Friday Feb 06, 2026

Friday Feb 06, 2026

Friday, 11 July 2025 02:14 - - {{hitsCtrl.values.hits}}

When an enabling mechanism for listed Sukuk was first announced in the first half of 2024, there was a general feeling of excitement and anticipation that pervaded the Islamic Banking and Finance (IBF) circles, with the potential launch of a product that has piqued the interest of a multitude of stakeholders in the IBF industry.

Sukuk was an initiative that, in fact, had its origins over two decades ago but has come to fruition with Vidullanka PLC, a renewable energy company, launching the first ever Sukuk to be listed on the Colombo Stock Exchange.

Whilst the company should be lauded for this bold initiative, this was undoubtedly a feather in the cap of the CSE, who have strived to make this a reality and have persevered in their endeavour, along with officials of the regulatory body, the Securities and Exchange Commission (SEC) of Sri Lanka.

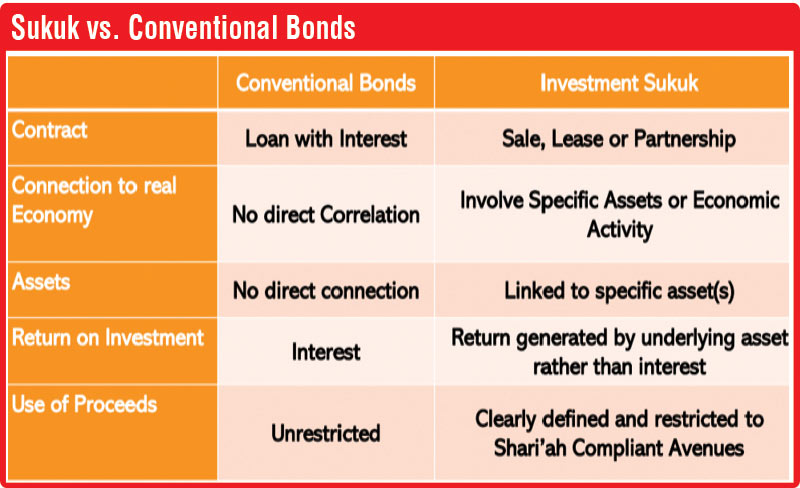

A Sukuk is analogous to a Debenture, in the plainest understanding of the product. However, it is a highly nuanced product with features that are inherently different. The most fundamental difference, especially to the lay observer, is the total elimination of ‘Interest’, which is the basis of ‘return’ associated with the Debenture. This would, of course, belie some of the other features that one could argue are as critical in structuring a Sukuk.

For instance, the need for an underlying Asset that would be at the very core of the product offering. In fact, this requirement is what makes the product more secure – and also somewhat assumes the features and characteristics more akin to a Securitised product.

Somewhat paradoxically, it is this very feature of the Sukuk being Asset-backed or Asset-based that has been an impediment to Sovereign Sukuk, which should be one of the key objectives in the development of a robust Sukuk Market. Sovereign Bonds do not incorporate any element of collateral and having to proffer an Asset seems anathema to many a Sovereign Issuer and we could probably include Sri Lanka in this list. However, countries and entities that are rated ‘AAA’ internationally are amenable to provide the underlying assets that are an essential prerequisite for a Sukuk Issuance. Therefore, it is imperative that we too take a cue from such countries, since Sovereign Sukuk issuances could open up a vista of opportunities for the country. It is also widely recognised as a product that many nations use to finance their infrastructure requirements – perfectly suited for Toll Roads, for instance, given that there is an easily identifiable revenue stream that could be used to service the Sukuk investors.

Sukuk are Shariah-compliant financial certificates representing proportionate ownership in tangible assets, usufruct, or services. It operates mostly on the concept of Asset-backed/Asset based models, and is devoid of any element of interest. Sukuk aligns with Islamic financial principles by promoting risk-sharing, whilst prohibiting speculative, unjust or socially abhorrent practices.

Sukuk vs. Conventional Bonds

Growth of the Global Sukuk Market

Underlying Principles of Issuing a Sukuk

Issuing a Sukuk, sometimes referred to as an Islamic bond, involves several underlying principles that align with Islamic Jurisprudence and Sri Lankan capital market regulations:

1. Prohibition of Interest (Riba): Sukuk adhere to the Islamic principle of prohibiting interest, which is considered usury and is forbidden in Islamic Jurisprudence. Instead of interest payments, Sukuk returns are commonly derived from, for instance, the rental income from underlying assets.

2. Asset-Backed Nature: Unlike conventional bonds, Sukuk represent ownership in tangible assets, projects, or business activities. This means that Sukuk are backed by real assets, providing a more secure investment for investors.

3. Risk and Profit-Sharing: Sukuk embody the principle of risk-sharing, where both the Issuer and Investors often share the risk of losses emanating from the underlying assets. This contrasts with conventional bonds, where the issuer bears the risk of default.

4. Ethical Investments: Sukuk comply with ethical investment principles, avoiding areas that are deemed forbidden under Islamic Jurisprudence. Some examples of such sectors are Gambling, Alcohol and Tobacco, just to name a few. These are considered socially abhorrent in most quarters and are not necessarily limited to people from any particular faith.

5. Prohibition of Uncertain Transactions: Sukuk transactions must be clear and free from excessive uncertainty or ambiguity.

Sri Lankan capital market regulations

The Securities and Exchange Commission of Sri Lanka (SEC) has introduced regulations to facilitate the issuance of Sukuk in Sri Lanka. One key area aspect is that of Shariah Governance. Therefore, Sukuk issuances require approval from a minimum of three accredited scholars, who are expected to certify that a particular issuance is in compliance with Islamic principles and jurisprudence. These scholars evaluate the structure and other aspects of the Sukuk to ensure they meet Shariah standards

Type of Sukuk

Some of the popular product structures are:

These structures provide various options for Issuers to develop Sukuk that comply with certain principles and cater to different investment preferences. Each structure has its own merits and the choice of structure largely depends on the specific needs and objectives of the issuer and investors. Of all the structures (and there are many more than what has been detailed above, including hybrid structures), the Ijarah Sukuk remains the most popular globally.

Sukuk provides an ideal way of financing infrastructure projects. There are many economic activities or projects that have employed Sukuk as a means of financing. This is especially apparent in countries such as Malaysia, where a plethora of projects, such as Highways, have utilised Sukuk, issued domestically as well as internationally, to raise funding. As a product whose tenor can extend to double-digits or even perpetuity, Sukuk have proved ideal for financing these projects, as an alternative to the more commonplace interest-based debt. The use of Sukuk to finance large projects means that investors in Sukuk are also incentivised to help economies develop by creating and producing new assets.

Listing on the Stock Exchange ensures the liquidity of the investment until maturity. This aspect adds to the lustre of the product, since the secondary market provides an effective mechanism to exit at very short notice. Some Sukuk are also used as Liquidity Management tools in some markets.

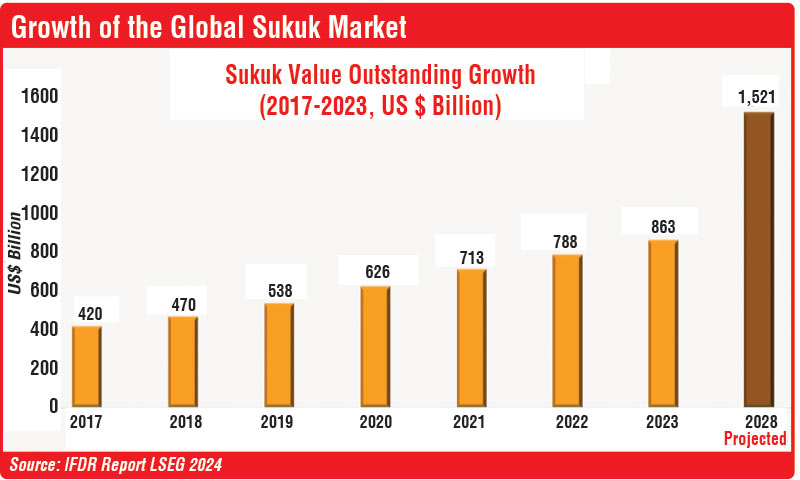

Sukuk are firmly entrenched in global capital markets. Whilst Malaysia has been the market leader, Sukuk have also featured in countries such as England, and listed on Stock Exchanges such as those in Luxembourg and Ireland. There are over $ 1 Trillion Sukuk currently outstanding and this figure is expected to rise exponentially. With Sukuk making an entry into Sri Lanka, there is a general consensus emerging from various stakeholders that this product will be an integral part of not just the IBF industry but also the Capital Markets landscape.

(Courtesy of Adl Capital Ltd. – [email protected])