Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 25 December 2025 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

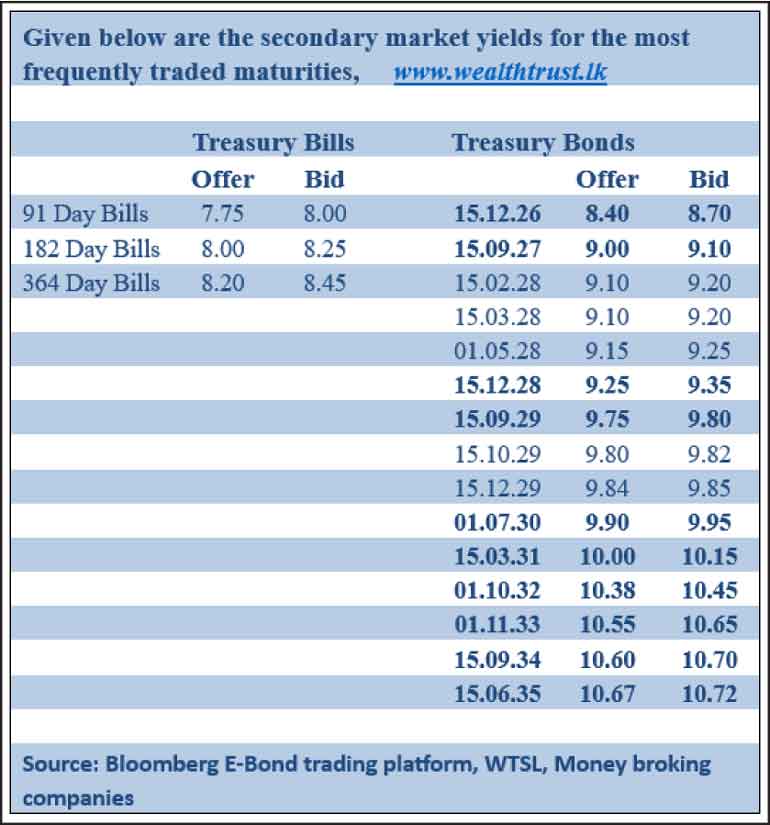

Yields in the secondary Bond market moved sharply higher yesterday, reacting to the outcome of the Treasury Bill auction held the previous day. The auction recorded increases in weighted average rates across all three maturities, with the 364-day tenor rising by a notable 16 basis points. Market activity was seen picking up with healthy volumes transacted.

In terms of the secondary Bond market trade summary, the 15.09.27 maturity was seen trading within the range of 9.05%-9.06%. The 15.02.28 and 15.03.28 maturities were seen trading at highs of 9.15% each while the 01.07.28 maturity at a high of 9.20%. The 15.10.28 maturity traded at the rates of 9.20%-9.23%. The 15.09.29, 15.10.29 and 15.12.29 maturities traded up the range of 9.75%, 9.80% and 9.85% respectively against its previous day’s closing levels of 9.55/65, 9.60/70 and 9.65/75 while the 01.07.30 maturity traded at a high of 9.95% against its previous day’s closing level of 9.70/80. The 15.03.31 maturity was seen changing hands at the rate of 10.15% and the 01.11.33 maturity at the rate of 10.60%.

The details of the next upcoming Treasury Bond auction, scheduled to be conducted on the 30 December (next week Tuesday) were announced. The round of auctions will have a total offered amount of Rs. 55 billion across three available maturities.

The auction will be comprised of: Rs. 30 billion from a 1 July 2030 maturity bearing a coupon rate of 9.75%; Rs. 25 billion from a 1 July 2037 maturity bearing a coupon rate of 10.75%; the settlement for which will be held on 1 January 2026.

The total secondary market Treasury Bond/Bill transacted volume for 23 December was Rs. 28.26 billion.

In money markets, the net liquidity surplus increased to Rs. 102.48 billion yesterday while the weighted average rates on overnight call money and Repo stood at 8.00% and 8.05% respectively.

Forex market

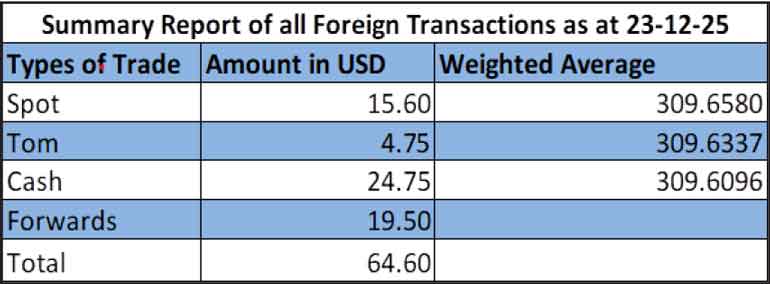

In the Forex market, the USD/LKR rate on spot contracts to closed depreciating slightly to 309.65/309.75 as against its previous day’s closing level of Rs. 309.65/309.75.

The total USD/LKR traded volume for 23 December 2025 was $ 64.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)