Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 17 April 2025 02:41 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The Secondary Bond market last week initially started off on a bearish note with yields seen increasing further, carrying over the upward momentum from the week prior.

The Secondary Bond market last week initially started off on a bearish note with yields seen increasing further, carrying over the upward momentum from the week prior.

The sell-off was largely concentrated on the 2027-2029 tenors, which saw a drastic increase in yields. This mirrored the risk-off sentiment in the local equity market and global financial markets in the aftermath of the imposition of reciprocal tariffs by the US. However, midweek, a notable recovery was observed against the backdrop of the ‘no change outcome’ at the weekly T-bill auction.

Market sentiment improved further after the US announced a 90-day pause on the imposition of reciprocal tariffs for most nations. Additionally, the outcome of the Treasury bond auction provided a further boost. Offered maturities were issued at weighted average yields well below the traded highs seen earlier in the week. These key developments triggered a reversal in the market trend, with yields taking a U-turn during the latter part of the week. As a result, secondary market two-way quotes were seen closing broadly unchanged on a week-on-week basis, despite the fluctuation. Overall market activity and transaction volumes remained at healthy levels.

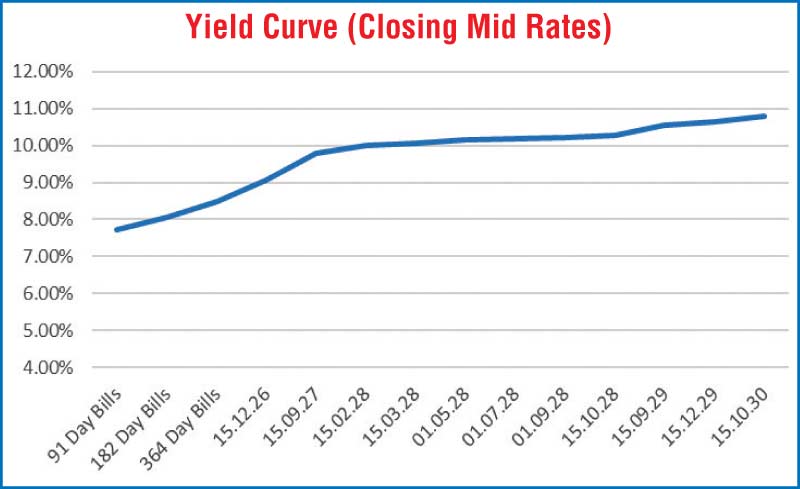

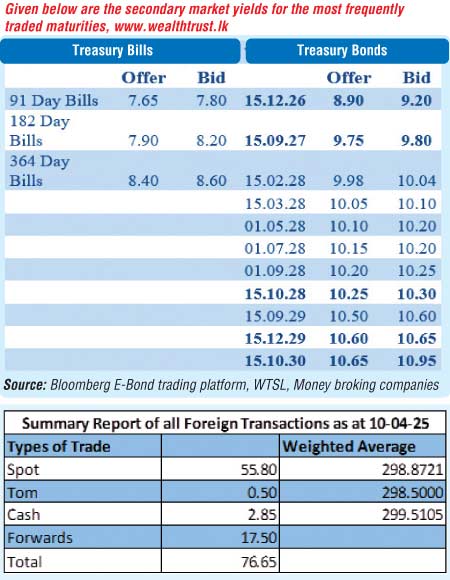

The 15.09.27 maturity was seen trading at a high of 10.00% earlier in the week, before rebounding to hit a low of 9.65% in the latter part of the week during the positive rally. Finally, the maturity settled at a closing two-way quote of 9.75%/9.80%. The rest of the yield curve followed a similar trading pattern. The 15.03.28 maturity was seen hitting an intraweek high of 10.25% before recovering to touch a low of 10.00%. The 15.03.28 closed quoted at 10.05%/10.10%. The yield on the 15.10.28 maturity initially moved up to trade at an intraweek high of 10.65% before subsequently dropping to a low of 10.18% on the recovery run. The aforesaid maturity closed quoted at 10.25%/10.30%. The 15.12.29 auction maturity was seen hitting an intraweek high of 11.00% before trading down to hit a low of 10.55%. It closed the week at the rate of 10.60%/10.65%.

At the weekly Treasury bill auction held on Wednesday (9), weighted average yields remained unchanged across all three tenors, following an increase in the previous week – the first rise in 20 weeks. The 91-day bill recorded a rate of 7.59%, the 182-day of 7.91%, and the 364-day of 8.31%. The auction went undersubscribed at the first phase for the third consecutive week, with only 4.69% or Rs. 3.75 billion of the total Rs. 80 billion amount offered. This was despite total bids received exceeding the offered amount by 1.74 times.

This was followed by a round of Treasury bond auctions conducted last Thursday (10) which successfully raised the entire Rs. 100 billion at the first phase in competitive bidding. This was an impressive outcome given that yields in the secondary market were seen increasing in the days leading up to the auction, and the T-bill auction preceding went undersubscribed. The total bids received exceeded the offered amount by a healthy 2.75 times.

The 15.12.29 maturity (11.75% coupon) recorded an impressive outcome and was issued at a weighted average yield of 10.64%, while the medium tenor 15.09.34 maturity (10.25% coupon) was issued at the weighted average rate of 11.21%.

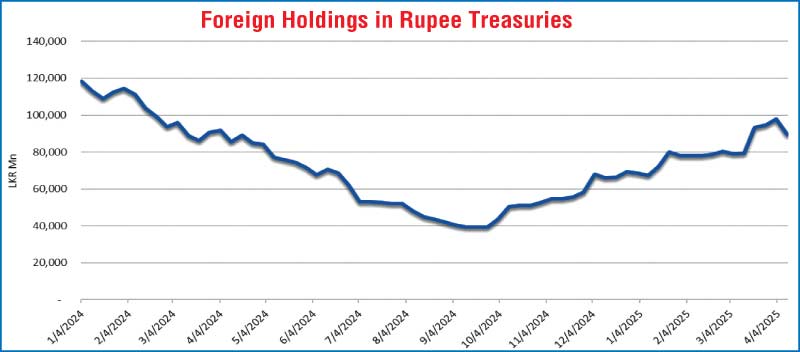

Meanwhile, foreign holdings in Rupee treasuries recorded a net outflow for the first time in four weeks for the week ending 10 April, amounting to Rs. 8.57 billion, and as a result, total holdings dropped to Rs. 89.29 billion.

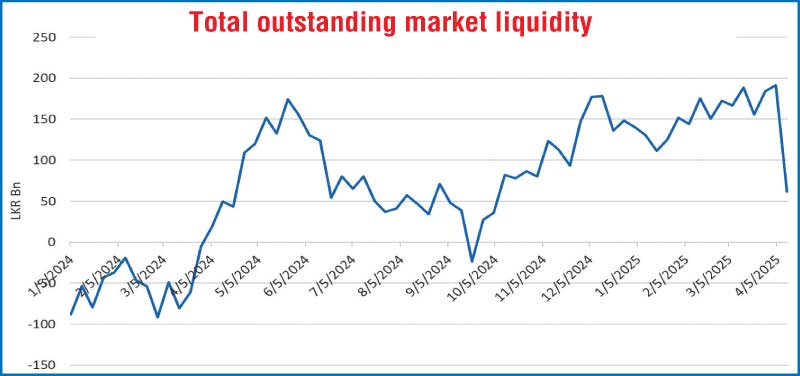

The total outstanding liquidity surplus in the inter-bank money market dropped to Rs. 61.71 billion as at the week ending 11 April, from Rs. 191.21 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.94%-7.97 and 7.95%-7.98%, respectively.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 23.05 billion.

The Central Bank of Sri Lanka’s (CBSL) holding of Government securities was registered at Rs. 2,511.92 billion as at 11 April, unchanged from the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating to close the week at Rs. 298.10/298.30 as against the previous week’s closing level of Rs. 296.65/296.75, and subsequent to trading at a high of Rs. 296.90 and a low of Rs. 302.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 92.46 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)