Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 15 July 2025 01:42 - - {{hitsCtrl.values.hits}}

PMF Finance Chairman Chandula Abeywickrema

In this comprehensive interview, PMF Finance PLC Chairman Chandula Abeywickrema reflects on the remarkable transformation of the company under his leadership—from a defunct finance institution to a steadily growing, professionally managed, and compliant entity. With PMF now poised for sustainable long-term growth, he shares how strategic leadership, governance, reform and an empowered team rebuilt confidence, performance, and stakeholder trust.

Q: You took over PMF during a difficult chapter in its history. What was the situation like in 2019 when you were appointed Chairman?

A: It was grim. The company had suffered due to years of mismanagement and political interference. When I took over as the Chairman of the Board , PMF was running at a loss of Rs. 93 million, the total asset base was just Rs. 2.8 billion, and deposits were drying up. The company had lost credibility in the market, and even the Central Bank had flagged several non-compliance issues. The culture was broken, and the systems were collapsing. Honestly, it was barely functioning.

Q: What were the first steps you took to stabilise and then restructure the company?

A: The first step was to reconstitute the Board and bring in people with the required expertise and acumen to formulate policy and give direction. Once the Board was reconstituted with the likes of Channa Manoharan, late Duleep Daluwatte, Rasika Gunawardena and Rangana Koralage ( nominee representing Sterling, the main shareholder), we had to embark on restructuring the entity which led to replacing nearly 90% of the staff over a period of time. At this stage, we were fortunate to secure the services of seasoned professionals like Nalin Wijekoon as the CEO and Travis Waas as a consultant (who subsequently joined the Board) with significant expertise on operations to join the PMF team.

One of the major challenges we faced was to attract good staff to many key positions. The stature of our Board members in the financial services sector, played a pivotal role in attracting personnel with the right mindset and attitudes to execute the decisions taken at Board level. Whilst giving cognisance to Central Bank of Sri Lanka (CBSL) directions and guidelines, we focused on building a quality lending portfolio and cleaning up the bad portfolio we inherited, including loans/leases without proper collaterals and sub-standard credit evaluations. Further, we planned on revamping our IT infrastructure. It was a complete reset. I am proud to say that we have moved away from ad-hoc decision-making to a structured, responsible and accountable governance ecosystem.

Q: How do the numbers reflect the turnaround over the last few years?

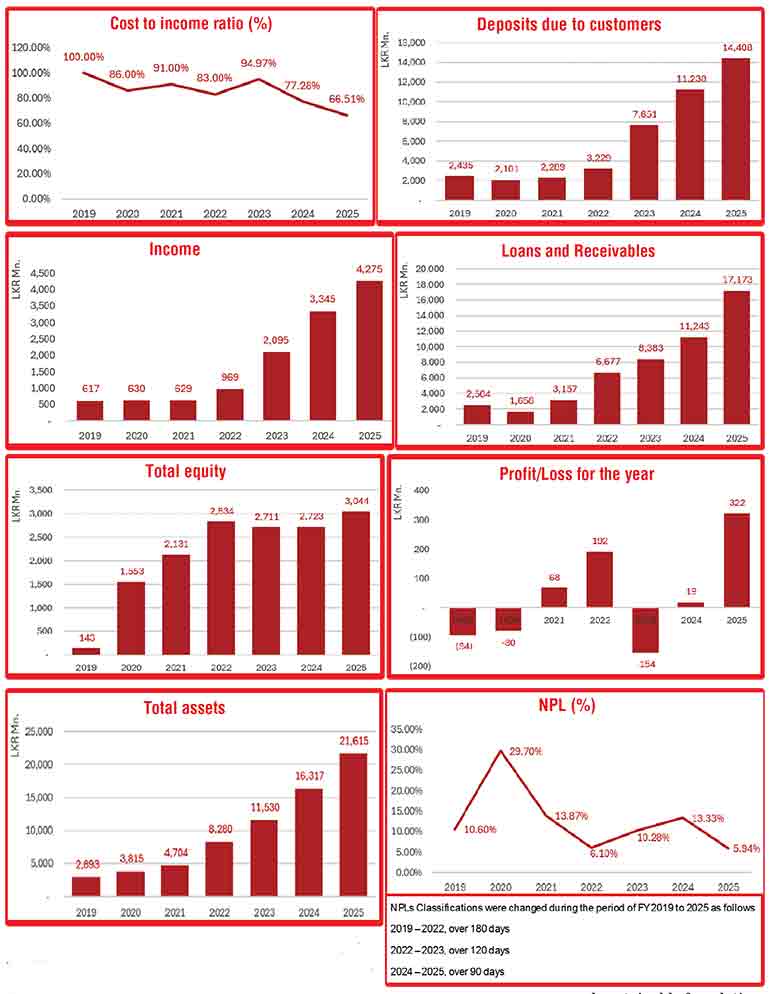

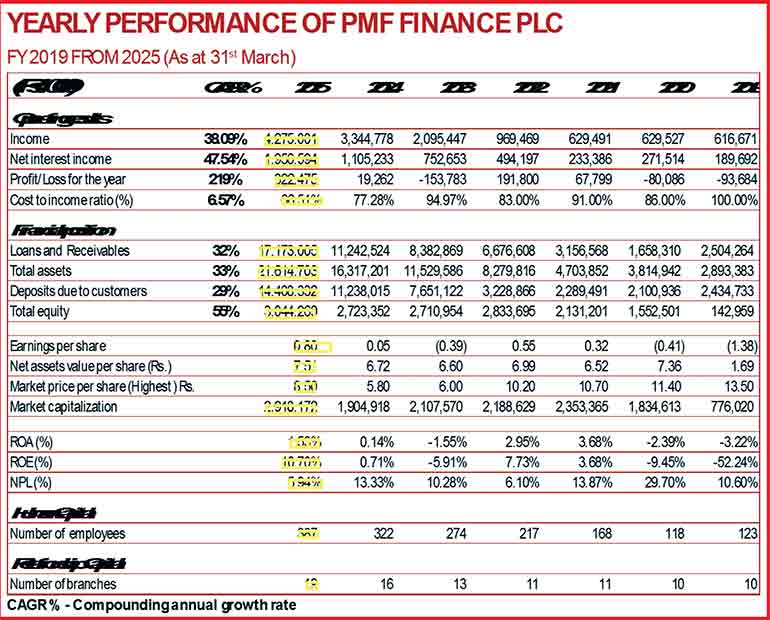

A: The data tells the story. From 2019 to 2025, our income grew at a compound annual growth rate (CAGR) of 38.09%, reaching Rs. 4.27 billion in FY 2025. Net interest income grew 47.54% CAGR, with Rs. 1.95 billion in 2025. We turned a loss of Rs. 93 million in 2019 into a profit of Rs. 322 million in 2025—a staggering 219% CAGR in bottom-line growth.

Our total assets have increased from Rs. 2.89 billion in 2019 to Rs. 21.6 billion in 2025—a 33% CAGR. Loans and receivables reached Rs. 17.17 billion, growing 32% annually, and deposits increased to Rs. 14.4 billion, with a 29% CAGR. Equity rose from just Rs. 143 million to over Rs. 3 billion, a 55% CAGR.

We also scaled our human capital from 123 employees to 387, and branch count has almost doubled, reaching 19 in 2025. These aren’t just numbers—they reflect commitment, discipline, and long-term strategy.

Q: What are some of the operational challenges you faced?

A: Further to what I had mentioned before, at one point, our loan collection rate was just 20%. That’s unsustainable. We strengthened our recovery units, brought in risk and compliance experts, and aligned all operations with Central Bank regulations. Today, our non-performing loan (NPL) ratio is down to 5.94%, from nearly 30% a few years ago.

Q: Governance and leadership seem to have played a key role in this transformation. Can you elaborate?

A: Absolutely. One of the strongest pillars of our recovery has been the calibre of our Board of Directors. Today, we have a proactive board comprising seasoned professionals who bring extensive, cross-sectoral expertise. As we progressed, I was able to invite, Travis Waas, with over 30 years’ experience in leasing and finance, formerly of HNB, Assetline and Orient Finance, with seasoned operational insight, Dr. Nirmal de Silva offers expertise in strategy, entrepreneurship, and impact investing, providing a unique lens on SME development. Krystle Reid Wijesuriya is a respected leader in youth empowerment and disability inclusion, enriching our social governance focus. Rohan Pandithakorralage, appointed in July 2024, is an HR strategist with over four decades of experience, adding a strong people centred leadership dimension. K. M. D. B. Rekogama, an engineer by profession, former banker and Micro, Medium and Small Enterprise (MSME) consultant appointed in August 2024, strengthens our technical and banking acumen. In September 2024, we welcomed Ashoka Goonesekere, who brings valuable governance, risk management, and audit experience from his tenure at HNB, DFCC Bank and HNB Assurance, and Kaniska Weerasinghe, a legal counsel and former Director-General of the Employers’ Federation of Ceylon, who enhances our regulatory and compliance depth. We also brought in Prof. Ajith Medis in the year 2023 as the CEO for his marketing and business development expertise, who has contributed together with the management team to further strengthen our Board driven strategic focus and staff empowerment, initiate cost controls, and to maintain sustainable growth. The solid foundation we have laid since 2019, and the decisive approach of the Board, when faced with challenges, has paved the way for a resilient and sustainable future for PMF Finance.

What we have achieved this year is just the icing on the cake. This board is not decorative—it’s functional, dynamic, and deeply invested in the future of PMF. That is our edge.

Q: Looking forward, what’s your vision for the future of PMF?

A: We’ve laid a strong and sustainable foundation. Now, it’s about scaling responsibly. If macroeconomic conditions hold, we aim to cross Rs. 500 million in profit within the next year. We’re also eyeing growth sectors like tourism and MSMEs. That said, external risks—from economic instability to global financial shifts—must be managed carefully.

Q: What are you most proud of in this seven-year journey?

A: Taking a nearly defunct company and turning it into a respected, regulated, and profitable financial institution. We’ve rewarded staff with long-overdue rewards and incentives, provided career growth, and built a team culture that’s mission-driven. For me, it’s deeply fulfilling—not just professionally, but personally