Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 11 July 2025 01:55 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market on Wednesday saw yields edge up marginally as the uncertainty stemming from the imposition of ‘Reciprocal Tariffs’ by the US continued to weigh down on market sentiment. Trading activity and transaction volumes were seen at subdued levels.

The secondary bond market on Wednesday saw yields edge up marginally as the uncertainty stemming from the imposition of ‘Reciprocal Tariffs’ by the US continued to weigh down on market sentiment. Trading activity and transaction volumes were seen at subdued levels.

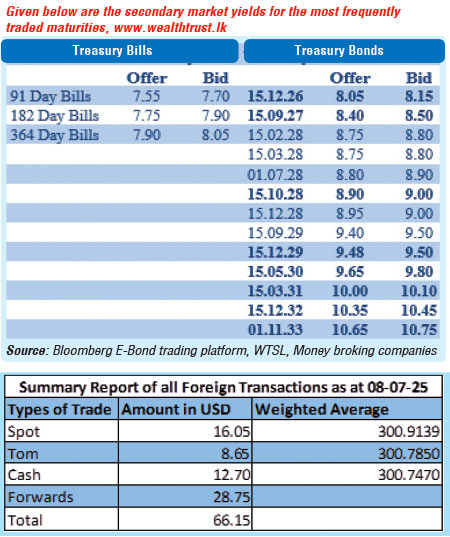

Accordingly, limited trades were observed on selected maturities. The 01.09.28/15.10.28 and 15.12.28 maturities were seen trading at the rates of 8.95% and 8.975% respectively. The 15.10.29 and 15.12.29 maturities were seen trading at the rates of 9.45% and 9.48%-9.51% respectively.

In secondary market bills, trades were observed on August, September, November and December bills at the rates of 7.52%, 7.60%, 7.68% and 7.75%-7.73% respectively.

This comes ahead of a round of Treasury bond auctions, due on the 11 July (today) with a total offered amount of Rs. 200.00 billion.

The auction will be comprised of:

1. Rs. 75.00 billion from a 15 October 2029 Maturity bearing a coupon rate of 10.35%

2. Rs. 75.00 billion from a 1 June 2033 Maturity bearing a coupon rate of 09.00%

3. Rs. 50.00 billion from a 15 September 2034 Maturity bearing a coupon rate of 10.25%

The settlement for which will be held on 15 July 2025.

For context at the previous round of Treasury Bond auctions held on Friday, 27 June 2025: Sri Lanka conducted its largest Treasury Bond auction of the year, matching the record-high offer of Rs. 295 billion previously set in June 2024. Four bond maturities were offered, with all except the 2033 tenor being fully subscribed during the first phase of competitive bidding. Due to the partial subscription of the 2033 maturity, a second phase was opened exclusively for that tenor. Altogether, the auction raised a total of Rs. 240.74 billion, representing an 81.61% subscription rate across both phases.

Maturity-wise outcomes:

The total secondary market Treasury bond/bill transacted volume for 8 July was Rs. 52.32 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.75% and 7.76% respectively.

The net liquidity surplus was recorded at Rs. 93.94 billion yesterday. An amount of Rs. 1.43 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 95.37 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating to Rs. 300.45/300.55 as against

Rs. 300.75/300.85 the previous day.

The total USD/LKR traded volume for 8 July was $ 66.15 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)