Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 4 April 2025 01:25 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Secondary Bond market yesterday experienced considerable volatility. Initially yields were seen increasing drastically as a knee-jerk reaction to the news that the US had imposed reciprocal tariffs of 44% on Sri Lankan exports. This was compounded by the results of the previous day’s Treasury Bill auction, which saw rates rise for the first time in 20 weeks. However, renewed buying interest was seen kicking in at the elevated levels which led to a strong recovery. Despite this secondary market two-way quotes were seen closing higher day on day. Market activity and transaction volumes were seen at robust levels.

The Secondary Bond market yesterday experienced considerable volatility. Initially yields were seen increasing drastically as a knee-jerk reaction to the news that the US had imposed reciprocal tariffs of 44% on Sri Lankan exports. This was compounded by the results of the previous day’s Treasury Bill auction, which saw rates rise for the first time in 20 weeks. However, renewed buying interest was seen kicking in at the elevated levels which led to a strong recovery. Despite this secondary market two-way quotes were seen closing higher day on day. Market activity and transaction volumes were seen at robust levels.

The 15.09.27 was seen trading at a high of 9.95% before rebounding back to 9.80%. The yield on the 01.07.28 maturity initially moved up to trade at a high of 10.20% before settling back down to a low of 10.17%. The 15.12.28 maturity was seen touching an intraday high of 10.50% before moving back down to trade at 10.30%. The rest of the yield curve followed a similar trading pattern. The 15.09.29 maturity was seen hitting an intraday high of 10.75% before recovering to trade at 10.45%. The 15.10.30 saw yields recover from 10.60% to 10.50% and the 15.12.32 traded within the range of 11.05%-11.00%.

The total secondary market Treasury Bond/Bill transacted volume for 1 April was Rs. 12.20 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.95% and 7.97% respectively.

The net liquidity surplus stood at Rs. 183.68 billion yesterday.

Forex Market

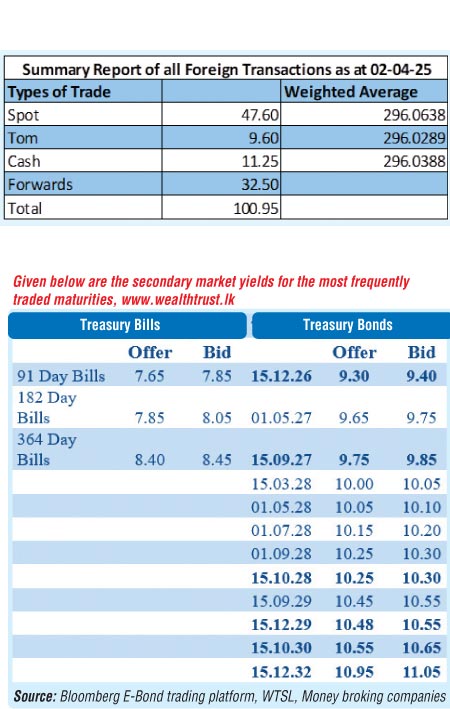

The forex market also experienced considerable volatility following the news of the 44% tariff on Sri Lankan exports by the US. Accordingly, the USD/LKR rate on spot contracts was seen depreciating, to close the day at Rs. 296.90/297.20 as against the previous day’s closing level of Rs. 296.02/296.07 and subsequent to trading at a high of Rs. 296.20 and a low of Rs. 297.80.

The total USD/LKR traded volume for 2 April was $ 100.95 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)