Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 7 August 2025 02:17 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

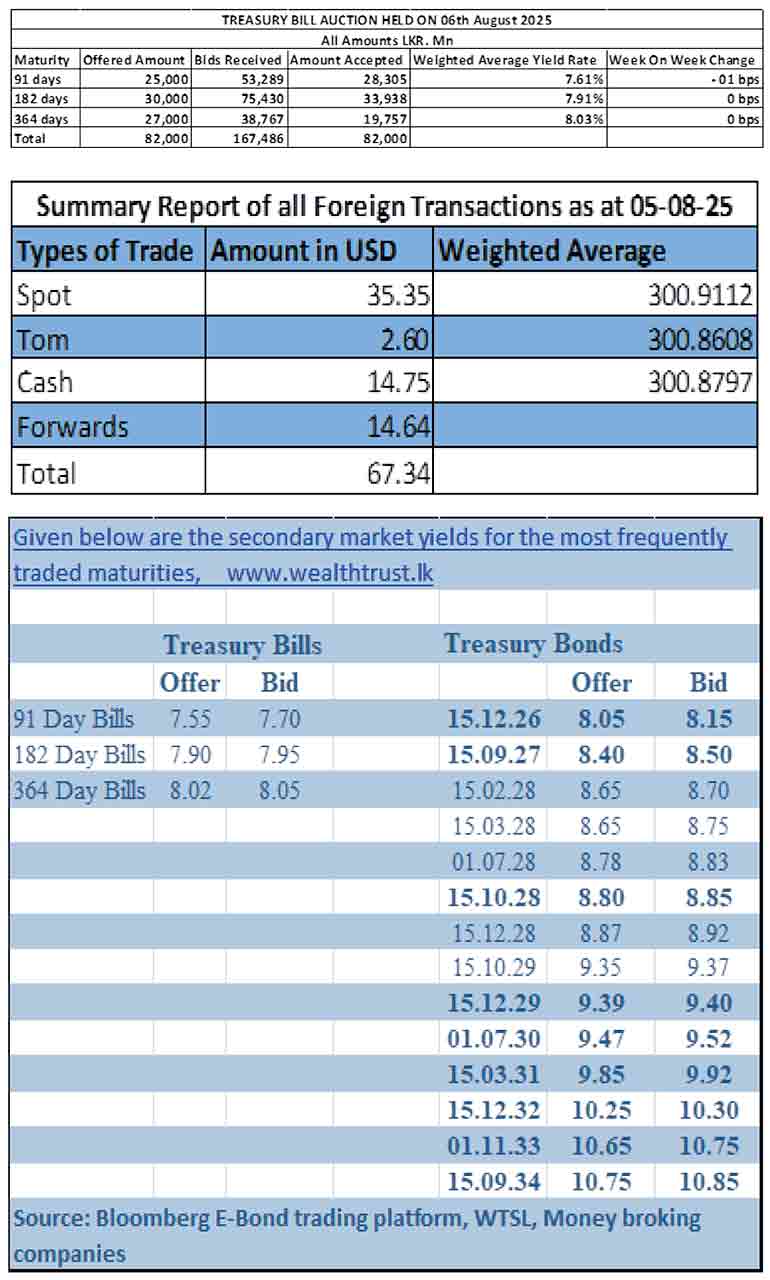

The weighted average yield rates at the weekly Treasury Bill auction held yesterday remained broadly stable, for the third consecutive week. Accordingly, the weighted average rate on the 182-day tenor and the 364-day tenor remained unchanged at 7.91% and 8.03% respectively. However, the 91-day tenor registered a marginal decline of 01 basis point to 7.61%.

The auction raised the entire total offered amount of Rs. 82.00 billion at the first phase in competitive bidding. This marked the first-time instance of full subscription following two consecutive weekly Treasury Bill auctions going undersubscribed. Total bids received exceeding the offered amount by 2.04 times. Notably, the shorter tenor 91- and 182-day maturities raised more than their respective offered amounts, while the 364-day maturity raised less than its respective offered amount.

The Phase II subscription across all three maturities are now open until 3 p.m. of business day prior to settlement date (i.e., 07.08.2025) at the WAYRs determined for the said ISINs at the auction.

Overall activity in the secondary government securities market remained subdued. A slight pick-up in activity was observed following the announcement of the T-bill auction results. However, yields stayed anchored around prevailing levels. Trading was limited to a few selected maturities.

The 01.07.28 maturity was observed trading within the range of 8.82%-8.80%. The 15.12.29 and 01.07.30 maturities were seen trading at the rates of 9.40%-9.39% and 9.50% respectively.

In addition, the details of the Treasury Bond auction, scheduled to be conducted on 12 August were announced. The round of auctions will have a total offered amount of Rs. 65 billion across two available maturities.

The auction will be comprised of:

1.Rs. 40 billion from a 1 January 2032 Maturity bearing a coupon rate of 08.00%

2.Rs. 25 billion from a 15 June 2035 Maturity bearing a coupon rate of 10.70%

The settlement for which will be held on 15 August 2025.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.84% and 7.86% respectively. The net liquidity surplus was recorded at Rs. 92.05 billion yesterday.

Forex market

In the Forex market, the USD/LKR rate on spot contracts to closed broadly steady at Rs. 300.85/300.95 as against its previous day’s closing level of Rs. 300.88/300.90.

The total USD/LKR traded volume for 05 August 2025 was $ 67.34 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)