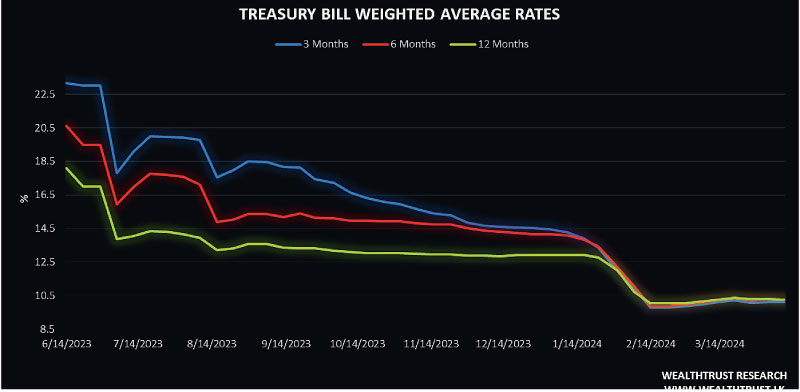

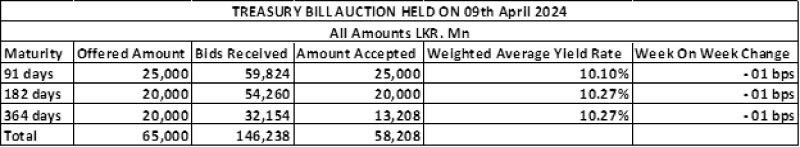

At the weekly Treasury bill auction conducted yesterday, the weighted average yields experienced marginal declines across all three tenors. The 91-day maturity reduced by 01 basis points to 10.10%, while the 182-day maturity decreased by 03 basis points to 10.27% and the 364-day maturity dropped by 01 basis point to 10.27%. The auction went undersubscribed with only Rs. 58.21 billion or 89.55% out of the total offered amount being raised at the 1st phase of the auction

At the weekly Treasury bill auction conducted yesterday, the weighted average yields experienced marginal declines across all three tenors. The 91-day maturity reduced by 01 basis points to 10.10%, while the 182-day maturity decreased by 03 basis points to 10.27% and the 364-day maturity dropped by 01 basis point to 10.27%. The auction went undersubscribed with only Rs. 58.21 billion or 89.55% out of the total offered amount being raised at the 1st phase of the auction

The 2nd phase of subscription, across all three maturities will be opened until 4:00 pm on the day before the settlement date (i.e., 10.04.2024) at the respective weighted averages determined at the 1st phase of the auction.

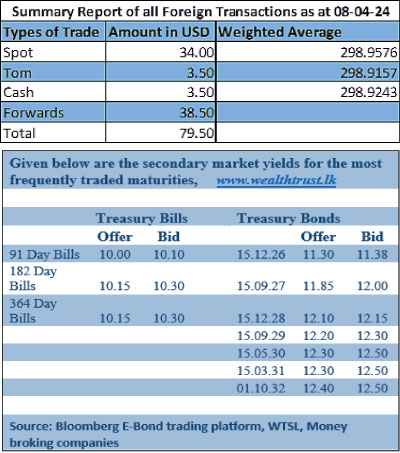

The secondary bond market yesterday experienced a slight reduction in yields, while activity experienced a notable increase. The 15.12.26 maturity saw a noteworthy drop in yields as some buying interest saw rates drop to intraday lows of 11.32% down from intraday highs of 11.40%. Similarly, the 2028 tenors (01.07.28 and 15.12.28) were seen changing hands within intraday highs and lows of 12.15% and 12.10%. However, the shorter tenor 01.07.25 was seen edging up to trade at 10.60 on the back of significant volumes. Additionally, trades were observed on the medium tenor 15.05.30 and 01.07.32 at the rates of 12.47% and 12.62% respectively.

The total secondary market Treasury bond/bill transacted volume for 9 April was Rs. 28.96 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.63% and 9.14% respectively while the net liquidity surplus Rs 149.03 billion yesterday. An amount of Rs. 8.20 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 197.23 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight repo auction for Rs 40.00 billion at the weighted average rate of 8.67%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating to Rs. 298.60/298.65 against its previous day’s closing level of Rs. 298.90/299.00.

The total USD/LKR traded volume for 8 April was US $ 79.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)