Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 25 March 2024 00:16 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market for the week ending 22 March witnessed moderate activity overall, while yields were observed moving sideways, fluctuating within a narrow band.

The secondary bond market for the week ending 22 March witnessed moderate activity overall, while yields were observed moving sideways, fluctuating within a narrow band.

Trading as usual centred on the short end of the yield curve, with specific emphasis on tenors between 2026 and 2028, and in particular the recent bond auction maturities.

Accordingly last week saw the popular 2028 tenors (01.07.28 and 15.12.28) declining to intraweek lows of 12.06% as against intraweek highs of 12.19% on the back of substantial volumes, while the liquid 2026 tenors (01.06.26, 01.08.26 and 15.12.26) were seen trading between intraweek highs of 11.40% and lows of 11.30% also with considerable volumes transacted. Additionally, trades were observed on the 2027 tenors (01.05.27 and 15.09.27) and 01.07.32 within the ranges of 11.85% to 11.78% and 12.30% respectively, on the back of relatively slimmer volumes. Despite the fluctuations, two-way quotes were seen closing the week broadly steady, week on week following the news that Sri Lanka had reached a staff level agreement for the next tranche of the IMF Extended Funding Facility program.

At the weekly Treasury bill auction last Wednesday (20 March), the weighted average yields were seen increasing across all three maturities, for a fourth consecutive week. The 91-day maturity increased by 13 basis points to 10.23%, the 182-day maturity increased by 14 basis points to 10.35%, while the 364-day maturity also went up by 14 basis points to stand at 10.38%. The auction went undersubscribed for a second consecutive week, with only 90.19% or Rs. 139.80 billion out of the Rs. 155.00 billion offered raised at the first phase of the auction. An additional amount of Rs. 6.09 billion was raised at the second phase, on the 182- and 364-day maturities.

On the inflation front, the National Consumer Price Index -NCPI (Base: 2021=100) or National inflation for the month of February 2024 was recorded at 5.10% on its point to point as against 6.50% recorded in January 2024.

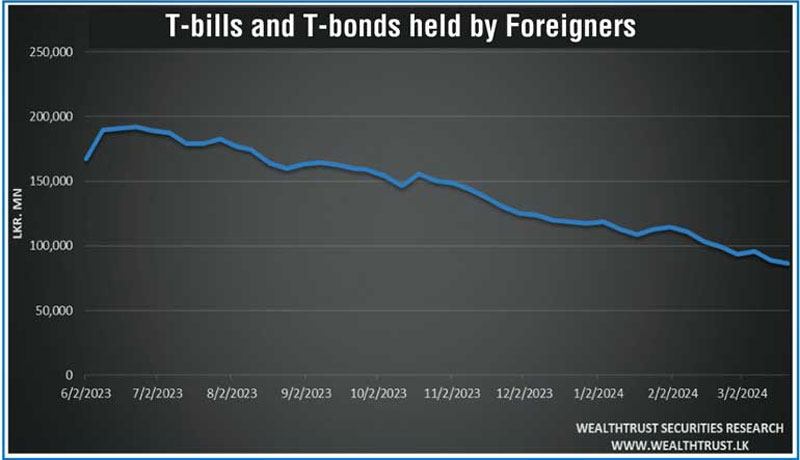

The foreign holding in Rupee bonds and bills for the week ending 21 March recorded a net outflow for a second consecutive week, amounting to Rs. 2.33 billion. As a result, the total holding decreased to Rs. 86.36 billion.

This week the Monetary Policy Board of the Central Bank of Sri Lanka on 26 March (this Tuesday) is due to release the 2nd Monetary Policy announcement for the year 2024. At the last announcement on 23 January the monetary policy interest rates were left unchanged. Accordingly, the Standing Deposit Facility Rate (SDFR) remained at 9.00% and the Standing Lending Facility Rate (SLFR) at 10.00%.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 28.97 billion.

In money markets, the total outstanding liquidity deficit decreased to Rs. 61.29 billion by the week ending 22 March from its previous week’s deficit of Rs. 80.42 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight and term reverse repo auctions at weighted average yields ranging from 9.09% to 9.38%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,691.27 billion as at 15 March, unchanged from its previous week’s level.

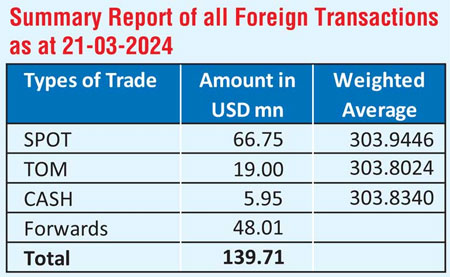

In the forex market, the USD/LKR rate on spot contracts was seen appreciating during the week to close at Rs. 303.40/303.50. This is as against its previous week’s closing level of Rs. 305.20/305.25 and subsequent to trading at a high of Rs. 304.90 and a low of Rs. 303.35.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 102.77 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)