Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 20 September 2018 00:40 - - {{hitsCtrl.values.hits}}

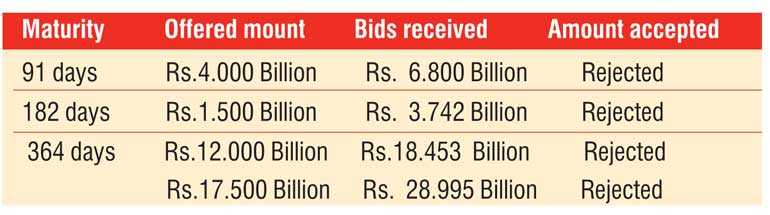

All bids received for yesterday’s weekly Treasury bill auction were rejected for the first time in close to one-and-a-half years (79 weeks) due to most market participants demanding for higher yields.

The secondary market bond yields fluctuated yesterday as continued selling interest during morning hours of trading led to yields increasing further, with the liquid maturities of 15.10.21, two 2023’s (i.e. 15.03.23 and 15.07.23), 01.08.24 and 15.03.28 hitting intraday highs of 10.58%, 10.70%, 10.80%, 10.90% and 11.05%, respectively, against its previous day’s closing levels of 10.35/45, 10.60/65, 10.55/60, 10.60/75 and 10.70/85.

However, renewed buying interest subsequent to the outcome of the Treasury bill auction saw yields on the maturities of 15.10.21, two 2023’s (i.e. 15.03.23 and 15.07.23) and 01.08.24 dip to lows of 10.42%, 10.60%, 10.55% and 10.65%, respectively, once again.

The total secondary market Treasury bond/bill transacted volumes for 18 September was Rs. 3.99 billion.

In money markets, the Open Market Operations (OMO) department of the Central Bank was seen infusing an amount of Rs. 17.87 billion and Rs. 10 billion on an overnight basis and six days at weighted averages of 7.99% and 8.11%, respectively, yesterday. The overnight call money and repo rates averaged 8.01% and 8.02%, respectively, as market liquidity remained negative at Rs. 22.86 billion.

Rupee loses ground further

The rupee on its spot contracts depreciated further yesterday to close the day at Rs. 167.00/40 against its previous day’s closing level of Rs. 165.90/10 on the back of continued importer demand and a strengthening dollar internationally.

The total USD/LKR traded volume for 18 September was $ 28.33 million.

Some forward USD/LKR rates that prevailed in the market were 1 month - 168.00/30, 3 months 169.60/00, and 6 months - 172.30/70.