Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 20 February 2019 00:00 - - {{hitsCtrl.values.hits}}

In the year 1998, Russell Weerappah, a professional in credit management and experience in the field in Australia decided to move back home and established a professional international organisation to handle debt collection based on new concepts of managing receivables as practiced in international markets. Hence Total Credit Management Services pioneered outsourced receivables in Sri Lanka and was founded in 1999.

|

Russell Weerappah |

TCM since its inception 20 years ago, has educated the business and financial sector to understand the importance and impact of cash flow management throughout an organisation during boom times or recession. With a professional understanding and expertise it pivots TCM to the pedestal of being your strategic partner in consumer and commercial accounts receivables collections. They are always ready to support any business at any stage of your order-to-cash cycle.

Historically they have helped cultivate and retain positive working relationships with client’s customers by providing non-contentious solutions through amicable solutions.

Their professional team understands and promotes the value of your ongoing business relationships so by outsourcing the debt recovery process you are able to focus on your core business and their professional team are always ready to support you through Disputed Resolution and Litigation.

They provide these key services to the business community right at their door step; especially exporters who would have to travel overseas and incur high expenses and so much time to resolve their issues, while TCM have offices that can undertake these assignments within hours and report back the status of the account. Furthermore, the exporter would want to know more about their current or prospective clients and the wellbeing of their business. As we all know it does not take long for a business to hit trouble times and keep trading while insolvent and as a result drag down their current suppliers and as well as new suppliers in the hope of resuscitating their business.

It is advisable to always get financial health/risk reports on companies who are current or prospective new clients, irrespective of how big they are or for whatever period of time they have been trading. Even though trading times have been good or bleak, businesses tend to extend credit terms to survive and the risk of recovery remains high, as the old adage goes, ‘Credit is a necessary evil’. In this context the importance and impact of credit and cash flow management is felt right through the organisation from CEO to the bottom of the ladder.

TCM is a specialist in worldwide debt collection and credit risk reporting believes that corporate credit is a privilege and not a right, but the abuse of that privilege leads to overdue and high bad debt provisions impacting adversely on the overall results of the company.

Good credit management determines the success of any business and this has been the critical factor for creating an awareness in this industry in Sri Lanka. Weerappah says that in his experience of more than 35 years specialising in credit management and involvement with the Australian Institute of Credit Management which commenced in Australia, Sri Lankan businesses now realise the importance of managing their receivables more prudently which is a critical element of the business cycle and implement an in house credit policy that entails client credit applications to be scrutinised and assessed prior to granting a credit facility. This must be periodically reviewed. If high credit limits are extended due to good sales, securing the facility is necessary, as most unsecured debts remain at the bottom of the queue when it comes to official administration by liquidators. Businesses use extended credit to fund their cash shortages when other facilities are exhausted, which is an easy way to secure extra cash.

TCM adheres to ethical standards practiced by the industry and their network offices around the world, as they are members of various international collectors associations and Institutes.

Outsourcing credit collections has its dangers in that if organisations entrust their receivables to an outsourced company that is unprofessional and adopts unethical methods, it can harm the reputation of the organisation and its relationship with its customers causing far reaching irreparable damage.

Having worked in the credit industry in Australia where regulatory laws have to be strictly adhered to; there is an urgent need for the collection Industry in Sri Lanka to be regulated as unprofessionalism has brought disrepute to the industry.

The Central Bank of Sri Lanka has now implemented and enforced many laws protecting the borrowers from unprofessional and unethical behaviour because as Weerappah says, “Debtors are not criminals and should be treated with respect and decorum and always keeping in mind that we in the credit industry act as an extension of our clients credit department.”

Their services in the industry have expanded Island wide after the cessation of the war and have made their presence in almost every corner of the country

TCM looking forward

The credit and collection industry has grown and many large lenders e.g. banks have gone to great lengths to improve how they manage their overdueReceivables. Some banks have built great recovery centres with much focus on reducing their NPLs.

20 years ago banks had to think hard if they were to outsource their recovery operations. Today, it is an integral part of their expanding lending portfolios.

With the development and excitement of new technology trends in the global market, TCM is also planning to leapfrog into the domain the Blockchain and Cryptocurrencies. In this regard, they are first looking at how best they can inculcate the awareness and training required for this new platform which is taking the world by storm. Once a firm commitment is made to deliver Blockchain development training in the local market, we foresee a massive surge in the proliferation of financial business apps using this platform, and this a huge lift to the quality and effectiveness of business at large across all sectors.

Blockchain: The future

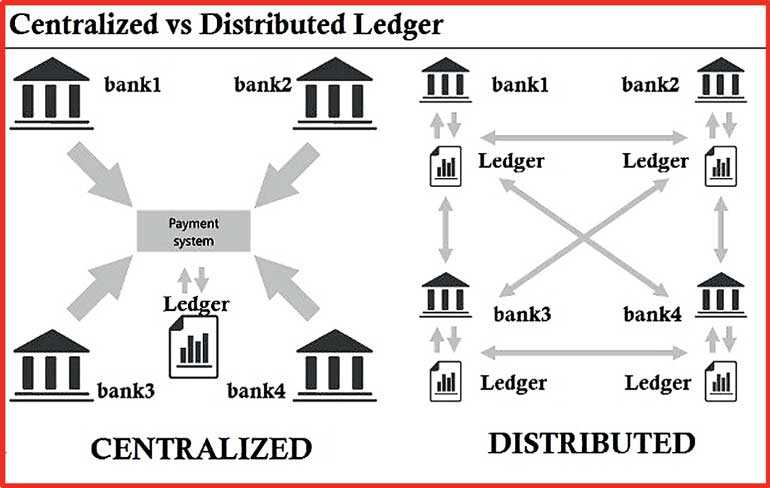

A blockchain is a digital ledger that records transactions both chronologically and publicly. Blockchains are the underlying technology that power cryptocurrencies, dApps, and other crypto technologies. The technology was first conceived in 1991 and elements of blockchain were used in P2P technologies like Tor, torrents, cloud computing, and more. They can also be used to develop many other applications across multiple domains.

Blockchains are powered by nodes, which are servers, computers, and other end-point machines hosting and processing transactions of the ledger. Transactions are grouped into ‘blocks’, and the chain of these is what gives the technology its name.

There are three major factors behind the push for Distributed Ledger Technology (DLT) in the finance industry:

Blockchain technology is built on smart contracts, which is a computer protocol intended to digitally facilitate, verify, or enforce the negotiation or performance of any normal contract.

Smart contracts allow the performance of credible transactions without the need for third parties. These transactions are trackable and irreversible. They provide for contractual clauses to be made partially or fully self-executing, self-enforcing, or both. The aim of smart contracts is to provide security that is superior to traditional contract law and to reduce other transaction costs associated with contracting. Various cryptocurrencies, presently in the global markets, have implemented their own smart contracts.

Cryptocurrency

A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets. Cryptocurrencies use DLT’s opposed to centralised digital currency and traditional banking systems.

The decentralised control of each cryptocurrency works through the DLT, typically a blockchain, that serves as a public financial transaction database.

Bitcoin, first released as open-source software in 2009, is generally considered the first decentralised cryptocurrency. Since the release of bitcoin, over 4,000 altcoins (alternative variants of bitcoin, or other cryptocurrencies) have been created.

The governments of China, the UK, South Korea, Australia, the UAE, Switzerland, Chile, Estonia, Georgia, Singapore, Indonesia, India, the EU, the Ukraine, Venezuela, Sweden, Brazil, Canada and the USA, are some of the countries moving ahead in implementing blockchain technology within many areas of their public administration.

The huge shifts in thinking, within governments and even the private sector, are just some of the moves that are happening, as we speak, that will make blockchain technology to take over as a sound infrastructure for tomorrow’s innovations.

It’s only a matter of time.