Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 11 September 2025 00:12 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

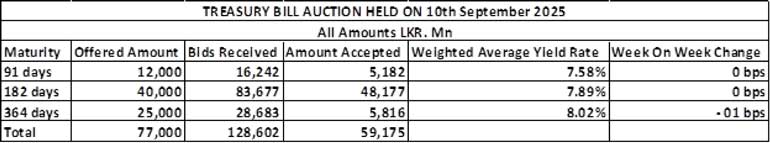

At yesterday’s weekly Treasury Bill auction, the weighted average yields remained broadly steady, with the rate on the 91-day, 182-day remaining unchanged at 7.58% and 7.89% respectively. The 364-day maturity registered a marginal dip of 01 basis point to 8.02%.

However, only 76.85% of the total offered amount was raised, with successful bids amounting to Rs. 59.18 billion against the Rs. 77 billion on offer in the first phase of competitive bidding. This marked the third consecutive auction that fell short of fully raising the targeted amount.

Interestingly, the 182-day maturity raised more than its respective offered amount, while the 91-day and 364-day maturities raised less than their respective offered amounts.

The Phase II of subscription on across all three maturities is now open until 3 p.m. of business day prior to settlement date (i.e., 11.09.2025) at the WAYRs determined for the said ISINs at the auction.

This was ahead of the T-Bond auctions scheduled for today where a total amount of Rs. 155 billion is on offer, across three maturities.

The auction will be comprised of:

The settlement for which will be held on 15 September 2025.

For context, the previous round of Treasury Bond auctions held on 12 August with a total offered amount of Rs. 65 billion across two available maturities, went undersubscribed. The auctions raised only Rs. 18.53 billion or 28.51% out of the total offered amount in successful bids across both phases, despite total bids received exceeding the offered amount by 2.06 times. This marked the fourth consecutive bond auction to raise less than the offered amount. Maturity-wise the results were as follows:

The first offered security, the 01.01.32 maturity (8.00% coupon) was rejected at the first phase of the auction. This was despite bids received totalling Rs. 79.79 billion and exceeding the offered amount of Rs. 40 billion by 2.00 times. This marks the first instance since 12 September 2024 to see a particular maturity where all bids were rejected.

The second offered security, the 01.07.37 maturity (10.75% coupon) also failed to raise the entire maturity-wise offered amount of Rs. 25 billion at the first phase, which prompted the opening of the second phase. 74.13% or Rs. 18.53 billion was raised in successful bids at a weighted average rate of 10.97% across both phases.

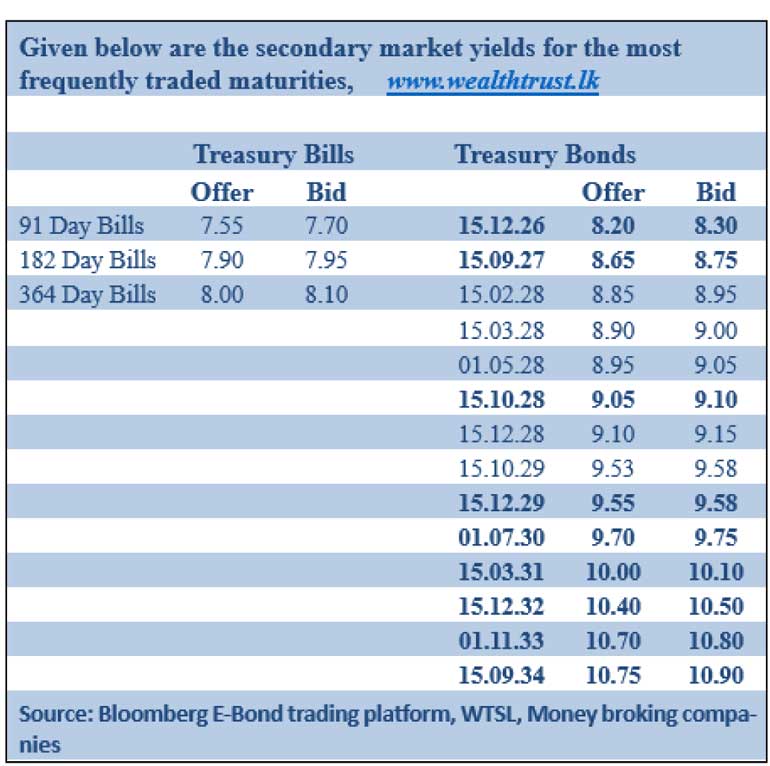

The Secondary Bond market remained largely subdued for a third consecutive day, with activity limited to a few trades across selected maturities and overall participation staying thin. Market participants adopted a cautious stance ahead of the upcoming Treasury Bond auction, leaving conditions at a virtual standstill for much of the session. Yields, however, continued to edge higher during trading, with two-way quotes closing the day up.

The 15.02.28 and 15.03.28 maturities were seen trading at the rates of 8.85%-8.965%. The 15.10.28 maturity was observed trading at the rate of 9.08%. The 15.05.30 maturity was seen trading at the rate of 9.70% and the 15.03.31 at the rate of 10.05%. The 01.11.33 maturity traded at the rate of 10.75%.

In the Secondary Bills market, trades were observed on January 2026 maturities at the rate of 7.70%. Early March 2026 maturities traded at the rate of 7.93% and June 2026 at 8.03%.

The total secondary market Treasury Bond/Bill transacted volume for 9 September was Rs. 6.10 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.86% and 7.87% respectively.

The net liquidity surplus was recorded at Rs. 160.60 billion yesterday.

Forex market

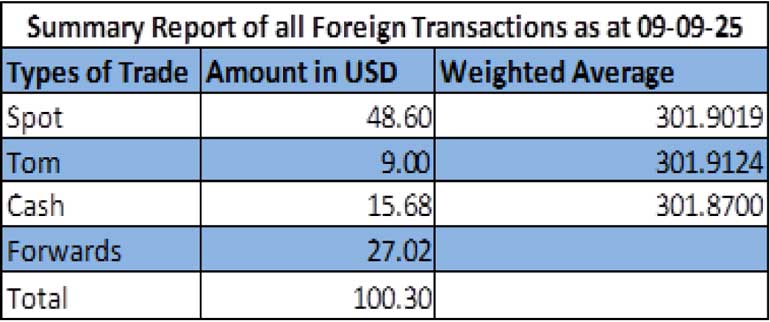

In the Forex market, the USD/LKR rate on spot contracts to closed steady at 301.98/302.02 as against its previous day’s closing level of Rs. 301.97/302.05.

The total USD/LKR traded volume for 09 September was $ 100.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)