Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 1 December 2025 03:36 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The secondary Bond market last week started off slowly, as market participants adopted a wait and see approach ahead of an action-packed week. Activity was shaped by anticipation of the sixth and final Monetary Policy Announcement for the year 2025, together with a series of back-to-back Treasury Bill and Bond auctions conducted throughout last week. Yields were initially seen consolidating at prevailing levels, as trading followed a sideways pattern fluctuating in a narrow band.

The secondary Bond market last week started off slowly, as market participants adopted a wait and see approach ahead of an action-packed week. Activity was shaped by anticipation of the sixth and final Monetary Policy Announcement for the year 2025, together with a series of back-to-back Treasury Bill and Bond auctions conducted throughout last week. Yields were initially seen consolidating at prevailing levels, as trading followed a sideways pattern fluctuating in a narrow band.

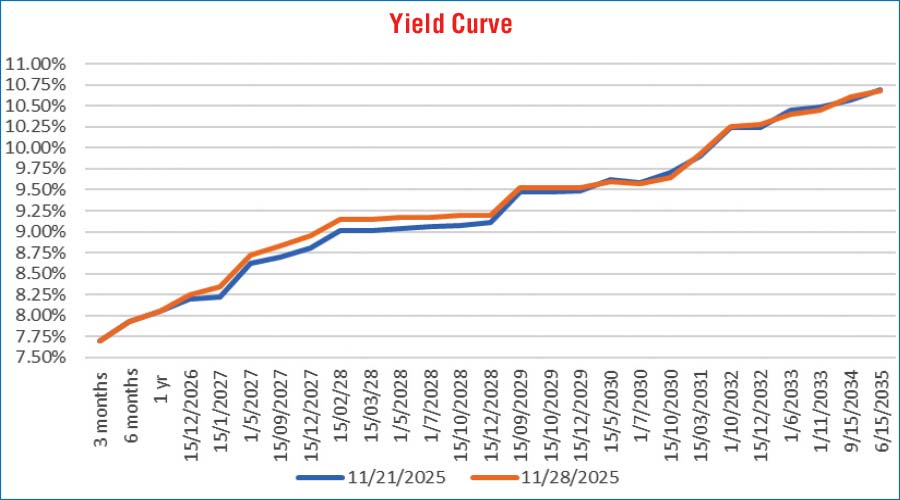

On Wednesday (26 November), following the Monetary Policy Announcement, the secondary Bond market saw yields increase, mainly on the short end of the yield curve. However, the long end of the yield curve continued to consolidate and hold broadly steady.

The Central Bank of Sri Lanka (CBSL) decided to hold the Overnight Policy Rate at 7.75%. This marked the third consecutive monetary policy decision to keep rates on hold. The Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR), which are linked to OPR with pre-determined margins of ± 50 basis points, also remained unchanged at 7.25% and 8.25%, respectively. The statutory reserve rate was left unchanged at 2%.

Subsequently, on Thursday after the outcome of the Treasury Bond auction, where rates came in below market expectations, the market continued to consolidate. On Friday, at the tail end of the week, as the effects of Cyclone Ditwah rocked Sri Lanka with adverse weather, market activity was seen at subdued levels and yields on the shorter tenors edged up further, while the long end held firm.

The Treasury Bond auctions conducted on Thursday (27 November) produced remarkable outcomes registering weighted averages below prevailing secondary market yields. The auction was comprised of two maturities with a total offered amount of Rs. 42 billion.

Maturity wise the results were as follows:

The shorter tenor 01.03.2030 maturity recorded a weighted average rate of 9.53%, this was as against a pre-auction rate of 9.60/9.64 for a similar maturity (01.07.2030). However, the 01.03.30 maturity only raised 87.00% or Rs. 17.40 billion out of the Rs. 20 billion maturity wise offered amount across both 1st and 2nd phases.

Similarly, the 01.06.2033 maturity recorded a weighted average rate of 10.39%, also significantly below its previous day’s closing rate of 10.45/10.50. The 01.06.33 maturity raised the entire maturity wise offered amount of Rs. 22 billion in competitive bidding at the 1st phase. Demand subsequently extended into the Direct Issuance Window, where only the 2033 tenor was on offer, and the full Rs. 2.20 billion available was entirely taken up.

In conclusion, at the close of the week, secondary Bond market two-way quotes were seen closing higher on the short end of the yield curve as yields drifted higher in that segment throughout the week. However concentrated buying interest at the longer end kept a cap on rates and as a result the long end held broadly steady. Overall activity remained restrained throughout last week.

In terms of the secondary Bond market trade summary for the week, the 2026 maturity of 01.06.26 traded at 8.20%, while the 2027 segment saw the 15.01.27, 01.05.27, and 15.09.27 maturities changing hands within 8.30%–8.82%. The 2028 tenors were active across the week, with the 15.03.28 trading at 9.02%–9.15%, the 15.02.28 at 9.05%-9.15, the 01.05.28 within 9.10%–9.14%, the 01.07.28 at 9.10% to 9.15%, and the 15.12.28 operating within 9.15%–9.18%.

The 2029 maturities saw rates bunch up as the 15.06.29, 15.09.29, 15.10.29, and 15.12.29 traded within the range of 9.49%–9.55% collectively. The 01.07.30 maturity was active throughout the week, trading within 9.57%–9.65%. The 15.03.31 maturity traded at 9.94%, while the 01.06.33 changed hands around 10.45%.

In the longer tenors, the 15.09.34 maturity traded consistently across the week between 10.58%–10.62%, and the 15.06.35 maturity remained active within a narrow band of 10.65%–10.70%, indicating continued consolidation at the long end.

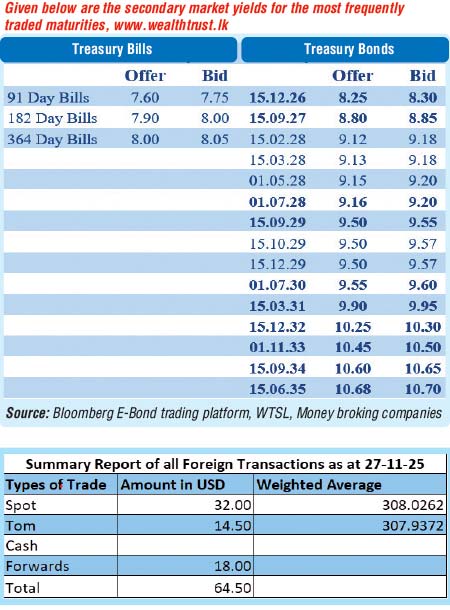

At the weekly Treasury Bill auction held last Wednesday (26 November) the weighted average rates at the weekly Treasury Bill auction conducted remained unchanged across the board. Accordingly, the yields on the 91-day, the 182-day and the 364-day tenors were recorded at 7.52%, 7.91% and 8.03%. This marks the 19th week where T-Bill rates have stayed broadly anchored around prevailing levels. However, the auction was undersubscribed, raising only 64.32% or Rs. 55.637 billion out of the Rs. 86.50 billion offered. This marks the fourth consecutive auction to undersubscribed, despite the bids received to offered amount ratio being recorded at 1.44 times.

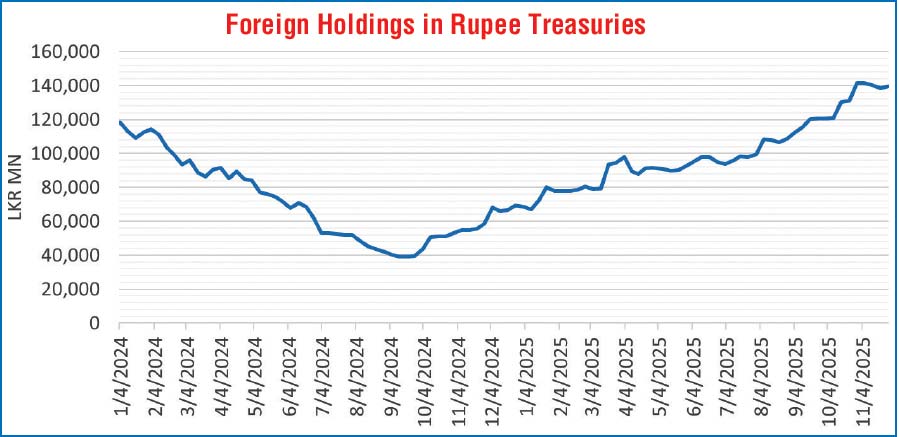

The foreign holdings of rupee-denominated Government securities resumed its upward trajectory recording a net inflow amounting to Rs. 1 billion as at the close of the week ending 27 November, a 1% increase week on week. As a result, the total holdings rose to Rs. 139.53 billion. This comes against the backdrop of increased expectations of a further US FED rate cut due in December, with the CME FedWatch tool showing an 86.40% probability of a further 25 basis points cut.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 14.39 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market increased to Rs. 105.80 billion as at the week ending 28 November 2025, from Rs. 78.27 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.94%-7.95% and 7.96% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government securities was registered at Rs. 2,508.92 billion as at the 28 November 2025, unchanged against the previous week’s closing level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 308.05/308.20 as against the previous week’s closing level of Rs. 307.80/307.95. This was subsequent to trading at a high of Rs. 307.82 and a low of Rs. 308.20.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 78.21 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)