Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 9 October 2025 05:16 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

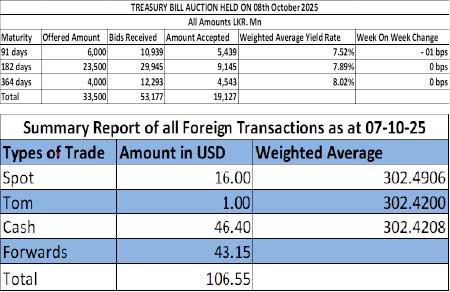

The weighted average rates at yesterday’s weekly Treasury Bill auction held largely steady, with the exception of the 91-day maturity, which registered a further drop of one basis point. The 182-day and 364-day tenors remained unchanged at 7.89% and 8.02%, respectively. This marks the 12th week where T-Bill rates have stayed broadly anchored around prevailing levels.

The weighted average rates at yesterday’s weekly Treasury Bill auction held largely steady, with the exception of the 91-day maturity, which registered a further drop of one basis point. The 182-day and 364-day tenors remained unchanged at 7.89% and 8.02%, respectively. This marks the 12th week where T-Bill rates have stayed broadly anchored around prevailing levels.

Nevertheless, the auction went undersubscribed. Only 57.10%, or Rs. 19.13 billion, out of the Rs. 33.50 billion targeted offered amount was raised. This was despite the bids received to the offered amount ratio standing at 1.59 times.

Phase II of subscription across all three tenors is now open until 3 p.m. of the business day prior to the settlement date (i.e., today) at the Weighted Average Yield Rates (WAYRs) determined for the said International Securities Identification Numbers (ISINs) at the auction.

The secondary Bond market yesterday saw activity at subdued levels for a second straight session. The market was at a virtual standstill apart from sparse trades seen on selected maturities. Yields were seen holding broadly steady and consolidating at the prevailing levels. Market participants were seen adopting a wait-and-see mode, amid the absence of strong directional cues, underscoring the broader tone of restraint that has characterised trading in recent sessions.

The 01.08.26 maturity was seen trading at the rate of 8.30%. The 15.09.29 and 15.10.29 maturities were seen trading at the rate of 9.73%, with the 15.12.29 maturity up the range of 9.72%-9.74%.

In the secondary Bills market, trades were observed on January, February, and March 2026 maturities at the rates of 7.57%, 7.95%-8.05%, and 8.00%.

In addition, the details of the next upcoming Treasury Bond auction, scheduled to be conducted on 13 October, were announced. The round of auctions will have a total offered amount of Rs. 181 billion across three available maturities.

The auction will be comprised of:

The settlement for which will be held on 15 October.

The total secondary market Treasury Bond/Bill transacted volume for 7 October was Rs. 9.50 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 7.87% and 7.89%, respectively.

The net liquidity surplus was recorded at Rs. 174.31 billion yesterday, deposited at the Central Bank’s Standard Deposit Facility Rate (SDFR) of 7.25%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed depreciating slightly to Rs. 302.65/302.69 as against its previous day’s closing level of Rs. 302.52/302.59.

The total USD/LKR traded volume for 7 October was $ 106.55 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)