Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 17 June 2025 03:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market opened the week with yields initially quoted higher, as sentiment was dampened by the prevailing Israel-Iran conflict, mirroring declines in the stock market. However, renewed buying interest at these elevated levels curtailed further upward movement and sparked a recovery, with yields ultimately closing the day only marginally higher. Market activity and transaction volumes were seen at healthy levels.

The secondary bond market opened the week with yields initially quoted higher, as sentiment was dampened by the prevailing Israel-Iran conflict, mirroring declines in the stock market. However, renewed buying interest at these elevated levels curtailed further upward movement and sparked a recovery, with yields ultimately closing the day only marginally higher. Market activity and transaction volumes were seen at healthy levels.

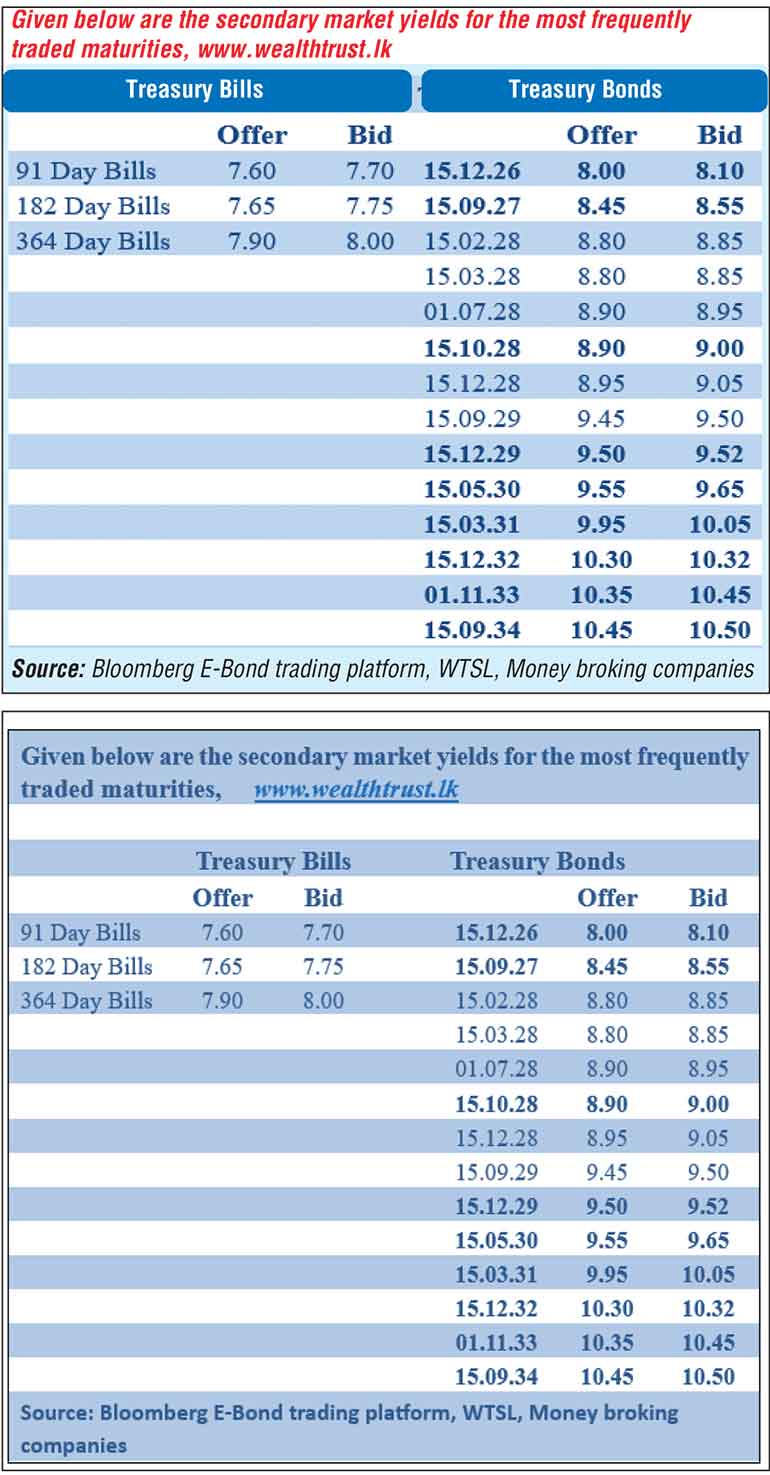

The 15.12.26 maturity traded at the rate of 8.00%. The 01.05.27 and 15.09.27 maturities were seen trading at the rates of 8.35% and 8.50% respectively. The 15.02.28, 15.03.28, and 01.05.28 maturities were seen trading at the rates of 8.75%-8.80%, 8.80% to 8.85% and 8.90% respectively. The 15.09.29 maturity traded within the range of 9.46%-9.48%. The 15.12.29 maturity initially hit an intraday high of 9.58% before recovering to trade at an intraday low of 9.53%. The 15.12.32 maturity held broadly steady and traded within the range of 10.31%-10.34%. The 15.09.34 maturity traded at the rates of 10.45%-10.48%.

In addition, it was reported that Sri Lanka’s GDP grew by 4.80% during the 1st Quarter of 2025 amidst a low inflation environment as 12-month moving average CCPI inflation was recorded at (0.80%) as at March 2025.

The total secondary market Treasury bond/bill transacted volume for 13 June was Rs. 11.15 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.70% and 7.73% respectively.

The net liquidity surplus decreased to Rs. 131.87 billion yesterday. An amount of Rs. 0.34 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 132.21 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex Market

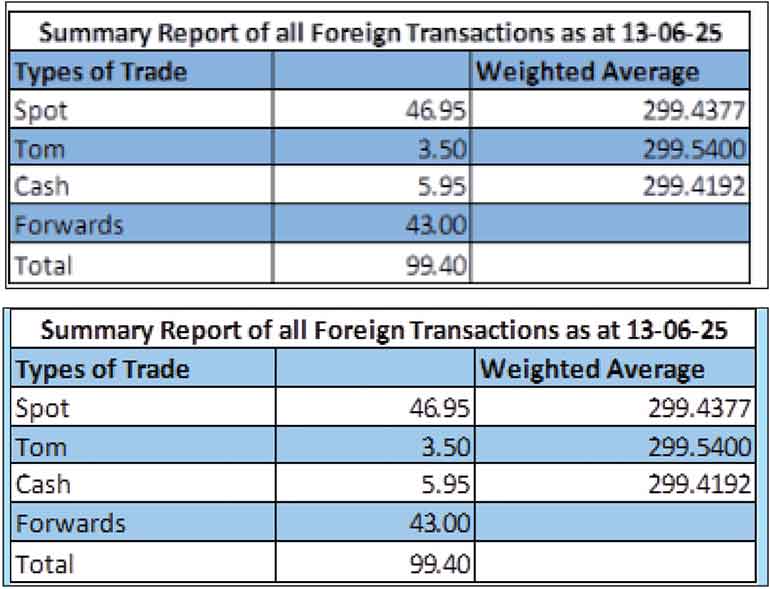

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 300.90/301.15 as against 299.70/300.00 the previous day.

The total USD/LKR traded volume for 13 June was $ 99.40 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)