Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 4 June 2025 00:12 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday initially continued to consolidate. However, renewed buying interest emerged at the elevated levels, causing rates to swing back down marginally. As a result, yields closed the day marginally lower. Market activity and transaction volumes picked up, although they remained at moderate levels.

The secondary bond market yesterday initially continued to consolidate. However, renewed buying interest emerged at the elevated levels, causing rates to swing back down marginally. As a result, yields closed the day marginally lower. Market activity and transaction volumes picked up, although they remained at moderate levels.

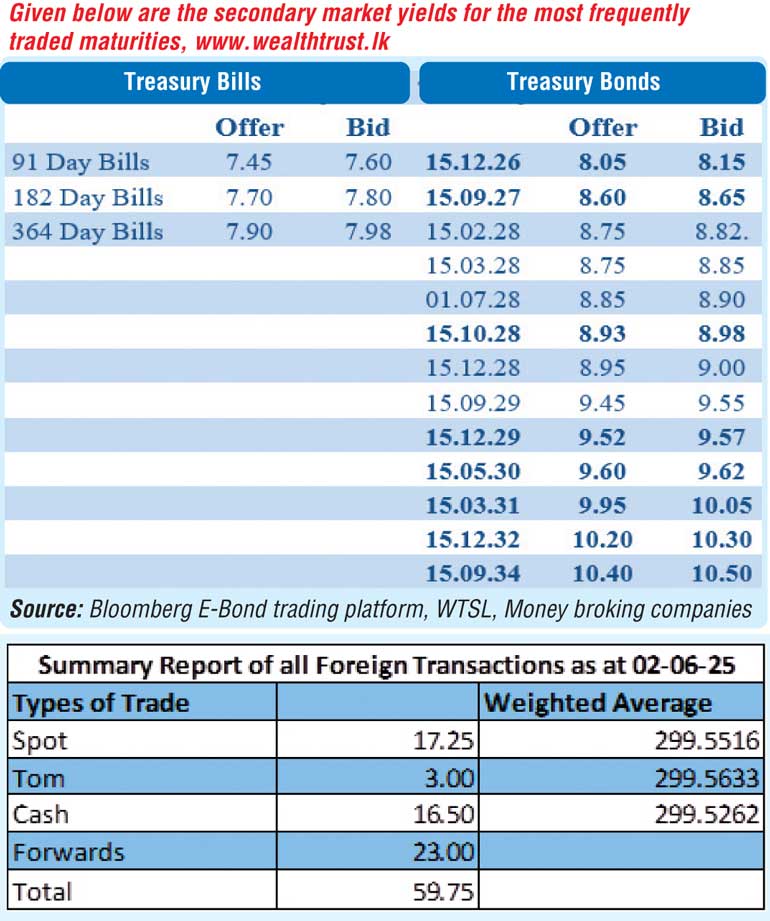

The 15.09.27 maturity saw its yield drop down the range of 8.73%-8.62%. The 15.03.28 and 01.07.28 maturities were seen trading within the ranges of 8.82%-8.80% and 8.93%-8.87% respectively. The 15.10.28 maturity traded within the range of 9.02%-8.95%. The 15.06.29 maturity initially hit an intraday high of 9.55% before trading back down to a low of 9.48%. The 15.12.29 maturity followed a similar pattern trading down from an intraday high to a low of 9.60%-9.55%. The 15.05.30 traded within the range of 9.67%-9.60%. The 15.12.32 maturity traded at the rate of 10.25%.

This comes ahead of the Treasury bill auction due today. The auction will have on offer a total amount of Rs. 167.50 billion on offer, an increase of Rs. 5.00 billion over the previous week. This will consist of Rs. 22.50 billion on the 91-day maturity,

Rs. 55.00 billion on the 182-day and Rs. 90.00 billion on the 364-day maturity.

For reference, the weekly Treasury bill auction conducted last Wednesday (30 May) was fully subscribed. The entire Rs. 162.50 billion on offer successfully raised in the 1st phase in competitive bidding. The total bids received exceeded the offered amount by 2.31 times. This was incidentally the first auction since the Central Bank of Sri Lanka slashed the Overnight Policy Rate by 25 basis points. Accordingly, the weighted average yield rate on the 91-day tenor declined by 10 basis points to 7.55%, the 182-day tenor by 20 basis points to 7.77% and the 364-day tenor by 31 basis points to 7.98%. An additional amount of Rs. 16.25 billion, being the maximum aggregate amount offered was raised at the 2nd phase.

The total secondary market Treasury bond/bill transacted volume for 02 June was

Rs. 14.75 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.74% and 7.76% respectively.

The net liquidity surplus increased to Rs. 156.62 billion yesterday. Rs. 0.11 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 156.73 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts were seen closing the day appreciating marginally to Rs. 299.40/299.45 as against 299.54/299.59 the previous day.

The total USD/LKR traded volume for 02 June was $ 59.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)