Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 27 June 2022 01:28 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond markets turned bearish during the week ending 24 June 2022 as yields were seen increasing further. Renewed selling interest on the liquid maturities of 01.06.25, 01.05.27 and 15.01.28 saw its yields hit intra-week highs of 21.60% and 21.25% each respectively against its previous weeks closing levels of 20.40/75 each while buying interest at these levels curtailed any further upward movement.

The secondary bond markets turned bearish during the week ending 24 June 2022 as yields were seen increasing further. Renewed selling interest on the liquid maturities of 01.06.25, 01.05.27 and 15.01.28 saw its yields hit intra-week highs of 21.60% and 21.25% each respectively against its previous weeks closing levels of 20.40/75 each while buying interest at these levels curtailed any further upward movement.

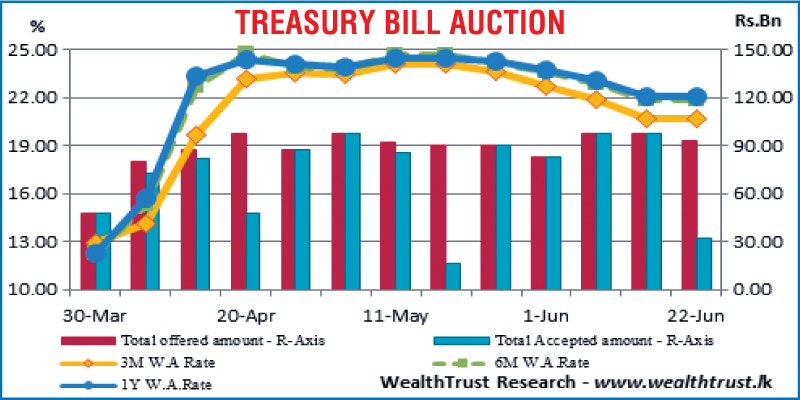

The undersubscription of the weekly Treasury bill auction for the first time in five weeks contributed to the upward trend in bond yields as well.

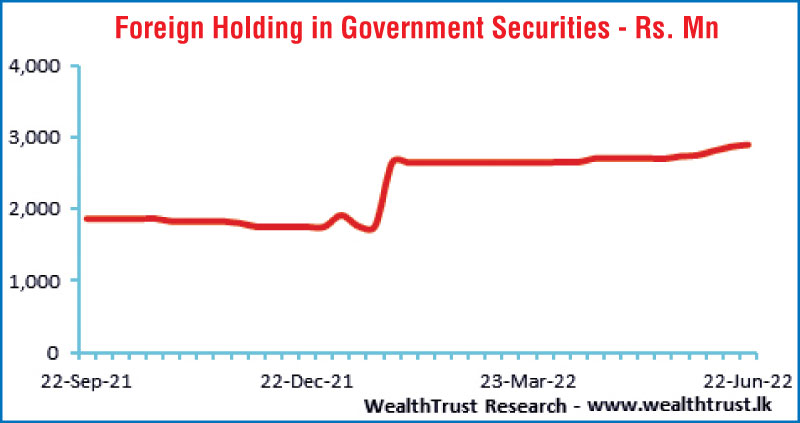

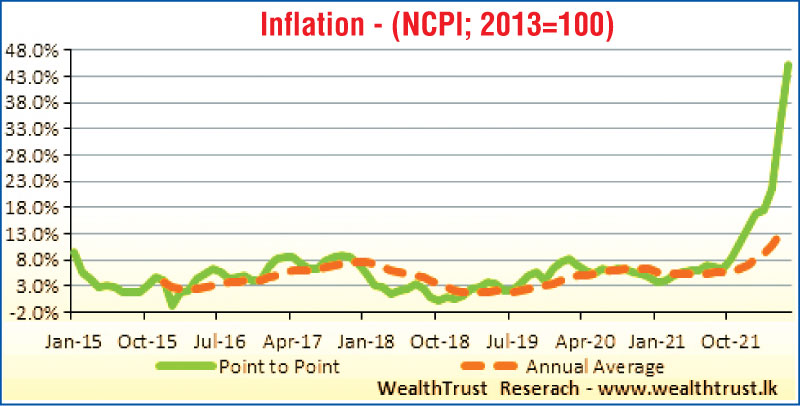

The National Consumer Price Index (NCPI) for the month of May was seen leaping on its point to point to 45.3% against its previous of 33.8% while its annualised increased to 16.3% from 13.00%. Meanwhile, a fifth consecutive week of foreign inflows to the rupee bond market saw its holding increase by a further Rs. 28.79 million for the week ending 22 June 2022.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 10.49 billion.

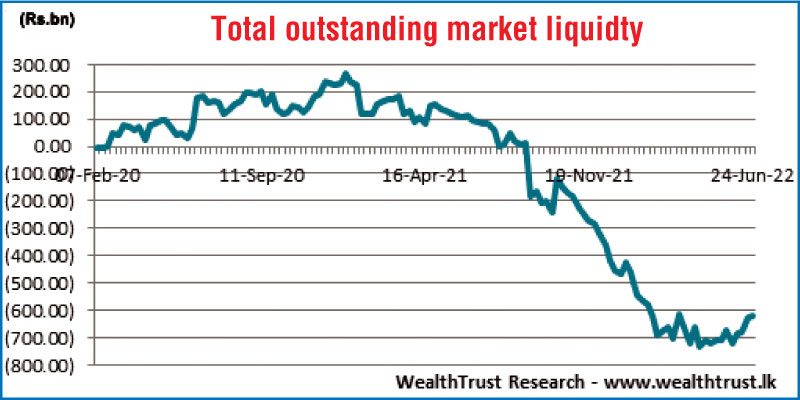

In money markets, the Domestic Operations Department (DOD) of CBSL continued to conduct outright sales of Treasury bill auctions during the week and it sold down an amount of Rs. 2.9 billion in total at weighted averages ranging from 20.75% and 21.80% for durations ranging from 129 days to 297 days.

The total outstanding liquidity deficit reduced further to Rs. 619.20 billion by the end of the week against its previous weeks of Rs. 629.00 billion while the CBSL’s holding of Gov. Security’s increased further to Rs. 2,086.32 billion against its previous weeks of Rs. 2,045.94 billion.

The weighted average rates on call money and repo stood at 14.50% each for the week.

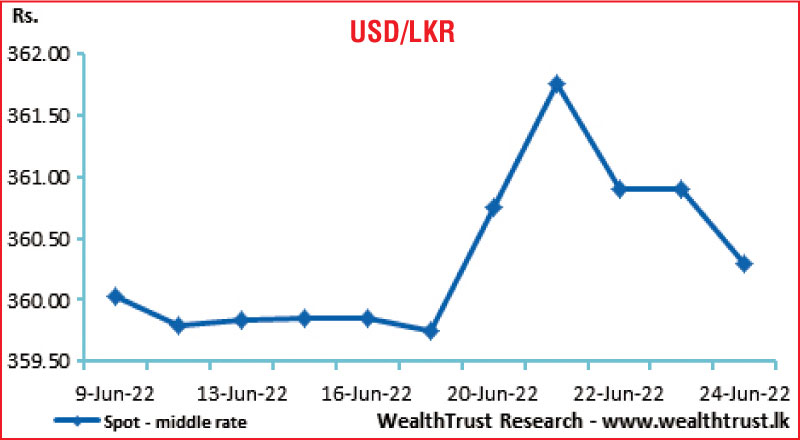

USD/LKR

In the Forex market, the middle rate for USD/LKR spot contracts fluctuated within the range of Rs. 361.75 to Rs. 360.30 during the week.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 16.03 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)