Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 14 May 2025 00:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

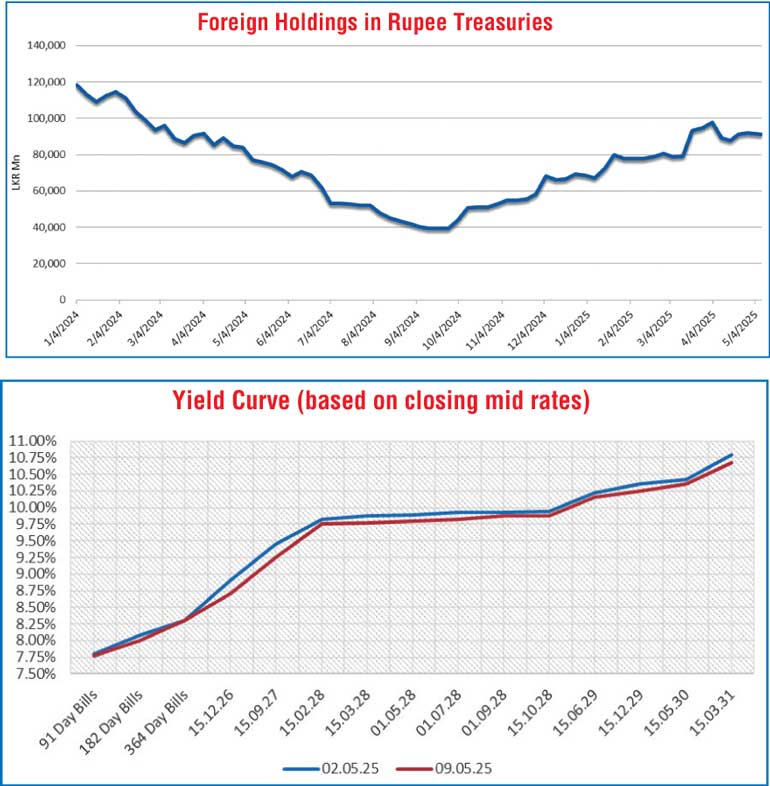

The secondary bond market during the week ending 09 May 2025 initially started off on a positive note and saw yields edge lower. However, momentum was seen shifting just ahead of the Treasury bond auctions as profit taking selling pressure was seen reversing gains and pushing rates up. Following the announcement of the bullish Treasury bond auction results market sentiment turned positive once again resulting in a recovery that pushed rates back down and sparked a rally. The overall market activity and transaction volumes were seen at healthy levels. Trading was predominantly on 2026-2031 tenors. In conclusion, despite the fluctuation in yields, two-way quotes were seen ending the week considerably significantly lower, resulting in a downward shift of the yield curve.

The 01.05.27 maturity traded down from an intraweek high of 9.30% to a low of 9.08%. The 15.10.28 maturity was seen trading within intraweek highs and lows of 9.92%-9.85%.

The inverted U-shaped trading pattern was most pronounced on the 2029 tenors. The market favourite, the 15.12.29 maturity, traded down from 10.30% to a low of 10.26%. However, profit-taking pressure that emerged just before the T-Bond auction pushed the yield back up to 10.32%, before recovering to close the week at 10.25%. The rest of the 2029 tenors followed a similar trading pattern. During the week the 15.09.29 maturity traded down the range of intraweek highs to lows of 10.30%-10.20% and 15.06.29 from 10.20% to a 10.15%.

The 15.03.31 maturity traded down the range of 10.78% to 10.70%. The 15.03.35 maturity traded at the rate of 11.10%.

The Treasury Bond auctions held last Friday (09 May) concluded on a bullish note, with the full Rs. 80 billion on offer successfully raised at the 1st phase in competitive bidding. Rates were below market expectations, with total bids exceeding the offer by 2.98 times.

The new 15.10.29 maturity (10.35% coupon) was fully subscribed in the first phase at a weighted average yield of 10.22%. For reference this was well below a similar 15.09.29 maturity which was quoted at 10.25%/10.30% pre-auction and a 15.12.29 maturity at 10.30%/10.33%.

Similarly, the 01.11.33 maturity (09.00% coupon) raised the entire maturity-wise offered amount of Rs. 45 billion at a yield of 10.97%. This was also below market expectations as 2031 maturities were seen quoted at the rate of 10.70%/10.80% just prior to the auction. Given blow are the details of the auction.

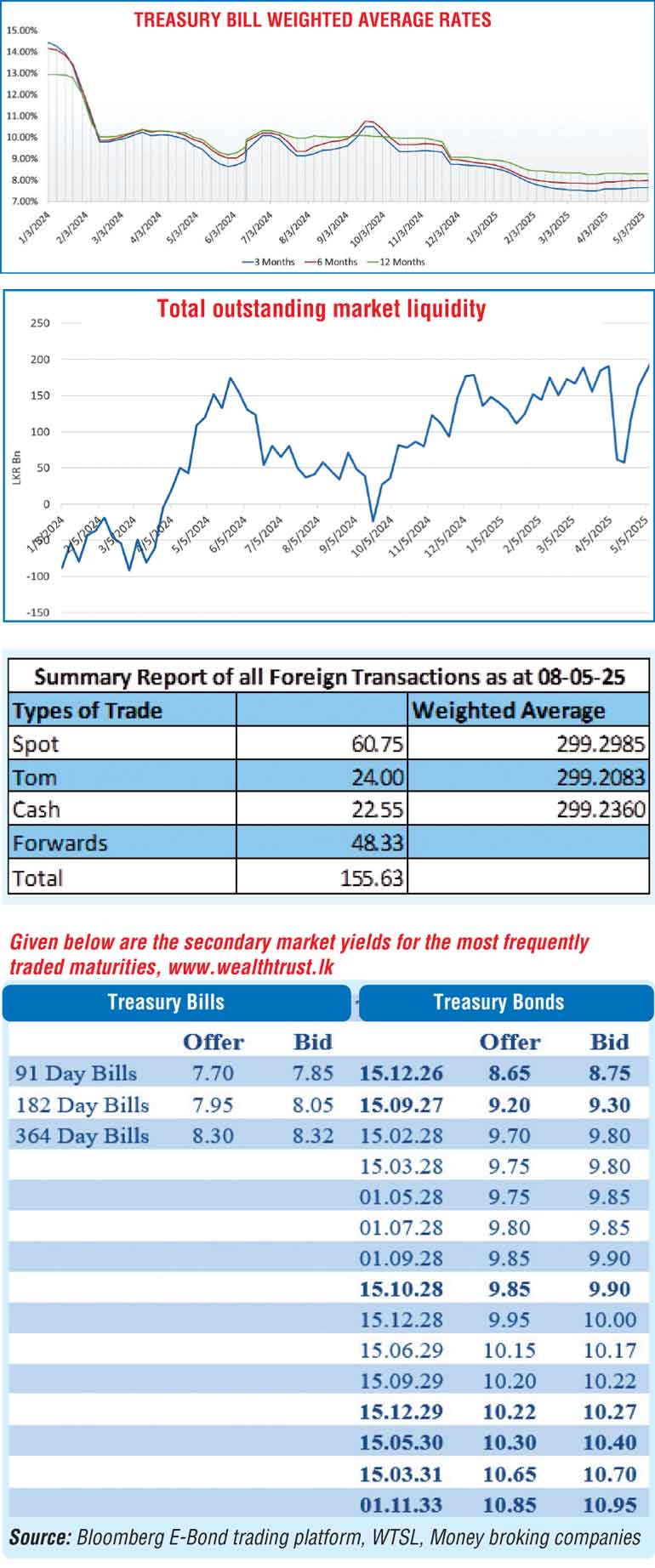

However, the weekly Treasury bill auction conducted last Wednesday (07 May) went undersubscribed, as only 94.42% or Rs. 122.74 billion, of the total offered volume of Rs. 130 billion was accepted in successful bids. This was despite total bids received exceeding the offered amount by 1.76 times. The auction saw weighted average yield rates hold broadly steady, with the exception being the 182-day tenor. Accordingly, the weighted average rates on the 91-day tenor and 364-day tenors remained unchanged at 7.65% and 8.30% respectively. However, the weighted average rate on the 182-day tenor increased by 01 basis points to 7.98%

Meanwhile, the foreign holding in rupee treasuries recorded a net outflow, following two consecutive weeks of inflows, amounting to Rs. 697.00 million and as a result the total holding reduced to Rs. 91.06 billion as at 08 May 2025. The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 29.14 billion.

The total outstanding liquidity surplus in the inter-bank money market increased to Rs. 194.50 billion as at the week ending May 09 2025, from Rs. 163.28 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.96%-7.98% and 7.97%-7.99% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at Rs. 2,509.42 billion as at the May 09 2025, unchanged from the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating notably, to close the week at Rs. 298.85/298.95 as against the previous week’s closing level of

Rs. 299.48/299.52 and subsequent to trading at a high of Rs. 298.80 and a low of Rs. 299.61.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 93.55 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond

trading platform, Money broking

companies)